Chinese metaphysics has restructured the jewelry business, with the market size soaring to 770 billion yuan

Publish Time:2025-11-25 09:11:08Pageviews:88

abstract: "A piece of Hetian jade, half of the history of China." "Diamonds last forever, one will be passed down through the ages."

"A piece of Hetian jade, half of the history of China." "Diamonds last forever, one will be passed down through the ages." It can be said that from ancient times to the present, every girl has her own affection for jewelry.

In 2024, the market size of China's jewelry and gemstone industry exceeded 770 billion yuan, and the retail sales of jewelry e-commerce reached 298 billion yuan, with a year-on-year growth of 16.4%.

In 2024, the total import and export volume of China's jewelry industry reached 154.7 billion US dollars, increasing by 6.46% year-on-year, maintaining a trade deficit for ten consecutive years.

On June 17th, at the bidding site for the fashion jewelry industry in the Global Digital Trade Center of the sixth-generation Market in Yiwu, thousands of merchants gathered to "compete" for 389 prime stalls, with the competition being extremely fierce as "one stall was hard to come by".

In this article, Yiwu Index will take you through an interpretation of the jewelry industry.

01

The jewelry industry driven by mysticism and self-indulgent consumption: Market size soars to 770 billion

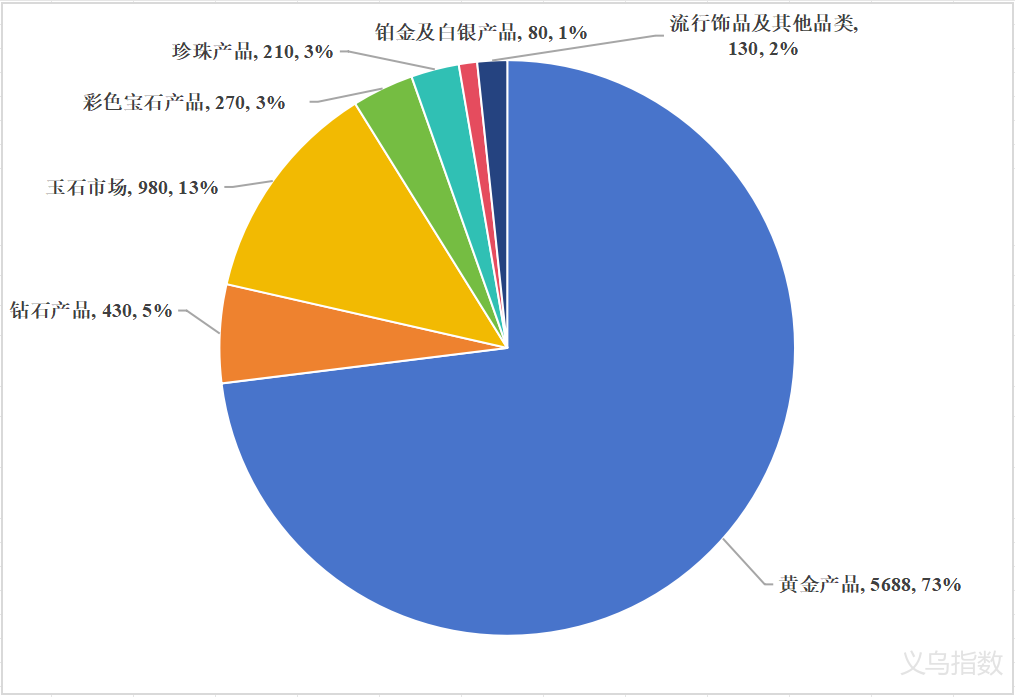

Amid the constantly changing market trends, the jewelry industry, with its unique charm and value, continuously attracts consumers' attention. The market size of China's jewelry and jade jewelry industry reached 778.8 billion yuan in 2024. Apart from gold products, jade is the most significant subcategory, with a market size of 98 billion yuan, accounting for approximately 13%.

Market Size and Proportion of sub-categories in China's jewelry and ornaments Industry in 2024 (billion yuan, %)

Data source: China Gems Association Yiwu Index

www.ywindex.com

(1) How Does the Tiny "Stone" Break Through the Circle

"Traditional demand, self-indulgent consumption, and mysticism" have become the key words for the current growth in jewelry consumption.

