It's hard to find a cabin! It's extremely hard to come by! One bed is hard to come by! Top 10 Monthly News Stories in the Small Commodities Industry

Publish Time:2025-11-25 09:34:20Pageviews:36

abstract: Keep an eye on the Yiwu Index. We will provide you with the latest updates such as exchange rate analysis, shipping market conditions, raw material market interpretation, industry news and hot information!

01

TOP10 Industry News

The China-Us economic and trade talks have made substantive progress, and the bilateral tariff levels have been significantly reduced

On May 12th, China and the United States issued the "Joint Statement of the China-Us Economic and Trade Talks in Geneva". The US side cancelled a total of 91% of the additional tariffs, suspended the so-called "equivalent tariff" of 24% for 90 days, and retained the remaining 10% of the tariffs. China has also accordingly cancelled and suspended some countermeasure tariffs.

From June 9th to 10th, the first meeting of the China-Us economic and Trade consultation mechanism was held in London, UK. The two sides had an in-depth exchange of views on economic and trade issues, reached a principle agreement on the framework of measures to implement the important consensus reached by the two heads of state during their phone call on June 5th and consolidate the achievements of the Geneva economic and trade talks, and made new progress in addressing each other's economic and trade concerns.

Source: Xinhua News Agency

From January to May 2025, Zhejiang's imports and exports grew by 6.5%, and its contribution rate to export growth ranked first in the country

According to statistics from Hangzhou Customs, from January to May this year, Zhejiang's foreign trade imports and exports reached 2.24 trillion yuan, increasing by 6.5% year-on-year. Among them, exports reached 1.69 trillion yuan, increasing by 9.6%. Imports reached 547.45 billion yuan, a decrease of 2.2%. The proportions of imports and exports, exports and imports in the national total were 12.5%, 15.9% and 7.5% respectively, up compared with the same period last year. Among them, Zhejiang's contribution rate to the national export growth reached 20.7%, ranking first in the country.

According to statistics from Hangzhou Customs, from January to May, Zhejiang maintained growth in all major markets except the United States. Among them, imports and exports to the top two trading markets, the European Union and ASEAN, reached 342.26 billion yuan and 337.18 billion yuan respectively, increasing by 11.1% and 13.1% respectively. The growth rates in emerging markets such as the Middle East, Latin America and Africa were 6.0%, 4.8% and 9.3% respectively. During the same period, imports and exports with countries along the Belt and Road Initiative reached 1.28 trillion yuan, increasing by 8.7%, accounting for 57.2% of the province's total import and export value.

Image source: Internet

3. The interim results of the China-Us trade negotiations have exceeded market expectations, and the shipping space has once again become a "hard currency"

Since May 12th, as the tariff friction between China and the United States has eased, the orders that Chinese foreign trade enterprises had accumulated for the United States in the early stage are accelerating their shipment. However, the recovery of the previously reduced capacity on the China-Us routes will take a process. The short-term imbalance in market supply and demand has driven a continuous surge in booking space on the US route, making it difficult to find a space and driving up freight rates in a non-linear manner. Entering June, the overall shipment pace in the domestic market slowed down, the overall capacity increased, the supply and demand on the China-Us route tended to balance, and the freight rates slightly dropped.

4. The scale of China-Africa trade has reached a new high. China will impose 100% zero tariffs on 53 African countries with which it has established diplomatic relations

From January to May 2025, China's imports and exports with Africa reached 963.21 billion yuan, increasing by 12.4% year-on-year. The scale set a new record for the same period in history and accounted for 5.4% of China's total import and export value. Among them, exports to Africa reached 599.57 billion yuan, increasing by 20.2%. Imports from Africa reached 363.64 billion yuan, increasing by 1.6%.

On June 14th, it was reported that the Ministry of Foreign Affairs recently announced that China will implement a zero-tariff policy on 100% of tariff items for products from 53 African countries with which it has established diplomatic relations. This move aims to provide more export facilitation for the least developed countries in Africa.

