The rise of domestic products + male beauty economy + brand going global: Industry analysis of the trillion-yuan beauty market

Publish Time:2025-11-25 09:17:57Pageviews:31

abstract: In this era where "appearance is justice", more than half of the world's people pay for beauty products.

Behind a bottle of essence and a lipstick lies a battle worth 440 billion US dollars.

In this era where "appearance is justice", more than half of the world's people pay for beauty products.

The global beauty market size will reach 441 billion US dollars in 2024 and is expected to maintain a growth rate of 5% between 2024 and 2030.

The scale of China's beauty market exceeded 850 billion yuan in 2024 and is expected to reach 1 trillion yuan in 2026, with an average annual compound growth rate of over 7.6%.

In 2024, domestic brands will have surpassed foreign brands in the domestic market share for two consecutive years, accounting for 55.74%.

In this article, Yiwu Index will provide you with an interpretation of the development of the beauty industry.

01

A trillion-yuan market: A daily necessity for all

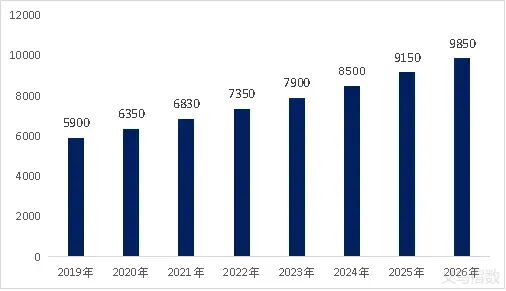

In the past five years, the scale of China's beauty market has grown from 590 billion yuan in 2019 to 850 billion yuan in 2024, maintaining its position as the world's largest market. It is expected to approach 1 trillion yuan in 2026, with an average annual compound growth rate of 7.6%. According to statistics from iResearch, 96% of Chinese people use beauty products (including personal care products) in their daily lives. It can be said that beauty products have become a necessity for all.

The market size of beauty products in China from 2019 to 2026 (in billions of yuan)

Data source: Yiwu Index

www.ywindex.com

The continuous expansion of China's beauty market is the result of the combined effect of multiple factors.

Factor One: With the awakening of health awareness, skin care has been upgraded to a "new necessity". Consumers' attention to skin health has reached an unprecedented level. Skin condition is not only a matter of "face", but also an important window to overall health. Skin care is transforming from a mere external pursuit into a "new essential need" related to health.

Factor Two: Self-pleasing consumption, combating anxiety about appearance level. Consumers are willing to invest in their personal image and skin health, and their aesthetic concepts have shifted from "standardized beauty" to "personalized beauty". Generation Z has become the main consumer force. Enhancing one's external image through makeup and skin care has become a daily habit, and the market demand has further expanded.

02

The cosmetics products are steadily expanding, and there is a vast space for the skincare line

(1) Skincare and makeup products are evenly split, ranking first in facial product sales

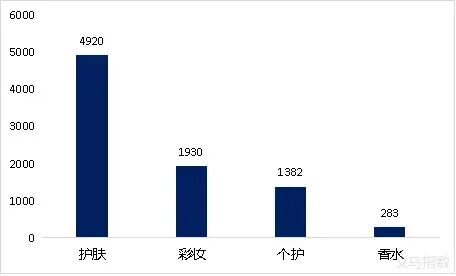

Beauty products are mainly subdivided into categories such as makeup, skin care, personal care, and perfume. Among them, the skincare category is the largest market segment with the most stable growth. The market size ratio of skincare to makeup is approximately 7:3.

The market size of China's first-tier beauty categories in 2024 (in billions of yuan)

Data source: Yiwu Index

www.ywindex.com

Skin care category: mainly includes facial care (anti-aging/whitening/repair), body care, hand care and other care. Representative products include face cream, eye cream, essence, lotion, mask, facial cleanser and toner

Cosmetics category: mainly includes face makeup, lip makeup and eye makeup, etc. Representative products include foundation, lipstick, mascara, BB cream, lip liner, blush, eyeshadow and nail polish.

Image source: Yiwu Index

In terms of market share, facial products dominate both the skincare and makeup markets.

