Cross-border E-commerce Series Special Topic (1) - Thirty Years of Globalization Journey, It's the Right Time to Go Global

Publish Time:2025-11-17 15:23:35Pageviews:537

abstract: The cross-border e-commerce industry is in an era full of opportunities and challenges. From policy fluctuations to technological innovation, from brand building to enterprises going global, every link tests the capabilities of enterprises. However, it is precisely these challenges that have provided impetus for the industry to break through and grow. In the future, with the optimization of supply chains, the rise of emerging markets and the advancement of overseas expansion strategies, the cross-border e-commerce industry is bound to play a more significant role in global trade.

When domestic "triple bunkers" bravely ventured into New York's Times Square and Yiwu fan caps topped the outdoor sales chart in Europe and America... China's cross-border e-commerce is accelerating its overseas expansion with a "simultaneous increase in both quantity and quality".

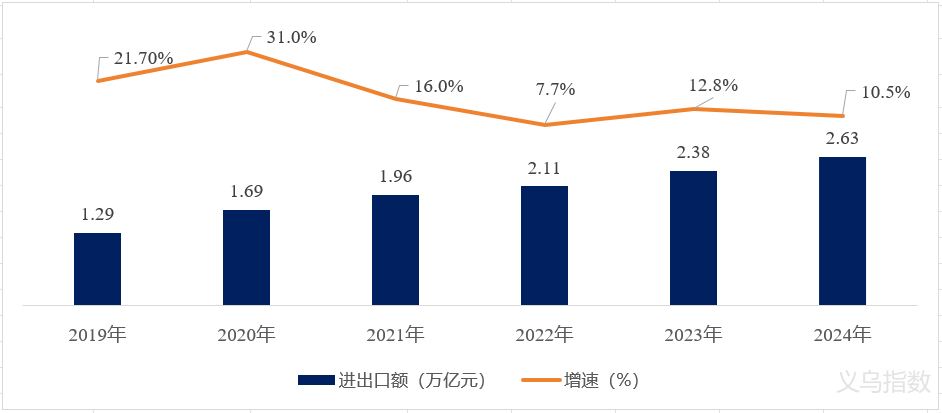

In 2024, the total volume of cross-border e-commerce imports and exports in China reached 2.63 trillion yuan, increasing by 10.8% year-on-year, more than doubling the overall growth rate of China's foreign trade during the same period.

