Cross-border E-commerce Series Special Topic (Part 2) - Behind the Trillion-yuan Market, the "Four Little Dragons" of Cross-border E-commerce are Redefining "Going Global"

Publish Time:2025-11-17 15:15:16Pageviews:528

abstract: Nowadays, cross-border e-commerce has long passed the era of "making money effortlessly". As an important trade model for enterprises to go global, the industry is moving towards a stage of "meticulous cultivation". Only by creating differentiated advantages can enterprises gain the initiative in the wave of globalization.

By 2025, the balance of retail consumption will continue to tilt in favor of e-commerce channels. Global e-commerce sales are expected to exceed 6.8 trillion US dollars, accounting for more than 20% of the total global retail sales.

The market size is constantly growing, and the competition among e-commerce platforms has also entered a white-hot stage.

In July 2025, the cross-border e-commerce promotion battle began. Amazon Prime Day event was extended for the first time to four days, covering 20 major global sites. TEMU launched the "TEMU Week" three-tier discount war ahead of schedule. Walmart's "Deals Promotion" is open both online and offline. TikTok Shop has even launched a "Live price comparison guarantee", promising to return the price difference...

With the rapid development of China's cross-border e-commerce industry, Prime Day is no longer Amazon's "solo show". Chinese cross-border e-commerce platforms represented by the "Four Little Dragons Going Global" (TEMU, TikTok Shop, SHEIN, and AliExpress) have engaged in fierce competition with Amazon and snatched away a considerable amount of traffic. This phenomenon also highlights the strong competitiveness of China's cross-border e-commerce industrial chain.

In this article, Yiwu Index takes you on a deep exploration of the full picture of the upstream and downstream of China's cross-border e-commerce industry chain and the development of cross-border e-commerce platforms.

01

A panoramic view of China's cross-border e-commerce industrial chain

Cross-border e-commerce, as a new trade model in the digital economy era, covers the entire industrial chain from production to the consumption terminal. The upstream supply, midstream services and downstream market work together to form a commercial closed loop.

Cross-border e-commerce industrial chain map

Image source: Yiwu Index

(1) Upstream of the industrial chain: A diversified supply side builds a global commodity pool

The upstream industrial links mainly include the supply and selection of physical and virtual products. The supply chain of goods is the foundation of cross-border e-commerce. Relying on China's manufacturing advantages and the upgrading of its service industry, it covers advantageous categories such as clothing, 3C electronics, home furnishings, hardware, and daily necessities.

Producers are the foundation of cross-border e-commerce development, located at the beginning of the industrial chain, and are responsible for the production and supply of goods. As a significant global manufacturing base, China, relying on its complete industrial system (covering the 39 major categories stipulated by the United Nations Industrial Classification) and mature supply chain network, provides cross-border e-commerce with abundant commodity resources. In recent years, with the joint promotion of the government and cross-border e-commerce platforms, a certain scale of cross-border e-commerce industrial belts has been formed in China, especially in the southeast coastal areas where they are relatively dense. Among them, Guangdong, Zhejiang, Jiangsu and Shandong achieved full coverage of e-commerce comprehensive pilot zones in all prefecture-level cities in 2022, establishing a coordinated development model of "industrial belts + cross-border e-commerce".

Image source: Yiwu Index

The core competitiveness of brand owners lies in their independent product innovation system. By integrating the full-chain management system including design, manufacturing and operation, they can create a differentiated competitive advantage. Its operation strategies mainly consist of the pan-product strategy and the premium product strategy. The pan-product strategy focuses on multi-category distribution, with SKUs typically ranging from tens of thousands to hundreds of thousands. The premium strategy, on the other hand, focuses on core products and quality, with SKUs typically ranging from tens to thousands.

The core competitiveness of traders lies in building the ability of a full-channel operation hub and the ability to integrate supply chain resources. They are deeply involved in core links such as product selection strategies, traffic operation, and light-asset logistics, and gradually extend and transform towards the brand value chain.