5. Trendy LABUBU toys have taken the world by storm, with "it's hard to come by"

Recently, the Chinese trendy toy brand LABUBU has taken the world by storm. In April this year, the Labubu 3.0 series was released, topping the shopping chart of the US App Store and triggering a global rush to purchase. The premium in the second-hand market was as high as tens of times. In June, a first-generation mint-colored LABUBU was sold for 1.08 million yuan. The rise to fame of LABUBU combines multiple factors such as star power, social media dissemination, blind box gameplay, and brand collaborations, coupled with the premium effect in the secondary market, creating a phenomenon-level breakout.

Image source of the first-generation mint-colored LABUBU: Internet

TikTokShop achieved a successful debut in Mexico, with GMV surging by 208%

TikTok Shop's fully managed model achieved a successful start in the Mexican market. The first Hot Sale festival, which concluded on June 3rd, delivered an impressive performance with a 208% increase in GMV and a 63% rise in order volume. Clothing, shoes, bags and 3C home appliances emerged as the biggest winners: women's sportswear, underwear and standard-sized men's clothing occupied the top three best-selling positions, while digital products such as handheld game consoles and water flossers saw growth rates exceeding 50%. The platform has created a closed-loop chain of "short video seeding + live-streaming conversion + shelf repurchase"; through a matrix of 400,000 local influencers and 2 sample centers. Among them, the GMV of the sportswear content field has soared by 239%, and that of the shelf field has grown by 191%.

The total number of business entities in Yiwu market has exceeded 1.2 million, ranking first among all county-level regions in China

By May 2025, 86,000 new market business entities had been established in Yiwu Market, with the total number of business entities exceeding 1.2 million, accounting for one-tenth of the provincial total and six-thousandth of the national total. Among them, 64,700 new individual business households were established, accounting for 75.23% of the total number of newly established market business entities. The total number reached 863,500, accounting for 71.96% of the total number of market business entities. They are mainly distributed in the wholesale and retail trade (accounting for 77.77%), manufacturing (accounting for 9.47%), and accommodation and catering services (accounting for 4.87%), etc.

The market value of Small Commodities City (600415) has exceeded 100 billion yuan

On the morning of June 3rd, the Small Commodities City continued its recent upward trend, with its share price once rising to 18.48 yuan per share, a significant increase of nearly 5%, and its market value exceeding 100 billion yuan. Since then, the share price has continued to climb, reaching a five-year high. After a decade, the market value of Xiaoshangcheng (600415) has once again exceeded 100 billion yuan. The return of the Small Commodities City to a market value of over 100 billion yuan is of great significance and to some extent reflects investors' confidence in China's small commodities exports. Behind this is the high-quality products and services of tens of thousands of merchants, as well as China's well-established supply chain system and manufacturing foundation.

As of June 20th, the stock price trend chart of Small Commodities City. Source: Yiwu Index

9. One bed is hard to come by! The Global Digital Trade Center (Market Section) has successfully concluded its recruitment for the fashion jewelry industry

The Global Digital Trade Center is a digital trade highland built by Zhejiang Province. It centers on three main lines: new trade, new markets, and new landmarks, and integrates three major Spaces: production, living, and ecology. It aims to create a global trade benchmark that is fashionable, international, modern, digital, and low-carbon. It is learned that the overall construction volume of the market section of the Global Digital Trade Center has been completed by 98%, and it has now entered the final stage of decoration. On May 28th, the Global Digital Trade Center released a recruitment notice for the fashion jewelry industry, attracting thousands of enterprises to sign up within just two weeks. The highly anticipated bidding process for commercial Spaces in the fashion jewelry industry concluded successfully on June 17th. Over 1,000 business entities in the jewelry industry competed for 389 commercial Spaces, with the highest winning bid reaching 123,999 yuan per square meter.