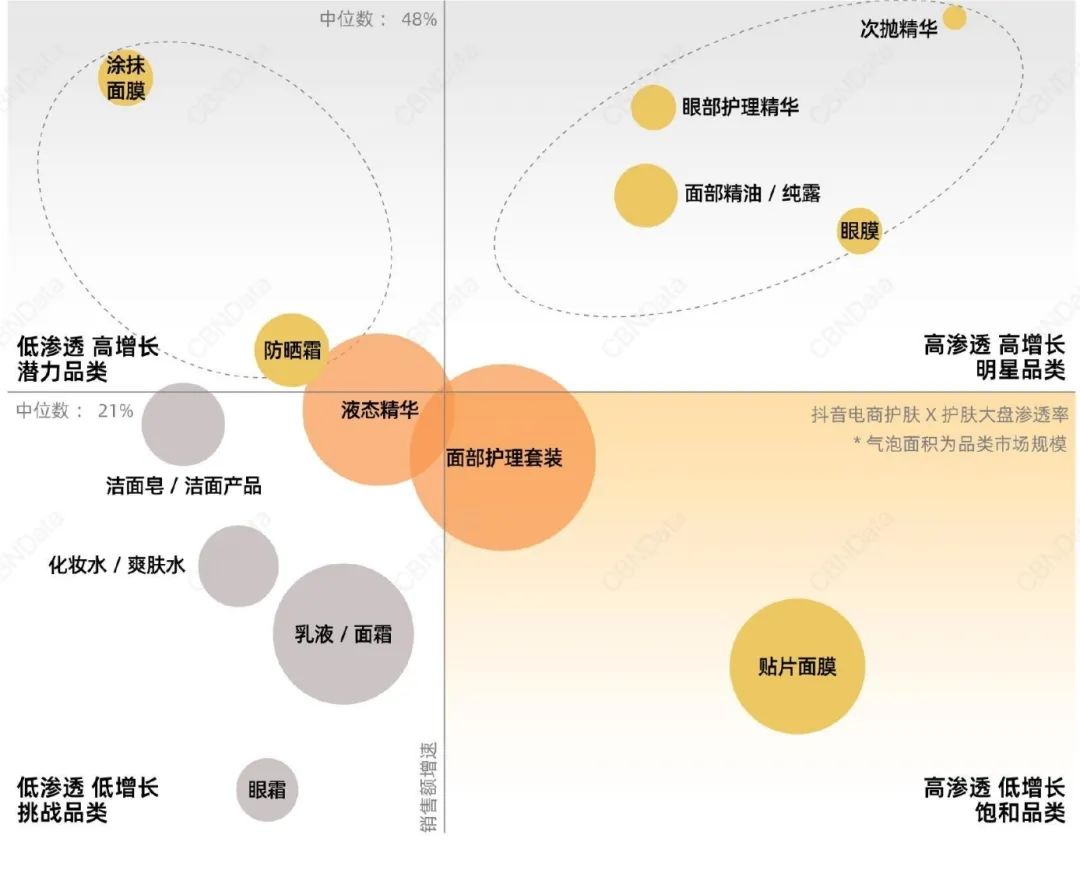

In the skincare sector, facial skincare products account for 78% of the entire skincare market size, among which masks, creams and essences are the core of the market. According to the data from Douyin e-commerce, the market size of face care sets and sheet masks in the skin care product category is large but highly saturated, showing a red ocean trend. The Top1 potential category in the blue ocean is facial masks, and the Top3 star categories are single-use essences, eye care essences and facial essential oils.

At 2025, the penetration and growth rate of skincare products on Douyin's e-commerce platform

Data source: Douyin E-commerce

www.ywindex.com

In the makeup market, face makeup accounts for approximately 49% of the entire domestic makeup market and has the highest sales growth rate. Among them, the categories with the highest growth rates are powder compact, blush, and pencil. According to the statistics of Yiwu Index, the market size of facial makeup products in China will reach 95 billion yuan in 2024, and it is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2028.

Image source: Yiwu Index

(2) Domestic market: Leading online, domestic products rise

Driven by the economy of appearance and consumption upgrade, the beauty industry has continued to improve and has witnessed the following changes:

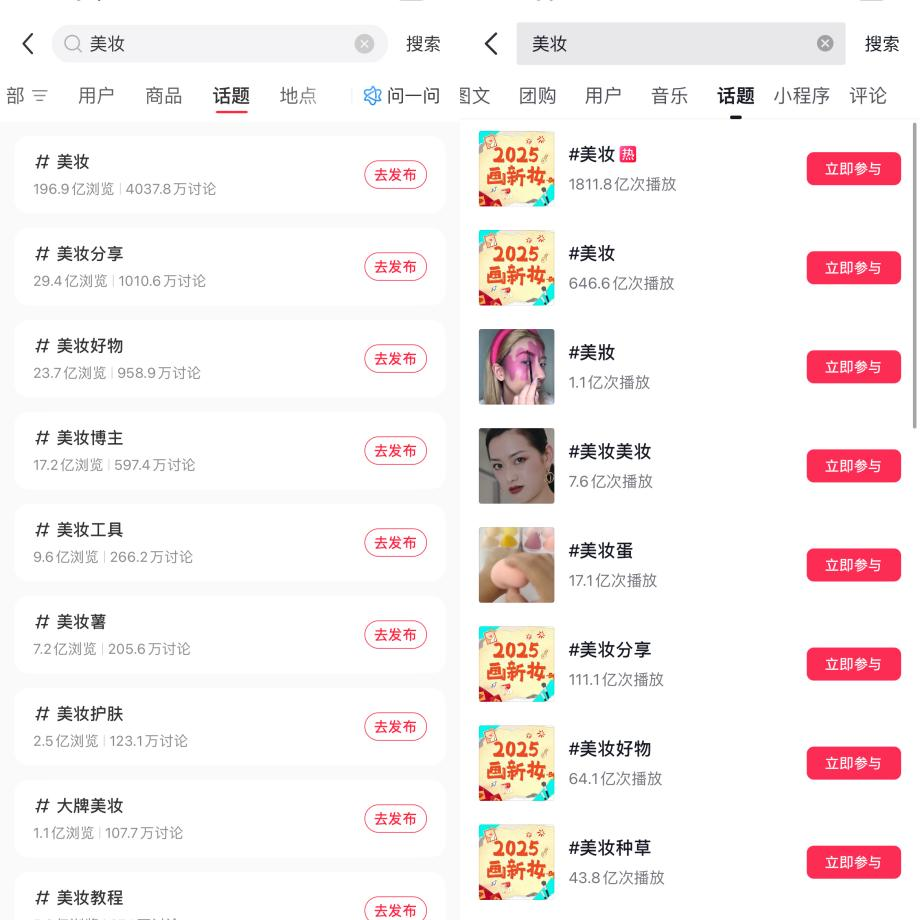

1. Online channels are the main battlefield, and social media continues to "plant grass"

Online channels have become the core sales channels in the beauty industry and are continuously expanding their market scale advantages. Live-streaming e-commerce and short-video platforms represented by Douyin and Xiaohongshu are key battlefields for brand marketing and sales. They guide consumers' purchasing decisions through content seeding and live-streaming interaction. According to the data from the China Cosmetics Yearbook, the sales proportion of online channels was approximately 50.8% in 2023, surpassing that of offline channels for the first time. In 2024, the proportion will continue to rise, reaching about 52.4%.

In July 2025, the page views and play counts of the keyword "beauty" on Xiaohongshu and Douyin platforms

2. Chinese people are paying attention to Chinese cosmetics, and domestic products are on the rise

Chinese consumers' preferences for beauty products are shifting towards "Chinese makeup" and domestic brands, driving the strong rise of domestic products. In 2023, the domestic market size of domestic beauty products grew by 21%, with a market share of 50.4%, surpassing international brands for the first time. In 2024, domestic brands continued to expand their leading edge, with their market share rising to 55.74%. With the frequent breakthrough of "national trend" beauty products, domestic brands represented by Perfect Diary, OsM, Hua Xi Zi, MAO Ge Ping and Han Su have maintained strong growth, and new and emerging brands are also constantly emerging.

The image source of the "Miao Ethnic Impression" series gift box of a certain domestic brand: Internet

3. The "male beauty economy" has become popular

In recent years, as men's attention to their personal image has been increasing, the male skincare market has gradually emerged, shifting from basic cleansing to anti-aging and repair, with a greater emphasis on the skin type compatibility of products. According to the data from Yiwu Index, it is estimated that the compound annual growth rate of the Chinese men's skincare market size from 2021 to 2026 will be 15.88%, and the overall market size is expected to reach 20.7 billion yuan in 2026.

4. Integration of makeup and skin care, blurring of category boundaries

The traditional category boundaries are blurring. More and more makeup products are beginning to incorporate skin care ingredients into their makeup products, achieving the goal of "nourishing the skin as soon as you apply makeup". The rise of this trend stems from consumers' higher pursuit of product functionality and their increasing emphasis on health and organic concepts. For instance, the "Butter Lip Gloss" developed by enterprises in Yiwu is a makeup product that contains butter, hyaluronic acid and other ingredients and has skin care effects. It is popular both at home and abroad.

Butter Lip gloss Image source: Yiwu Index

(3) International Market: The European and American markets are mature, while emerging markets offer numerous opportunities

Data shows that more than half of the people worldwide use beauty products. The skin types, aesthetic preferences and cultural customs of consumers in different countries have shaped product consumption habits with distinct regional characteristics.