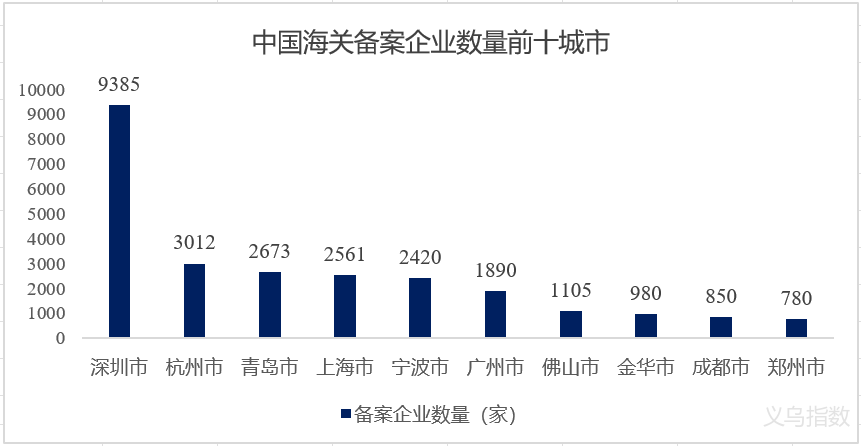

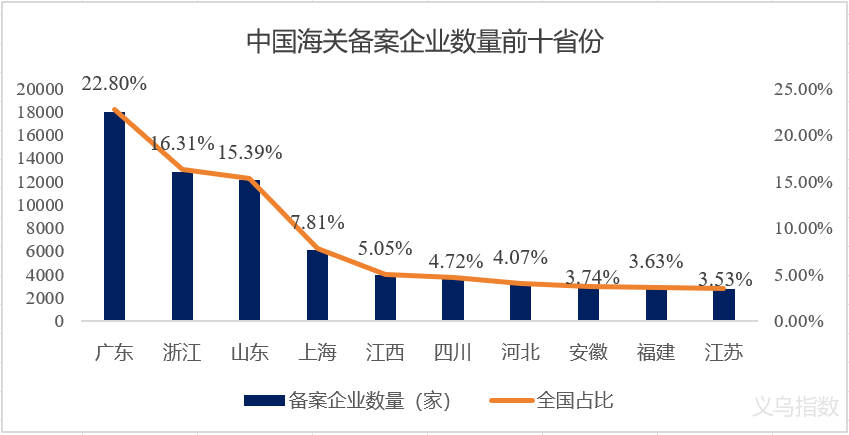

By 2024, the number of cross-border e-commerce enterprises registered with the customs in China will exceed 120,000, and the cumulative number of registered trademarks overseas will exceed 30,000.

Over the past five years, the scale of cross-border e-commerce trade in China has increased by more than ten times, and its share of the country's total imports and exports of goods has risen to 6%.

Cross-border e-commerce, as a new trade model in the digital economy era, is rapidly growing into a key engine for China's high-quality economic development. As the state further introduces policies to encourage the development of new forms of foreign trade such as cross-border e-commerce, the scale of cross-border e-commerce imports and exports is expected to grow further in the future.

Yiwu Index will take you to gain a deep understanding of the current development status of the cross-border e-commerce industry through a series of special topics on cross-border e-commerce.

01

The classification of cross-border e-commerce: The B2B model dominates, while interest-based e-commerce has seen significant growth

With the advancement of technology and the continuous changes in consumer demands, the cross-border e-commerce industry has developed various models and categories.

From the perspective of transaction entities, cross-border e-commerce can be classified into cross-border B2B, B2C e-commerce, and the emerging C2C and D2C e-commerce. Among them, B2B and B2C are currently the mainstream transaction models, occupying the majority of the cross-border trade market share. Data shows that the B2B model accounts for 80% of the market share, while the B2C model takes up nearly 20%.

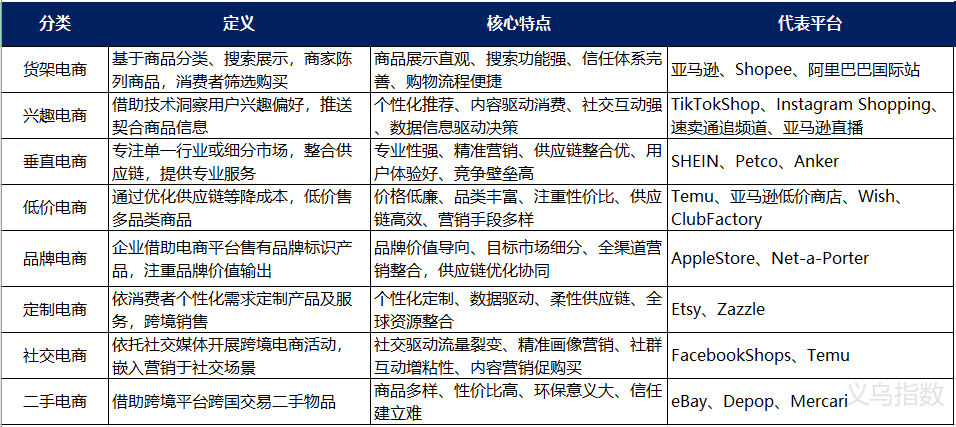

From the perspective of content orientation, cross-border e-commerce can be classified into eight major categories: shelf e-commerce, interest-based e-commerce, vertical e-commerce, low-price e-commerce, and brand e-commerce. Each type has its own unique operation model and market positioning.

Classification of cross-border E-commerce (by content orientation)