The bidding site was crowded with people. Source: Yiwu Index

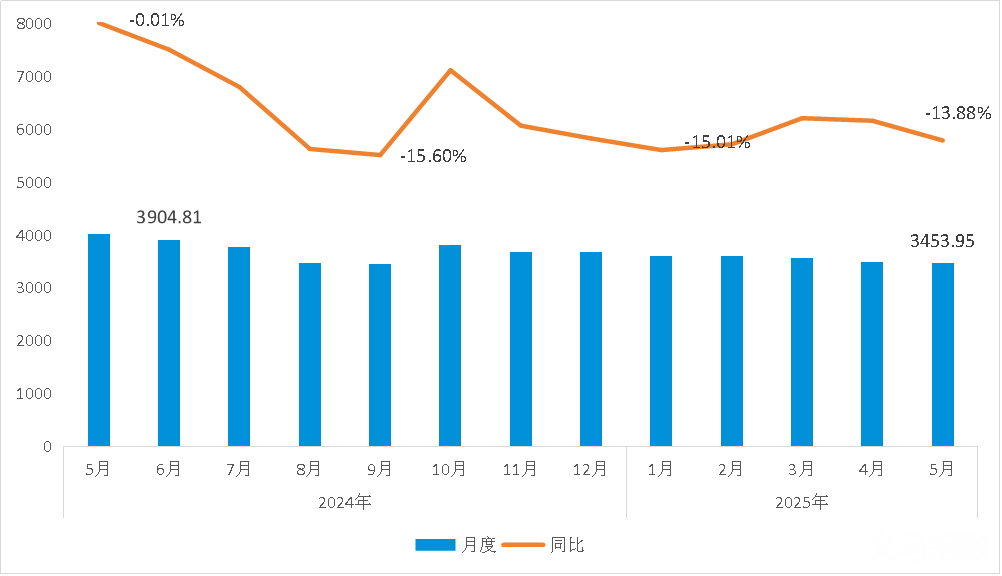

10. The sun protection economy is heating up, and solar fan caps from Yiwu have sold for 3.2 million yuan on TikTok

In 2024, the market size of sun-protective clothing in China exceeded 80 billion yuan, and it is expected to reach 95.8 billion yuan by 2026, among which the proportion of sun-protective clothing will exceed 50%. Recently, a solar fan cap produced in Yiwu has gone viral on TikTok. According to the monitoring of Yiwu Index, in the sports and outdoor category of TikTok in the US region, this solar fan cap has sold over ten thousand units in 28 days, with a total sales volume exceeding 450,000 US dollars, approximately 3.2 million yuan.

Image source: Yiwu Index

02

An Overview of International Logistics

Trends in ocean freight rates

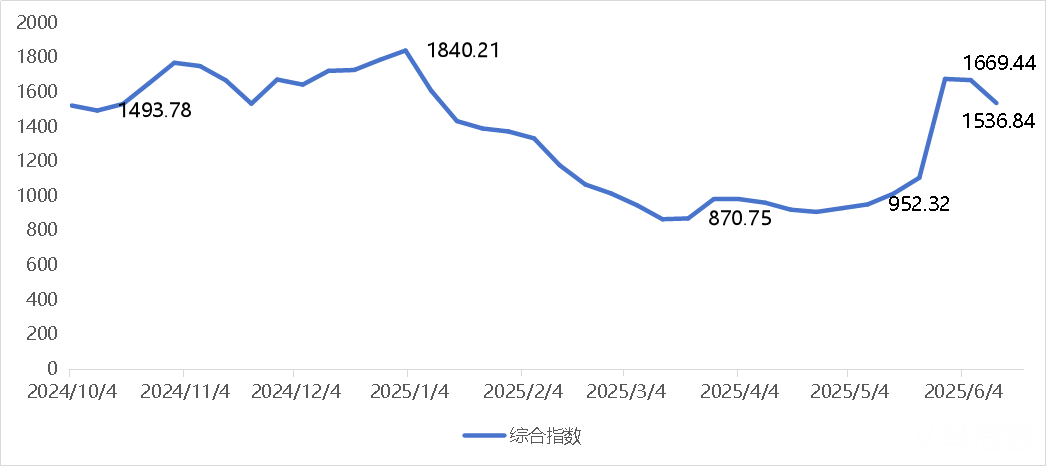

Ningbo Zhoushan Port undertakes a large amount of export business of small commodities from Yiwu and is an important seaport for Yiwu. According to the latest monitoring of Yiwu Index, on June 13, 2025, the Ningbo Container-based Freight Index (NCFI) closed at 1,536.84 points, up 65.2% from the previous month. In May, market shipments witnessed a strong growth. Coupled with the lagging recovery of shipping capacity and the tight space, ocean freight rates soared in the short term. In June, the overall shipment pace of the market slowed down, and freight rates dropped somewhat.