The traditional demands on specific days such as weddings and first birthdays form a solid foundation for the sales of jewelry products. These scenes hold special significance in traditional culture. As a carrier of emotions and blessings, jewelry has become an indispensable existence, providing a stable consumption base for the industry.

The rise of self-indulgence consumption has made "rewarding oneself" a new reason for purchasing jewelry. Research data shows that 40.1% of the younger generation of consumers will pay for emotional value. When self-indulging consumption meets the jewelry industry, more and more young consumers are willing to reward themselves and please themselves.

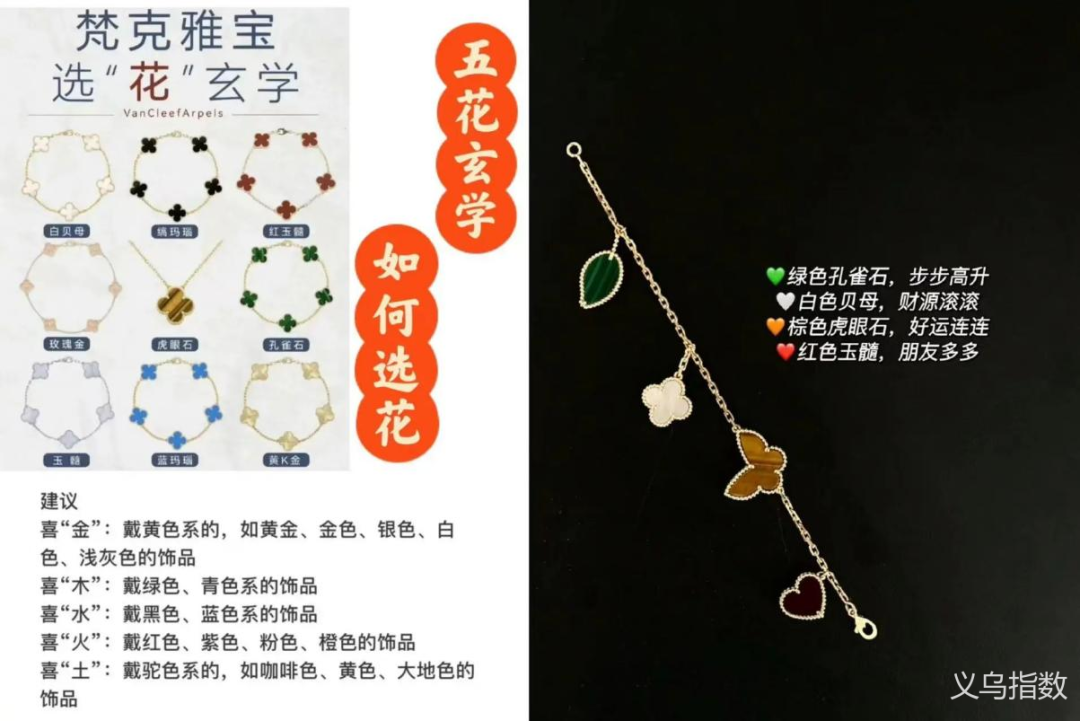

"The end of jewelry is mysticism." Nowadays, an increasing number of jewelry brands are attempting to capture the attention of anxious young people through esoteric jewelry. In traditional Chinese culture, jadeite is believed to soothe the mind and promote health, as well as to ward off misfortune and bring good fortune. The word "pearl" sounds like "to hold back" in Chinese, providing young people with a spiritual refuge to confront uncertainty. For instance, the seemingly absurd and esoteric claims such as "Van Cleef & Arpels bring wealth" and "Empress Dowager Xi assists in exams" are actually products of the sentiments of The Times. Therefore, the combination of the jewelry industry and metaphysics has naturally become a marketing hotspot that jewelry brands and merchants are competing to pursue nowadays. It is no exaggeration to say that starting from 2024, the jewelry business is entering an era of mysticism.

A metaphysics blogger interprets the Five Elements Metaphysics with the "Five Elements Theory". Image source: Xiaohongshu

(2) Domestic industrial distribution: Raw materials rely on imports and manufacturing division of labor is clear

The domestic jewelry industry has a relatively high degree of agglomeration and clear regional division of labor. Relying on resource advantages, processing traditions and market demands, each category has formed highly distinctive industrial belts.