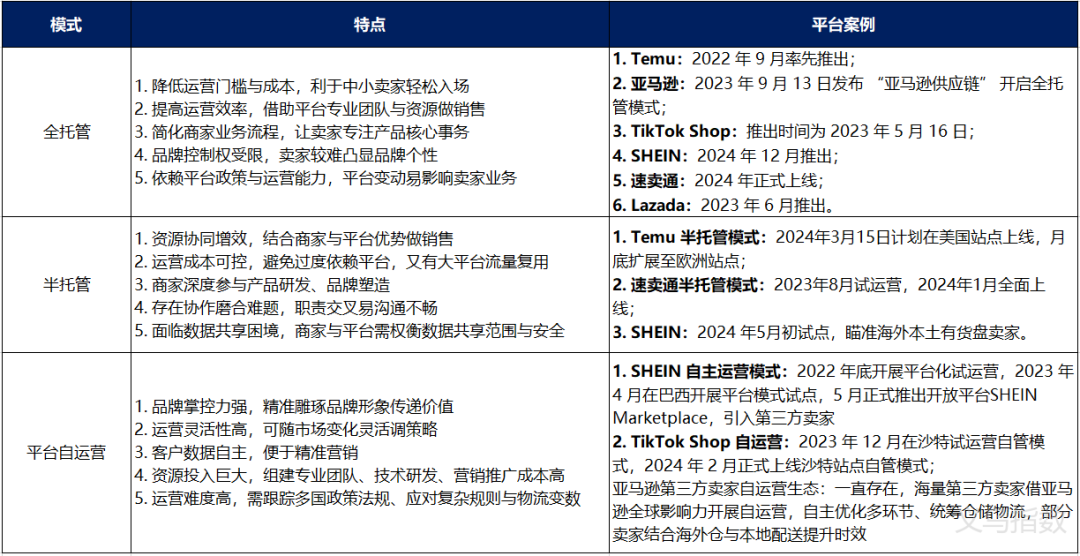

From the perspective of platform operation models, cross-border e-commerce can be classified into self-operated models by merchants, semi-managed models, and fully managed models.

Classification of cross-border e-commerce operation models

Characteristics of different operation models and platform examples

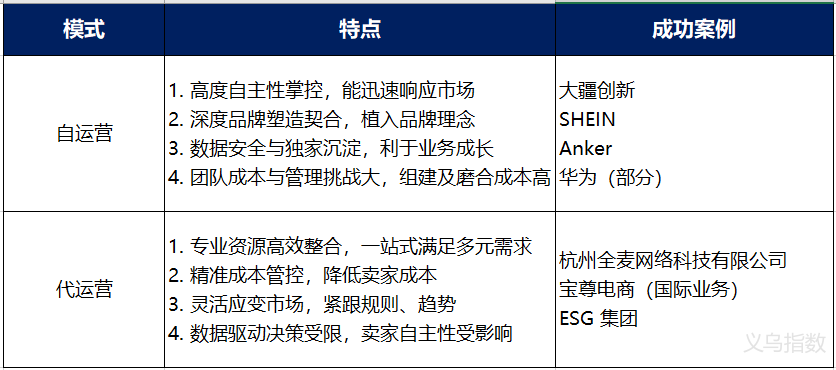

From the perspective of merchants' operation models, cross-border e-commerce can be divided into two major categories: self-operation models and agency operation models.

Self-operation relies on the internal team of the merchant to control the entire process. In recent years, its market share has gradually increased, and it has performed outstandingly in terms of revenue, repurchase rate and other dimensions. It has the characteristics of high autonomy and is conducive to brand building. Dji and SHEIN are successful examples. Agency operation refers to the practice where sellers outsource some or all of their key functions to third parties. The market size is growing rapidly and it enjoys high recognition. It has advantages such as efficient resource integration and precise cost control. Companies like Whole Wheat Network and Baozun E-commerce help enterprises successfully go global.