The trend chart of the NCFI Composite Index

Data source: Ningbo Shipping Exchange

www.ywindex.com

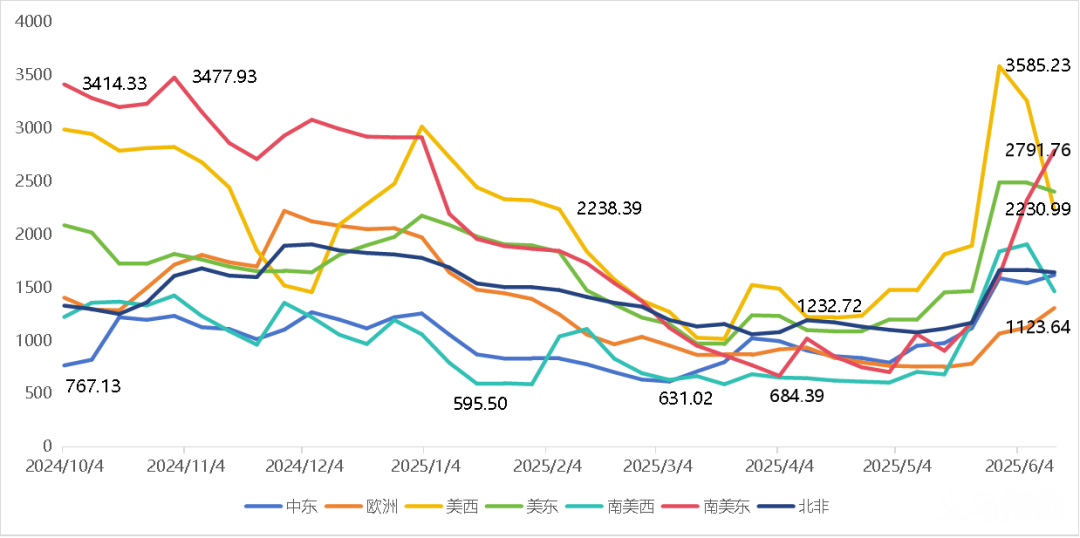

In mid-June 2025, the Ningbo-Europe route was adjusted to $2,925 per FEU for the month, with the route's freight rate index at 1,307.92 points, an increase of 71% compared to the previous month. The freight rate index for the Ningbo-West Coast route was 2,231.0 points, up 51% from last month. The price for the Ningbo-East Coast route is $7,099 per FEU, and the freight rate index is 2,403.3 points, an increase of 100% compared to last month. The freight rate index for the Ningbo-Middle East route stood at 1,618.67 points, up 104% from last month.

Trend chart of the main route index changes of NCFI

Data source: Ningbo Shipping Exchange

www.ywindex.com

The following chart shows the container prices for the export routes of the Jianyiyun freight platform in June (from Ningbo to the following ports), for reference only. After the end of Ramadan, the Middle East enters its traditional consumption peak season. The demand for retail, construction and industrial products surges, and the early replenishment of goods releases the demand for sea transportation, pushing up freight rates.

Data source: Collation of public information

www.ywindex.com

2. Maritime affairs

⚫ In May, COSCO Shipping Professional Carrier company launched a weekly BRICS train route to the east coast of South America. This new multi-purpose shipping route connects China's major ports with Brazil. These vessels operate regular weekly trips between major Chinese ports such as Qingdao, Taicang, Ningbo and Nansha, and major Brazilian ports such as El Salvador, Vitoria and Septiba, ensuring punctual departure and delivery. The fastest transportation time can reach 30 days.

⚫ Several shipping companies have begun to announce a new round of freight rate adjustment plans for late June. Several shipping companies, including MSC, Maersk, Hapag-Lloyd and CMA, continue to adjust the FAK rates on some routes and impose peak season surcharges (PSS), covering routes to Europe, the Mediterranean, Africa and South America.

⚫ In mid-June, several ports in Sweden (such as the port of Gothenburg, the port of Helsingborg, and the port of Piteo) announced a series of new strike plans. The Swedish Dockworkers' Union has issued a notice that a strike and lockdown will be carried out from June 19th to 26th. These operational disruptions may affect the normal operations of major ports.