(2) Midstream of the industrial chain: Dual-driven by cross-border e-commerce platforms and logistics warehousing

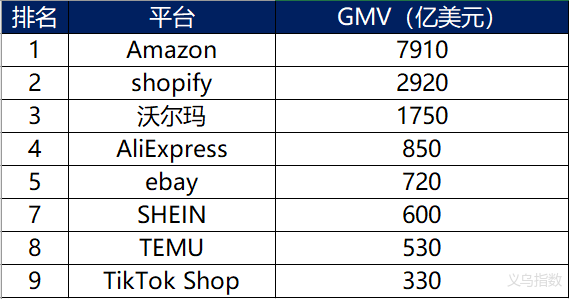

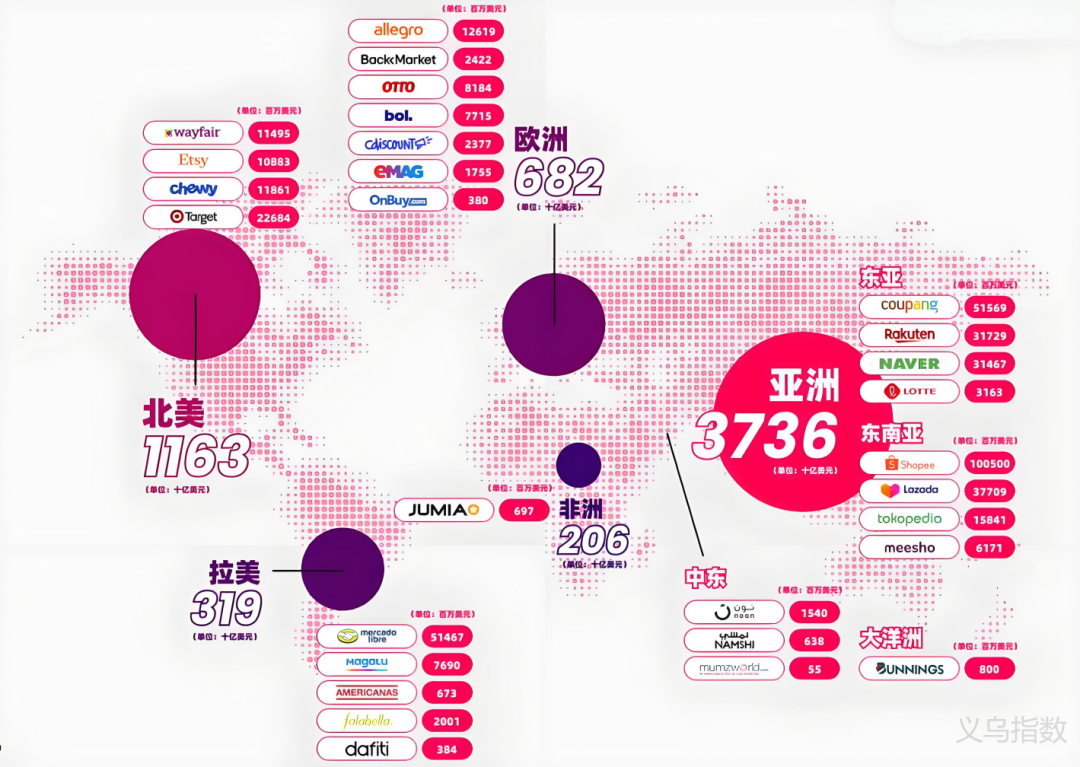

After two decades of development, cross-border e-commerce platforms currently present a situation of one superpower and many strong players. The global giant is led by Amazon. However, in recent years, with the rapid development of the domestic cross-border e-commerce industry, In China, the "Four Little Dragons Going Global" (TEMU, TikTok Shop, SHEIN, and Aliexpress) have gradually emerged. Their GMV has grown rapidly worldwide and they have gradually gained a strong say. Meanwhile, in different regions around the world, e-commerce platforms that are relatively mature in their local markets have also developed, such as Shopee and Lazada in Southeast Asia, Mercado in Latin America, and OZON in Russia, etc.