Examples of different business operation models

02

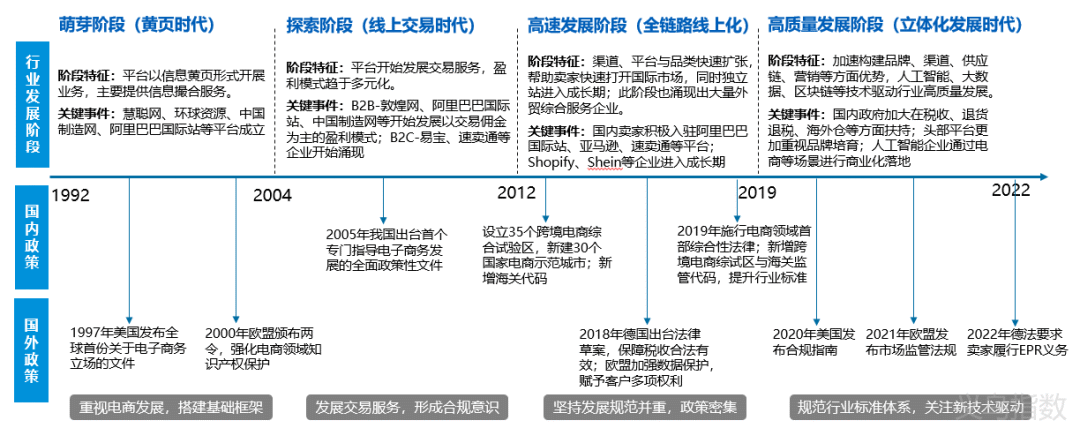

The Development History of China's Cross-border E-commerce: From "Information Yellow Pages" to "AI-driven"

Cross-border e-commerce, as the forefront of digital transformation in the field of international trade, has experienced rapid development over the past few decades and deeply reshaped the global business landscape. Overall, China's cross-border e-commerce industry has gone through four development stages since the 1990s. Early cross-border e-commerce platforms mainly focused on B2B information display and reporting. In 2016, Amazon Global Selling rose to prominence, leading to the rapid development of similar B2C cross-border e-commerce models. In recent years, domestic B2C cross-border e-commerce business has grown rapidly. The overseas expansion chain also covers the entire industrial chain, and services have become more professional. Now, the era when domestic platforms, brands, factories, and sellers go global comprehensively is approaching.

The development stages of China's cross-border e-commerce industry

Source of information: Collation of public information

The main development nodes of cross-border e-commerce in China are as follows:

In 2014: The era shifted from accelerated imports to exports. The year 2014 was hailed by the industry as the first year of cross-border import e-commerce. Traditional retailers, domestic and foreign e-commerce giants, start-ups, logistics enterprises, freight forwarders and others all entered the field. At the same time, the rapid rise of mobile Internet infrastructure. Both the platform end and the trade model have made remarkable progress: 1. Tmall Global was officially launched in February 2014, directly supplying original overseas products to domestic consumers; 2. Amazon has settled in the Shanghai Free Trade Zone. 3. The 9610 cross-border e-commerce code was issued, marking the first time that cross-border e-commerce was included in the official customs supervision code scope.

From 2015 to 2016: The competition among platforms began to intensify, and a comprehensive service system started to emerge. In 2015, the transaction volume of cross-border e-commerce in China grew rapidly. E-commerce platforms such as Alibaba, JD.com and Suning all entered the overseas shopping market. Models like "Yangmatou" and "Miya" also emerged along with the competition. Cross-border e-commerce initiated a major development in all links of the upstream and downstream industrial chains.

In 2018, the trade war ushered in an era of "anti-globalization". The United States has adjusted its tax laws, requiring e-commerce sellers to pay taxes as well. European countries have also adjusted their corresponding tax regulations.

In 2020, new customs supervision models 9710 (Cross-border e-commerce B2B Direct Export) and 9810 (Cross-border E-commerce export to overseas warehouses) were added to cross-border e-commerce.

In 2021, events such as Amazon account suspensions pushed cross-border e-commerce into an era of compliance. After Amazon shut down a large number of accounts targeting Chinese merchants in 2021, most sellers, including top sellers, were severely affected, but those with relatively high compliance were less impacted. At the same time, the platform's account suspension has directly accelerated the rapid rise of the independent website model.

In 2023, the "Four Little Dragons" of Chinese e-commerce going global rose rapidly, and the global cross-border e-commerce competition ushered in a new pattern. Chinese cross-border e-commerce dark horse Temu has developed rapidly, with over 100 million users in the United States. TikTok Shop's revenue and share in Vietnam are second only to Shopee. SHEIN has become one of the most downloaded shopping apps worldwide.

Image source: Yiwu Index

In 2024: Technologies such as artificial intelligence will drive the high-quality development of cross-border e-commerce. In 2024, Amazon successively launched AI applications such as the seller AI assistant Amelia and Video Generator. Alibaba International Station has successively released AI applications covering scenarios such as AI image generation and advertising placement. Promote the cross-border e-commerce industry to enter a high-quality development stage.