Europe and America: Accounting for approximately 53% of the global beauty market, they hold a dominant position. From the perspective of product preferences, in the US makeup market, liquid lipsticks, metallic eyeshadows, colored eyeliner pencils and base makeup products with skin care functions are the most popular. British consumers, on the other hand, pursue skin texture and luster. When it comes to base makeup, they prefer long-lasting and highly concealing foundations. Products such as lipstick, eyeshadow, nail art, and tanning have a considerable market capacity in the local market. In the field of skincare, consumers in Europe and America are in pursuit of milder and more natural formulas.

Image source: Yiwu Index

Southeast Asia: A hot spot for domestic brands to go global, with broad market prospects. The beauty market in Southeast Asia reached 164 billion yuan in 2018 and is expected to increase to 304.8 billion yuan by 2025, with a compound annual growth rate of 9.3%. The consumer group in Southeast Asia is getting younger, with a high acceptance and strong willingness to consume beauty products. There are also significant differences in product preferences among various countries. For instance, in Indonesia, Thailand, and the Philippines, there is a preference for European beauty products that highlight individual eyebrow and eye features as well as facial lines. Vietnamese consumers tend to prefer beauty products that are "good-looking, have inner depth" and can also whiten the skin.

Latin America: With a growth rate of 19%, it has become an emerging growth pole in the beauty and skincare industry. Latin America accounts for 9.8% of the global beauty market. It is projected that by 2032, the beauty market size in the Latin American region will reach 72.45 billion US dollars. Among them, Brazil and Mexico performed the most outstandingly. In the first quarter of 2025, the sales of cosmetics and skincare products increased by 16% and 10% respectively. In addition, the sales of mid-range cosmeceutical brands saw significant growth, with an increase of 30%.

Image source: Internet. A local Brazilian cosmeceutical brand

(4) "Hard Power" of Domestic Beauty Manufacturing: Production area Layout and raw material Upgrading

Regionalized industrial clusters and continuously upgraded raw material supply chains have become the key to the continuous improvement of China's beauty manufacturing capabilities.

1. Industrial belts: The Pearl River Delta, the Yangtze River Delta, and the Shandong region form a tripartite confrontation.

The Pearl River Delta region: The industrial belts are mainly distributed in Guangzhou, Chaoshan and other places, and it is the region with the largest number of cosmetics enterprises in the country. Enterprises are mainly divided into the following two categories: One is small and medium-sized enterprises, which mainly engage in contract manufacturing and are mainly distributed in the Chaoshan region. Another category consists of international beauty enterprises, such as Procter & Gamble and Colgate, which are mainly located in Guangzhou.

The Yangtze River Delta region: Represented by Shanghai, Zhejiang and Jiangsu, it is a medium and high-end product industrial belt, gathering international beauty production bases such as Estee Lauder and Shiseido, as well as leading domestic brands like Perfect Pain and OsM. Among them, Yiwu is one of the largest cosmetic production bases in Zhejiang Province, with the number of cosmetic manufacturing enterprises accounting for approximately one-third of the total in the province.

Shandong region: A major province in China for cosmetic raw materials, especially in the field of hyaluronic acid (hyaluronic acid), it holds over 75% of the global sales share. The industries are mainly distributed in cities such as Jinan, Qingdao and Linyi.

Image source: Yiwu Index

2. Raw material upgrading: Domestic substitution is accelerating, and "Chinese ingredients" are favored

Relying on technological upgrades and the advantage of high cost performance, Chinese cosmetic raw materials are gradually replacing traditional suppliers from Europe, America, Japan and South Korea. Raw materials such as hyaluronic acid, amino acid surfactants and sunscreens are gradually entering the supply chains of international brands.

As domestic consumers' recognition of domestic brands increases, more and more domestic and foreign beauty brands are using domestic raw materials, such as licoridin, centella asiatica, and extracts of Chinese herbal medicines, which have become the core selling points for brands to build differentiated competitiveness, in order to cater to domestic consumers' preference for "Chinese ingredients".