⚫ According to CCTV news, on June 5 local time, Peruvian President Boruarte personally visited the Qiankai Port and issued a port operation license to COSCO Shipping Peru 's Qiankai Port, marking the full entry of Qiankai Port into a new stage of commercial operation. It is reported that the opening of Qiankai Port has shortened the sea transportation time from Peru to Asia from 35 days to 23 days, significantly reducing logistics costs and enhancing the international competitiveness of export products.

The latest data from shipping research firm Alphaliner shows that the number of container ships navigating the Panama Canal in the first five months of 2025 has reached a record high, with the number of ships passing through the two-way locks exceeding 1,200. This record-breaking figure represents a 10.2% increase compared to the same period in 2024 and is 4.1% higher than the peak set in the first five months of 2022.

03

Exchange rate dynamics

The Americas, Europe, Africa and the Middle East are the key export regions of Yiwu Market. The following is the latest currency exchange rate analysis of its major export countries:

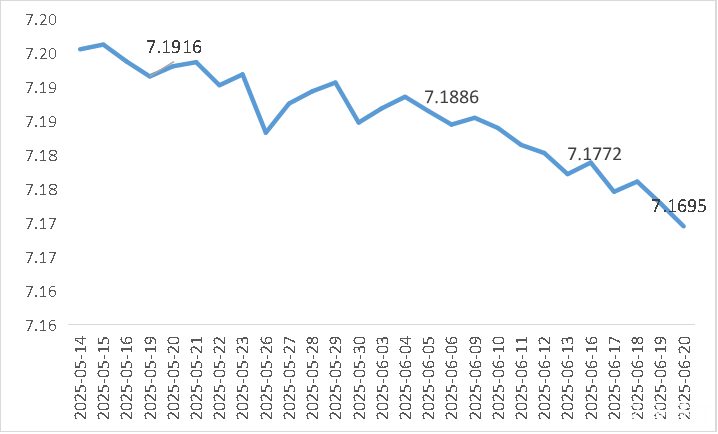

Us dollar (USD

On June 20th, the exchange rate of the US dollar against the Chinese yuan was around 7.17 yuan. The average monthly exchange rate of the US dollar to the Chinese yuan in May 2025 was 7.1950. The US dollar weakened against the Chinese yuan. On June 3rd, the Organization for Economic Cooperation and Development (OECD) lowered its forecast for the growth of the US economy in 2025 from 2.2% in March to 1.6%. The downward revision of economic growth expectations may lead to a decline in market confidence in the US dollar, which in turn will affect the exchange rate of the US dollar.

The trend chart of the central parity rate of the USD/CNY

Data source: China Money Net

www.ywindex.com

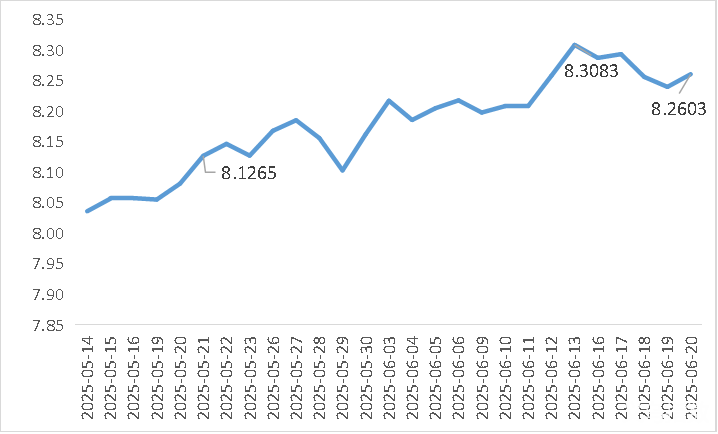

2. Euro (EUR

On June 20th, the exchange rate of the euro against the Chinese yuan was around 8.26 yuan. The average monthly exchange rate of the euro against the Chinese yuan in May 2025 was 8.1135 yuan, indicating a relatively weaker exchange rate of the Chinese yuan against the euro. Although the European Central Bank is in a rate-cutting cycle, its statement emphasizes that "the pace of future rate cuts may slow down." This statement shattered market expectations of sustained easing and prompted investors to reevaluate the value of euro assets.