The GMV situation of major global cross-border e-commerce platforms

Data source: Collation of public information

www.ywindex.com

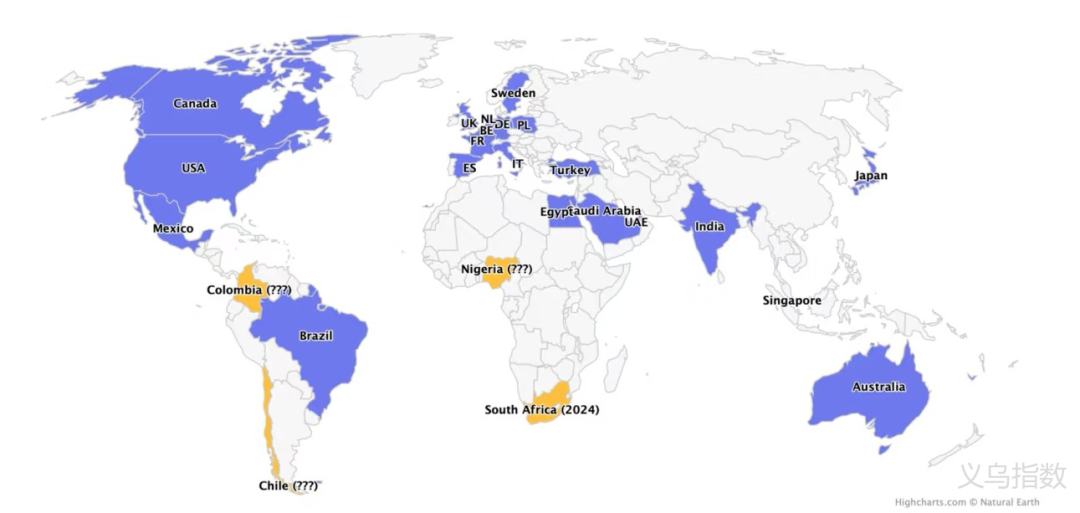

The distribution of major regional e-commerce platforms in 2024

Image source: World First

At present, the pattern of cross-border e-commerce platform giants is gradually becoming clear. Under the trend of convergence, each platform has developed different cooperation models with merchants. In the future, competition will become even more intense. Third-party platforms and independent websites are also the two main ways of export e-commerce, among which third-party platforms are relatively more mature.

From the perspective of cross-border e-commerce logistics and warehousing, it mainly refers to the one-stop logistics services provided by third-party service companies, including front-end collection, in-warehouse operation, export customs declaration, trunk transportation, overseas customs clearance, transshipment and distribution, last-mile delivery, and return processing. It mainly includes direct mail mode and overseas warehouse mode. Among them, the direct mail model is divided into three types: international postal service, dedicated line logistics and commercial express delivery. Overseas warehouses are classified into three types based on the warehouse operation entities: platform warehouses, third-party warehouses, and self-built warehouses.

(3) Downstream of the industrial chain: The market size and penetration rate have increased simultaneously

Data shows that the global e-commerce market size grew from 1.1 trillion US dollars in 2014 to 6.3 trillion US dollars in 2024, with a compound annual growth rate of over 19%. The e-commerce penetration rate has increased from 5.5% to 20.1%. Relying on the increase in penetration rate, the e-commerce market has achieved steady growth. It is expected that by 2027, the market size will grow to 8 trillion US dollars, and the penetration rate will increase to 22.6%.

02

A comparison of major global cross-border e-commerce platforms

(1) Chinese Cross-border E-commerce Platforms: The Four Little Dragons Going Global

Among the cross-border e-commerce platforms mainly used by global consumers, four cross-border e-commerce platforms from China (TEMU, TikTok Shop, SHEIN, and Aliexpress) have risen rapidly. Based on their repeated innovations in scale and gameplay, they have developed into the first-tier platform enterprises in China. They are known as the "Four Little Dragons" of Chinese e-commerce going global.