Image source: Yiwu Index

03

Yiwu: From "Small Commodities" to "Big Brands"

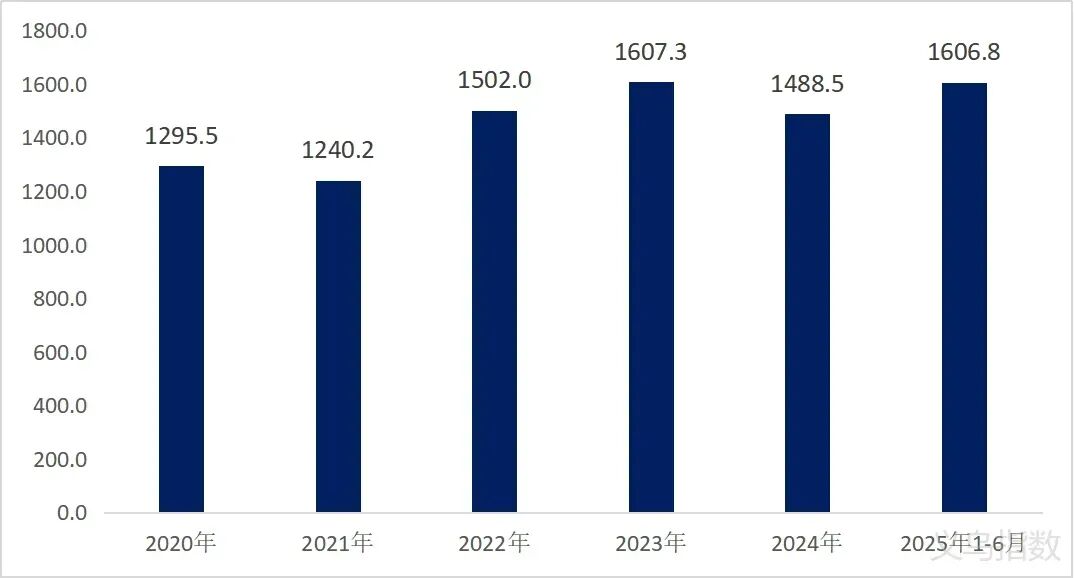

According to the monitoring of Yiwu Index, the prosperity index of skin care and beauty products has generally shown an upward trend. The prosperity index in the first half of 2025 has increased by 24% compared with that in 2020.

The monthly average prosperity index of skin care and beauty products from January to June 2020 to 2025

Data source: Yiwu Index

www.ywindex.com

(1) Overview of the Beauty Industry in Yiwu

The beauty industry in Yiwu started in the 1990s. After more than two decades of development, over 1,200 related business households have now gathered in the third zone of Yiwu International Trade City. At present, the export proportion of the industry remains stable at around 80%, and the products are sold to regions such as Europe, America, Southeast Asia, South America, Japan, the Middle East and Africa.

The beauty products in Zone 3 of the International Trade City. Source: Yiwu Index

According to the monitoring of Yiwu Index, the export value of beauty cosmetics and personal care products in Yiwu City exceeded 7 billion yuan in 2024, accounting for approximately 15% of the total export value of similar products in the country.

(2) The 2.0 Era of Yiwu Beauty

Product feature research and development: In response to the global consumers' demands for diversified and differentiated products, Yiwu cosmetics enterprises carry out precise research and development. Taking the Southeast Asian market as an example, Yiwu enterprises, in response to the local consumers' demand for multi-functional and affordable beauty products, have innovatively launched a double-head lip gloss that integrates mirror finish, matte finish and water and sweat resistance in a "three-in-one" manner. The product achieved a monthly sales volume of over ten million in the Philippines and set a record of selling 30,000 US dollars within three hours in Vietnam.

The double-headed lip glaze that has become extremely popular in Southeast Asia. Image source: Yiwu Index

Building international brands: The beauty and skincare industry in Yiwu is making every effort to build international brands and increase the sales proportion of self-owned brand products. According to the monitoring of Yiwu Index, currently nearly 60% of the business operators in Yiwu market own their own brands or act as agents for well-known brands, establish their own customer channels, and their products are exported overseas. A beauty business operator in Yiwu Market said, "Brand building is imperative. In the future, we need to create and promote our own brand and achieve self-production and self-sale. Otherwise, we will have no market competitiveness."

Exhibition space upgrade: The display facilities of beauty and skincare stores in the International trade city are constantly being upgraded. For instance, the shelves and counters have been upgraded from traditional wooden ones to modern display methods such as open glass display cabinets. The overall design is more upscale, showcasing the brand's tone while directly enhancing the shopping experience of consumers. Meanwhile, the sixth-generation market Global Digital Trade Center will create a skincare and medical aesthetics products market with larger business space, more reasonable structure and better business environment.

Industry: Innovation in raw materials is accelerating, and "Chinese ingredients" such as Chinese herbal medicines are increasingly favored.

Market: The domestic market has seen significant growth, and domestic brands have risen strongly. The European and American markets maintain a leading share, while the growth momentum in Southeast Asia is strong.

Category: The rigidity of skincare demand has become more prominent, functional makeup and skincare are accelerating their integration, market segmentation is deepening, and the "male beauty" economy is on the rise.

—— The content of this article is translated by Al ——

My favorites

My favorites