03

China's cross-border e-commerce: The wave of going global continues, with both opportunities and challenges coexisting

In 2021, the scale of China's cross-border e-commerce imports and exports exceeded one trillion yuan for the first time, reaching 1.44 trillion yuan. By 2024, the total volume of China's cross-border e-commerce imports and exports is expected to reach 2.63 trillion yuan, representing a year-on-year growth of 10.8%. Among them, exports reached 2.15 trillion yuan, increasing by 16.9% year-on-year. From the perspective of the overall industry scale, in recent years, it has maintained a stable and rapid growth trend, which is higher than the overall growth rate of foreign trade. This also reflects that in the environment where online infrastructure is gradually maturing, more small and medium-sized merchants are participating in the overseas expansion trend.

China's cross-border e-commerce import and export volume and growth rate from 2019 to 2024

Data source: General Administration of Customs

www.ywindex.com

According to data from the Ministry of Commerce, there are currently over 120,000 cross-border e-commerce entities registered with the customs in China, mainly concentrated in the eastern coastal areas. Among them, Guangdong, Zhejiang and Shandong provinces rank the top three, accounting for more than 54.5%, and Shenzhen alone accounts for nearly 12%, forming a pattern of concentration in the east and rise in the central and western regions. The distribution of cross-border e-commerce entities in 2024 is shown in the following figure.

Data source: Collation of public information; Yiwu Index

www.ywindex.com

Data source: Collation of public information; Yiwu Index

www.ywindex.com

From the perspective of the global environment that China's cross-border e-commerce is facing, the current global trade pattern is undergoing profound changes, and geopolitical factors are changing rapidly. Overall, it is in an era where opportunities and challenges coexist.

In terms of opportunities, cross-border e-commerce has been included in the "Government Work Report" for five consecutive years. The General Administration of Customs has introduced exclusive supervision codes such as "9710" and "9810" to simplify the customs clearance process. The "tax refund upon departure" policy has shortened the export tax refund cycle from 60 days to 15 days. And the drive of new technologies such as AI, etc., are promoting the sustainable development of cross-border e-commerce. In terms of challenges, the low growth and high inflation of the global economy have restricted the expansion of the industry. Trade protectionism and the competition among major powers have brought certain impacts to cross-border e-commerce.

Analysis of the Macro Environment for the Development of Cross-border E-commerce in China

Source of information: Collation of public information; Yiwu Index

www.ywindex.com

In terms of development patterns, China has been the world's largest online retail market for 11 consecutive years, with an e-commerce penetration rate of approximately 47% in 2024. Data shows that China's online retail sales reached 15.52 trillion yuan in 2024, ranking first in the world. During the same period, the e-commerce sales in the United States reached 1.2 trillion US dollars (approximately 8.6 trillion RMB), making it the world's second-largest e-commerce market after China. The e-commerce penetration rate in the United States was about 22.7%.

In terms of e-commerce penetration rate, the Chinese market is far ahead of other countries and occupies the first echelon. The e-commerce penetration rates in Indonesia, the United Kingdom and South Korea have all exceeded 30%, ranking in the second tier. The e-commerce penetration rates of the United States, Mexico, Singapore, Japan, Russia and Canada are also among the top ten, ranking in the third tier.

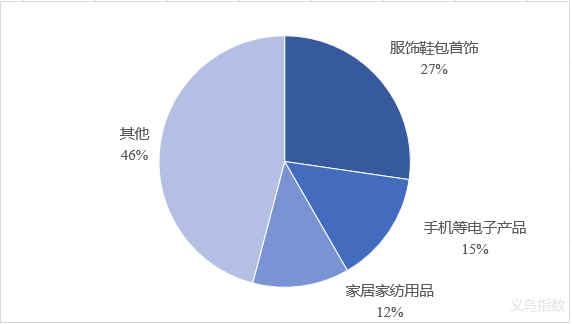

In terms of product categories, electronic products, clothing, shoes and bags, home textiles and other items have always been popular products in China's cross-border e-commerce field. Meanwhile, with the continuous changes in market demand, emerging categories such as health care and outdoor sports have gradually gained favor in the market and become new popular choices.