A comparison between the "Four Little Dragons Going Global" and the Amazon platform

Source of information: Collation of public information

www.ywindex.com

TEMU - The ultimate low price

TEMU is a cross-border e-commerce platform under Pinduoduo. It was launched in September 2022, with its first stop targeting the US market. In November of the same year, it ranked first on the US APP download chart. At present, TEMU has successfully entered over 70 countries and regions around the world, covering multiple markets such as Europe, North America, the Middle East, Oceania, Latin America, Southeast Asia, Japan, South Korea and Africa.

According to similarweb data, in March 2025, TEMU's average monthly visits were nearly 700 million. Among them, in the US e-commerce market, TEMU ranked second on the traffic list with 1.3 billion platform visits. According to statistics, the GMV of TEMU in 2024 is approximately 53 billion US dollars. TEMU has been continuously expanding with a "low price + social sharing" model, and its download volume has been constantly increasing.

In the future, TEMU will replicate the domestic "factory competition" model and build overseas warehouses to shorten the logistics time. Meanwhile, TEMU will focus on expanding its presence in markets such as Europe, the Middle East, and Southeast Asia, and reduce its reliance on the US market.

Image source: TEMU

2. TikTok Shop - Content-driven

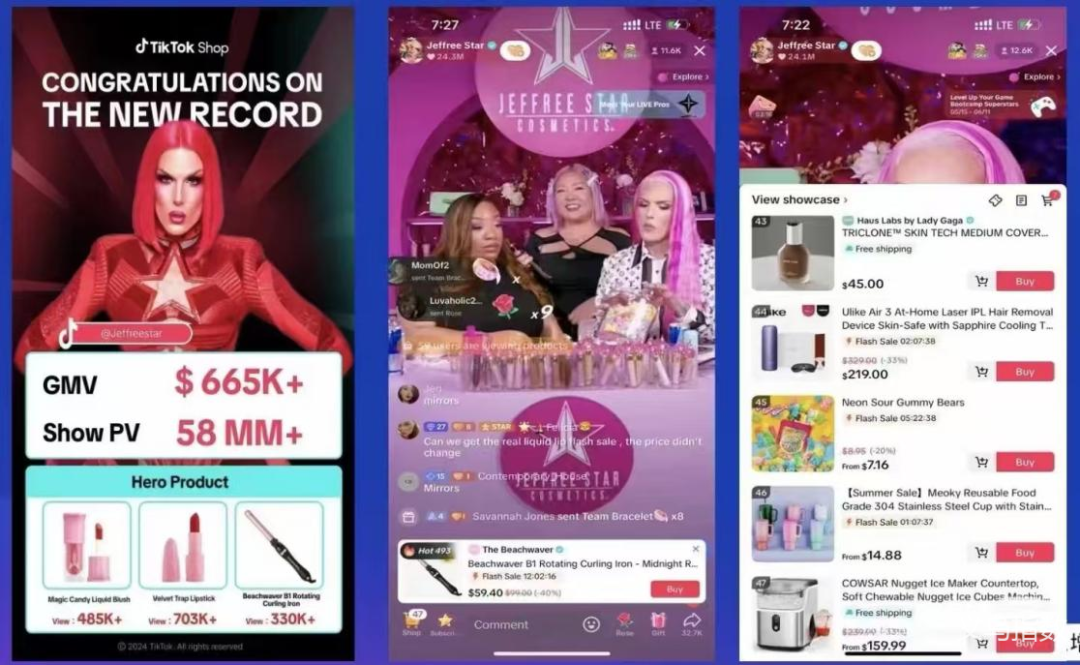

TikTok is a short-video social platform under ByteDance. Its overseas version was officially launched in May 2017, and its global headquarters are located in Los Angeles and Singapore. Data shows that TikTok has reached users in over 150 countries and regions around the world. By the end of 2024, TikTok had more than 2.05 billion registered users globally, with a monthly active user base of 1.58 billion.

TikTok Shop has quickly taken root relying on the TikTok parent platform. In 2021, TikTok's e-commerce business first entered the Indonesian market and gradually expanded into the Southeast Asian market. It was officially launched in the United States in September 2023 and began to recruit Chinese cross-border e-commerce self-operated sellers in October. As of July 2025, TikTok Shop has been launched in 17 countries or regions, including 6 countries in Southeast Asia, 10 countries in Europe and America, and Japan. In 2024, the global total GMV of TikTok Shop reached 33 billion US dollars, achieving an astonishing sevenfold growth compared to 2023.