Euro/RMB central parity rate trend chart

Data source: China Money Net

www.ywindex.com

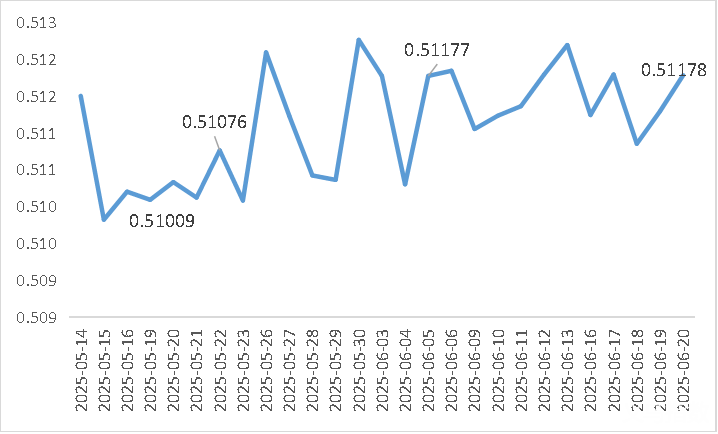

3. Uae Dirham (AED)

On June 20th, the exchange rate of the RMB against the dirham was around 0.51 yuan. The average monthly exchange rate of the RMB against the UAE dirham in May 2025 was 0.51. The United Arab Emirates is a major oil exporter. The rise in international oil prices usually strengthens the economic fundamentals of the UAE, thereby providing support for the dirham exchange rate. However, due to the limited increase in oil prices in June, the support for the dirham exchange rate was also relatively mild.

The trend chart of the central parity rate of RMB/UAE dirham

Data source: China Money Net

www.ywindex.com

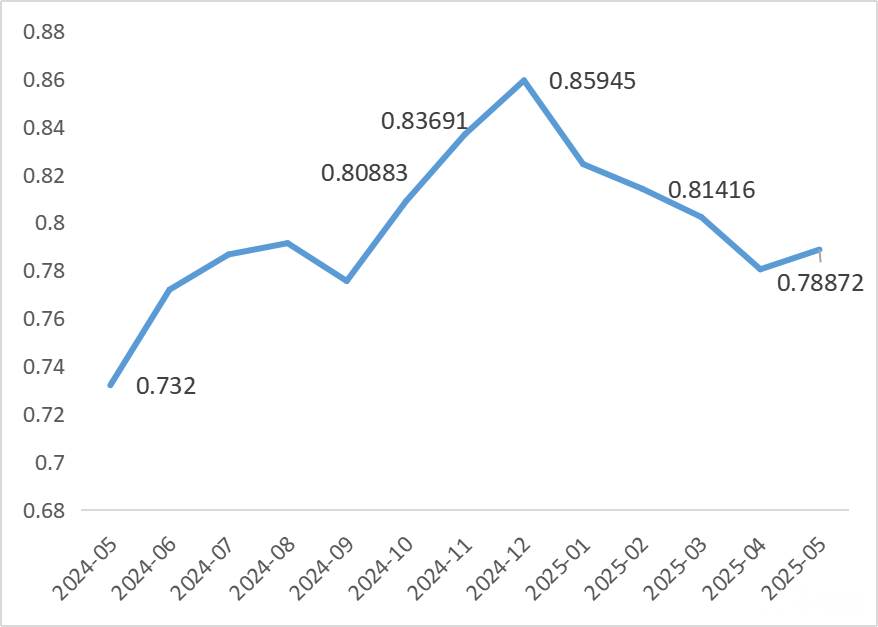

4. Brazilian Real (BRL

On May 30th, the exchange rate of the RMB against the Brazilian real was around 0.789 yuan. The RMB generally showed a trend of appreciation and weakening against the real. According to the "Focus Report" of the Central Bank of Brazil, the market's forecast for the exchange rate of the US dollar against the real at the end of 2025 has been lowered from 5.90 to 5.86, and the forecast for the end of 2026 has been adjusted from 5.95 to 5.91. The slowdown of inflation in the United States and the easing of trade relations between China and the United States have led to a rebound in market risk appetite and a decline in the US dollar index, driving emerging market currencies such as the real to strengthen.