The situation of popular cross-border e-commerce export categories in China in 2024

Data source: Collation of public information; Yiwu Index

www.ywindex.com

With the increasing recognition of domestic brands overseas year by year and the continuous growth of the global e-commerce retail penetration rate, the transaction volume of China's cross-border export e-commerce has been constantly rising, and its share in the global cross-border e-commerce retail transaction volume has also been steadily increasing. This growth is mainly attributed to the expansion of the global e-commerce market, the change in consumers' shopping habits and the improvement of the competitiveness of Chinese export goods.

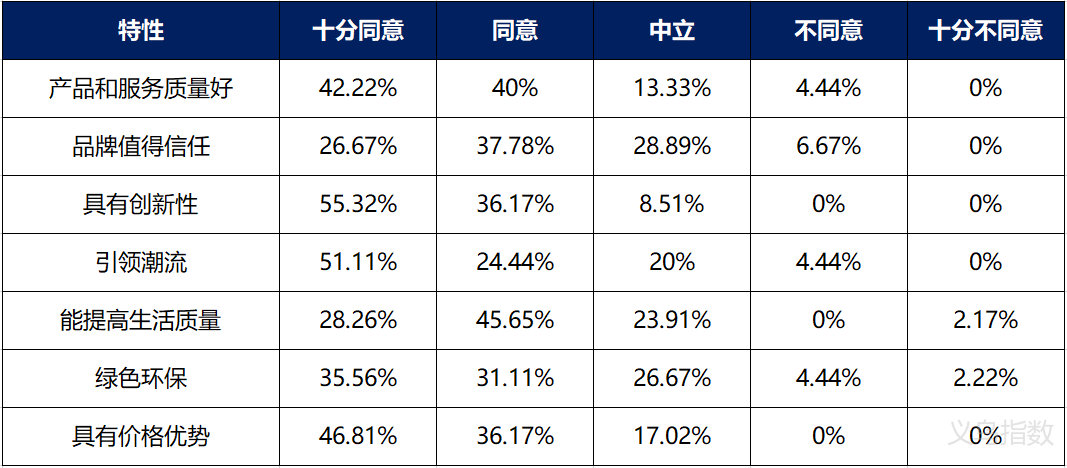

Table: Evaluations of the advantages of Chinese brands by overseas media people interviewed

Data source: Yiwu Index

www.ywindex.com

04

Global cross-border e-commerce: The market size is steadily growing, with the Asia-Pacific region taking the leading position

Cross-border e-commerce has demonstrated a strong growth trend worldwide, especially in emerging markets such as Southeast Asia, South Asia, Latin America, and Eastern Europe. With the gradual formation of online shopping habits, the market development potential in these regions is huge. Overall, the development of the cross-border e-commerce industry is closely related to the increase in e-commerce penetration rates in various countries around the world and the growth of traditional foreign trade.

From the perspective of the B2C sector, according to eMarketer's data, the global B2C cross-border e-commerce transaction volume will reach 1.98 trillion US dollars in 2024. From 2019 to 2024, the compound annual growth rate (CAGR) of global B2C cross-border e-commerce was 17.9%. The Asia-Pacific region is the largest B2C cross-border e-commerce market, accounting for 43.7% of the global market. Europe and North America account for 29.5% and 17.8% respectively. Fashion and electronic products are the most popular product categories in B2C cross-border e-commerce.

From the perspective of the B2B sector, according to Statista, the global B2B cross-border e-commerce transaction volume is expected to exceed 24 trillion US dollars in 2024. From 2019 to 2024, the compound annual growth rate (CAGR) of global B2B cross-border e-commerce was 11.2%. The Asia-Pacific region is also the largest market for B2B cross-border e-commerce, accounting for 34.2% of the global market. North America and Europe account for 28.5% and 25.3% respectively. Machinery, auto parts and chemical products are the industries with the highest transaction volumes in B2B cross-border e-commerce.

Summary

The cross-border e-commerce industry is in an era full of opportunities and challenges. From policy fluctuations to technological innovation, from brand building to enterprises going global, every link tests the capabilities of enterprises. However, it is precisely these challenges that have provided impetus for the industry to break through and grow. In the future, with the optimization of supply chains, the rise of emerging markets and the advancement of overseas expansion strategies, the cross-border e-commerce industry is bound to play a more significant role in global trade.

In the next issue, we will take you through the development of cross-border e-commerce platforms in the cross-border e-commerce industry ecosystem.

—— The content of this article is translated by Al ——

My favorites

My favorites