In the future, TikTok Shop will continue to drive through the dual wheels of "content field + shelf field", adopt the operation strategies of short video seeding and live streaming conversion, and focus on supporting local Internet celebrities.

Image source: TikTok Shop

3. SHEIN - Flexible Supply Chain for Fast Fashion

SHEIN is a Chinese fast fashion cross-border e-commerce company. Its predecessor, "SheInside", was founded in 2008, mainly engaged in the export of wedding dresses. In 2012, it was renamed SHEIN and transformed into a full-category women's clothing company. In terms of market share in the global fashion market in 2024, SHEIN, with a market share of 1.53%, surpassed ZARA, H&M and Uniqlo to become the world's third-largest fashion retailer. The main product categories include all types of clothing such as women's wear, men's wear and children's wear, as well as product lines such as jewelry, cosmetics and shoes.

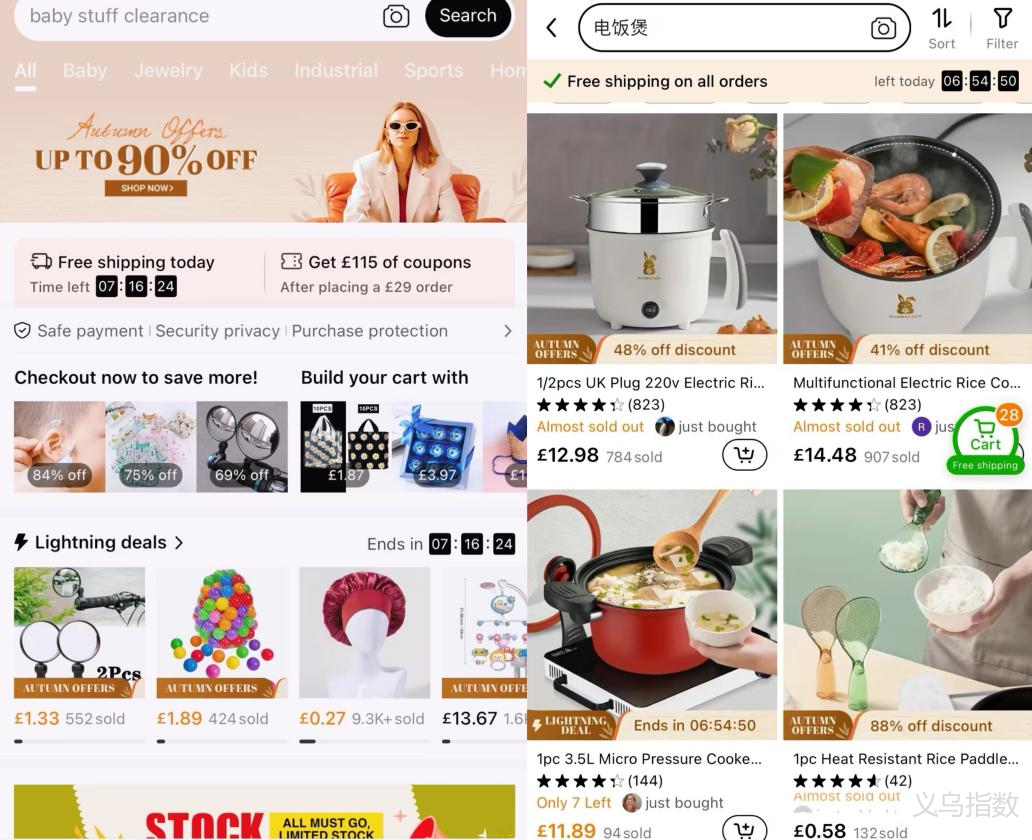

In its early stage, the platform achieved success in the women's clothing category by relying on the "small order quick response" model. After that, it gradually accumulated supply chain and empowerment capabilities, gradually transformed into a cross-border e-commerce platform model, and actively built channel brands with strong recognition through the self-built website model. At present, the business scope of the platform covers more than 150 countries and regions around the world, with a focus on consumer markets such as Europe, America and the Middle East. Data shows that in March 2025, SHEIN's monthly visits to the US market reached 239 million, ranking sixth, with a market share of approximately 2.68% in the US.