The reference exchange rate chart of the Brazilian Real (CNY/BRL)

Data source: China Money Net

www.ywindex.com

04

Overview of the Raw Materials Market

The production of small commodities in Yiwu Market involves the procurement of a large amount of raw materials such as textiles, plastic products, hardware accessories and electronic components. The following focuses on the dynamic situation of important basic raw materials such as steel, cotton, and polyethylene (PE)

1. Steel

Weak and volatile prices: In May and June, steel prices generally fluctuated and were weak, but there were also occasional short-term rebound trends. In June, steel demand is in a slack season, and exports will also decline from a high level. Overall demand is likely to fall significantly. In addition, with the influence of high temperatures and the rainy season, the demand for steel will be further suppressed.

The comprehensive average price index of domestic steel from May 2024 to May 2025

Data source: My Steel

www.ywindex.com

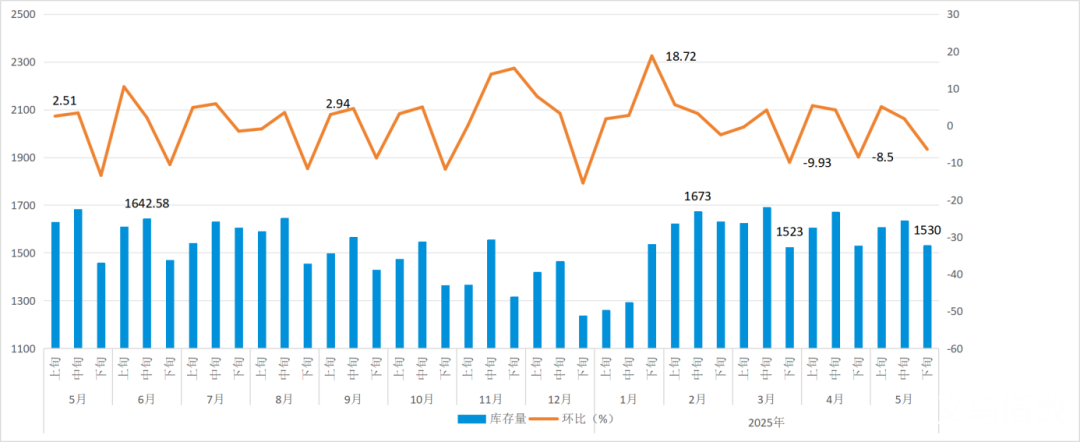

Inventory levels have dropped significantly: The pace of steel inventory clearance slowed down in May. According to data from the China Iron and Steel Association, by the end of May 2025, the steel inventory of key statistical steel enterprises reached 15.3 million tons, a decrease of 6.4%. Compared with the beginning of the year, it increased by 23.7%. It increased by 0.1% compared with the same period last month.

Inventory situation of key steel enterprises from May 2024 to May 2025 (in ten thousand tons)

Data source: China Iron and Steel Association

www.ywindex.com

2. Cotton

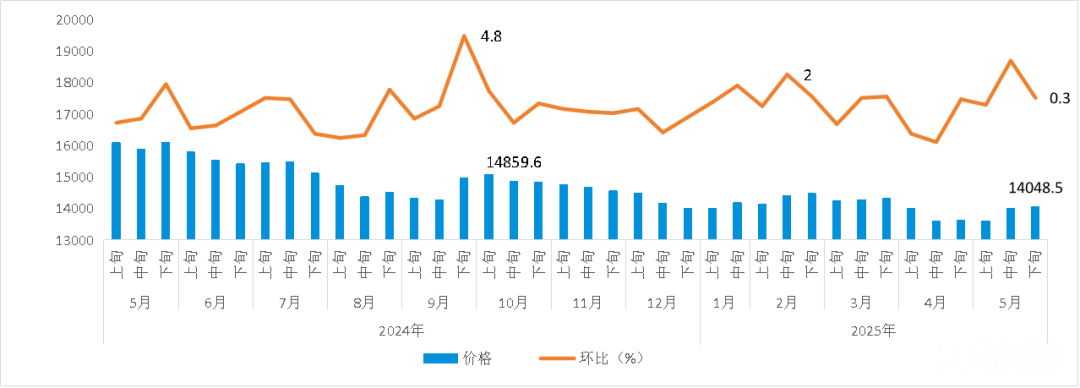

The price has been slightly adjusted: In late May 2025, the price of cotton (lint cotton, white cotton grade three) in the national circulation field was 14,048.5 yuan per ton, an increase of 43.3 yuan per ton compared with the previous period. The domestic cotton output in 2025 was slightly lower than market expectations. The actual output was approximately 6.5 million tons, an increase of 773,000 tons compared with the previous year. Cotton in Xinjiang is growing well. The temperature in the main production areas is relatively high, which is conducive to the growth of cotton.