SHEIN platform will launch a semi-managed model in 2024, allowing sellers to independently select and list products and operate independently. The selected products must have local inventory overseas and be able to fulfill orders locally. Sellers can quote their own prices, and SHEIN will assist with the pricing. At present, the platform has formed three operation models: self-operation, full hosting, and semi-hosting.

In the future, SHEIN will take data-driven (AI predicting bestsellers) and industrial belt integration (covering over 300 industrial belts across the country) as its core growth strategies, and expand from clothing to all categories including home furnishings, electronic products, and toys.

Image source: Internet

4. AliExpress - An established overseas expansion platform

Aliexpress, an international cross-border e-commerce platform under Alibaba Group, is often referred to by many sellers as the international version of Taobao and is one of the largest export B2C platforms in China. The platform features a variety of functions such as product display, customer ordering, online payment, and cross-border logistics. Its core advantage lies in providing terminal wholesale retailers with the convenience of direct online procurement and direct supply.

Aliexpress was launched in 2010 and its business covers over 200 countries and regions around the world. It enjoys a high market penetration rate and user base in countries and regions such as Russia, Brazil, Spain, the United States, France, and Poland. Among them, Russia was one of the markets that AliExpress focused on developing in its early days. It has a huge user base there and is one of the largest e-commerce platforms in the region. Spain has a relatively high market penetration rate and consistently ranks first in AliExpress's market penetration rate. Data shows that AliExpress's global GMV is approximately 85 billion US dollars in 2024.

In the future, AliExpress will continue to advance its layout and in-depth development in emerging markets, building local warehouses in markets such as Spain and Brazil to significantly reduce delivery time. At the same time, through the Choice service, ChoiceDay is created to compete with Amazon Prime, offering services such as free returns and 3-day delivery to enhance user stickiness.

Image source: Internet

(2) Global first-tier platforms: Amazon

Amazon is the world's largest cross-border e-commerce platform, covering various categories and services. As of 2025, it has 20 sites worldwide, including those in the United States, Canada, Spain, the United Kingdom, Japan, and others. More than 60% of the platform consists of third-party sellers, and the sales of Chinese sellers are growing rapidly.

The layout of Amazon's 20 global sites

Image source: Marketplace Pulse

Data shows that Amazon's GMV is expected to reach 790 billion US dollars in 2024, accounting for nearly 40% of the global e-commerce market share, taking a sharp lead over other platforms.

The core advantages of the Amazon platform include a huge traffic dividend and the FBA (Fulfillment by Amazon) logistics system. In 2024, the monthly visits to the Amazon platform reached 5.2 billion, and the number of Prime members exceeded 200 million. The users have high stickiness and strong purchasing power, providing a huge traffic dividend. The unique FBA logistics system supports global rapid delivery services and enhances the consumption experience of buyers. For cross-border sellers, Amazon is not only a sales channel but also a springboard for brand internationalization.

Image source: Internet

Summary

The "Four Little Dragons" have performed outstandingly in the global cross-border e-commerce field. With their unique supply chain management features and business models, they have successfully made it into the top ten shopping apps with the fastest global download growth. SHEIN's flexible supply chain gives it an edge in the fast fashion sector. TEMU's fully managed model and social sharing strategy have rapidly accumulated users. AliExpress's complete supply chain system and comprehensive product range meet the needs of different users. TikTok Shop's high traffic is achieved through live streaming and short videos for product exhibitions and sales.

Nowadays, cross-border e-commerce has long passed the era of "making money effortlessly". As an important trade model for enterprises to go global, the industry is moving towards a stage of "meticulous cultivation". Only by creating differentiated advantages can enterprises gain the initiative in the wave of globalization.

—— The content of this article is translated by Al ——

My favorites

My favorites