Domestic cotton market price changes from May 2024 to Early May 2025 (yuan/ton)

Data source: National Bureau of Statistics

www.ywindex.com

Supply has entered the inventory reduction stage: Inventory dropped to 3.459 million tons by the end of May, a decrease of 694,000 tons compared with April, with the inventory reduction speed reaching the highest level in recent years for the same period. The inventory of old crops has been continuously declining, but the new cotton is growing well (cotton fields in Xinjiang have already shown buds). The market's expectations for the New Year's supply are loose, and enterprises' willingness to replenish inventories has weakened. The inventory clearance rate slowed down in the first ten days of June.

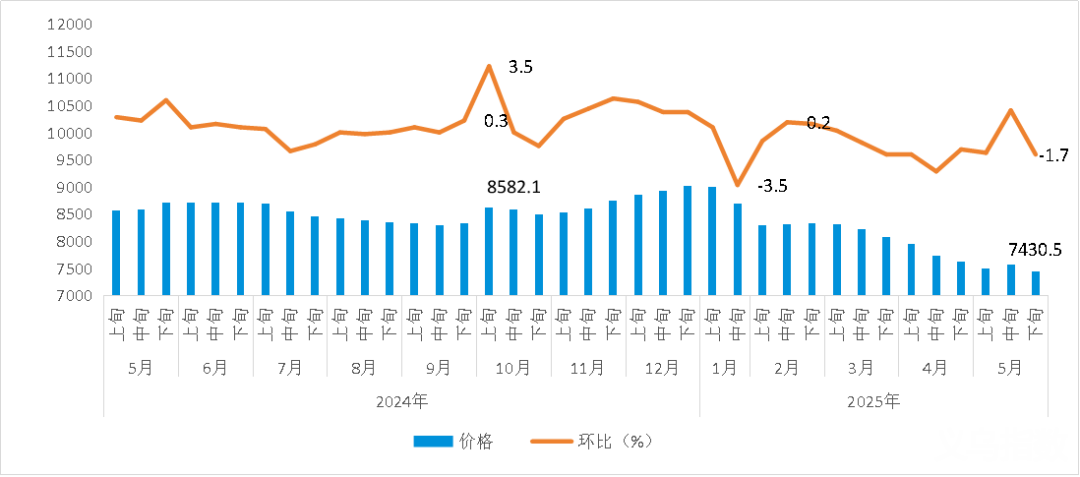

3. Polyethylene (PE

The price dropped slightly: In late May, the price of polyethylene in the national circulation field was 7,430.5 yuan per ton, a decrease of 1.7% compared with the previous month. In May, the downstream demand entered the off-season, and the demand for agricultural films and pipes showed a downward trend, which had a restrictive effect on the rebound of polyethylene prices. In June, with the favorable macro factors such as the e-commerce festival, downstream demand improved somewhat. Moreover, as international oil prices rose, the cost side of polyethylene was supported, and the price is expected to rebound.

Domestic polyethylene Market Price Changes from May 2024 to Early May 2025 (Yuan/ton)

Data source: National Bureau of Statistics

www.ywindex.com

Overall inventory re-accumulation: Polyethylene inventory is on the rise overall. As of June 4th, social inventories rose to 517,700 tons, an increase of 7.41% compared with the previous period. Petrochemical inventories rebounded to 520,000 tons, mainly due to the release of new production capacity and an increase in imports. Moreover, June is the off-season for agricultural film production, and the weak downstream demand has led to an increase in inventory.

Keep an eye on the Yiwu Index. We will provide you with the latest updates such as exchange rate analysis, shipping market conditions, raw material market interpretation, industry news and hot information!

、

—— The content of this article is translated by Al ——

My favorites

My favorites