The distribution of major jewelry industrial belts in China

Source of information: Collation of public information

www.ywindex.com

02

The jewelry industry is embracing new opportunities and redefining the concept of "jewels and treasures".

In response to the changing demands of consumers, the jewelry industry is proactively seeking changes in aspects such as category design innovation and sales channel expansion, adapting to the new situation of the jewelry industry with a more flexible and diverse attitude.

(1) Jadeite and other jade jewelry may be on the verge of a boom year

Jewelry categories are made of a wide variety of materials. Besides precious metals such as gold and platinum, they can be classified into natural gemstones (natural gemstones, natural jade, natural organic gemstones) and artificial gemstones (synthetic gemstones, artificial gemstones, recreated gemstones, and composite gemstones). At present, the four types of jewelry materials with relatively high popularity among the general public are as follows

-

Gemstone jewelry: Jewelry made of materials such as diamonds, rubies, sapphires, crystals, tourmalines, garnets, tanzanites, emeralds, aquamarines, etc.

-

Jade material jewelry: Jewelry containing materials such as jadeite, Hetian jade, chalcedony (agate), opal, turquoise, lapis lazuli, obsidian, and chicken-blood stone;

-

Organic gemstone jewelry: Jewelry made of materials such as amber, natural pearls, conch pearls, and shells (excluding products from wild protected animals);

-

Synthetic gemstone material jewelry: Jewelry containing synthetic diamonds, synthetic rubies, synthetic sapphires, synthetic emeralds, synthetic jadeite and other materials.

Hetian jade, tourmaline and garnet. Image source: Yiwu Index

Fashion is a cycle, and this is particularly evident in the field of jewelry. According to the business operators in Yiwu Market, "This year may be a boom year for jade and other jade jewelry. Since the second half of last year, the number of customers inquiring about jade in the store has significantly increased." From the traditional consumer staples of gold and platinum jewelry to the booming crystal business in the past two years, and now to the return of various jade jewelry to the public eye, the changing trends influence the dynamics of the market.

(2) Domestic market: Consumption stratification, e-commerce boom, IP collaboration

The trend of consumption stratification in the jewelry market has intensified, becoming a prominent feature of the current consumption pattern. The high-end jewelry market will continue to grow due to its scarcity and brand value. The mass jewelry market will focus more on product cost performance, diversification and personalized expression to meet the differentiated demands of different consumer groups. Meanwhile, as the concepts of circular economy and sustainable development have taken root in the hearts of Generation Z, the second-hand jewelry market is expected to enter a period of favorable development.

High-end jewelry image source: Yiwu Index

The growth rate of jewelry e-commerce has been stable with progress, and live-streaming sales have become a new driving force for jewelry sales. In 2024, the retail sales of jewelry through e-commerce in China were approximately 298.26 billion yuan, representing a year-on-year growth of 16.4%. The total e-commerce sales in five major industrial belts, including Shuibei in Shenzhen and Ruili in Yunnan, exceeded 100 billion yuan. The consumption potential of e-commerce channels is huge. Platforms such as Douyin and JD.com are accelerating their layout in potential fields like pearls and lab-grown diamonds. Nowadays, the young consumer group is more inclined to obtain information through social media, which has become an important driving force for the development of jewelry e-commerce. The middle-aged and elderly consumer groups are also beginning to try emerging channels such as live streaming on the Internet. The jewelry and accessories industry on Douyin's e-commerce platform is on the rise as a whole, with an average annual growth rate of 54%.

The image source of the jewelry store currently live-streaming on Douyin: Screenshot from Douyin

Jewelry +IP, creating best-selling trendy products. Seeking IP has become the main source of differentiated content for the survival and development of the industry. POPOP, the independent jewelry brand of Pop Mart, has officially opened offline stores in Beijing and Shanghai. On the first day of trial operation of the pop-up store in Shanghai, the LABUBU amethyst bracelet, which symbolizes academic support, was sold out quickly. It can be foreseen that in the jewelry industry in the future, IP will no longer be an add-on but a core competitiveness.

The source of the LABUBU bracelet image: Internet

(3) Overseas markets: The Asia-Pacific market is the main consumer force, while the Latin American market is experiencing strong growth

As the design level of the domestic jewelry industry gradually improves and craftsmanship becomes increasingly exquisite, many domestic brands are constantly expanding their overseas markets, driving the growth of the global jewelry consumption market size.

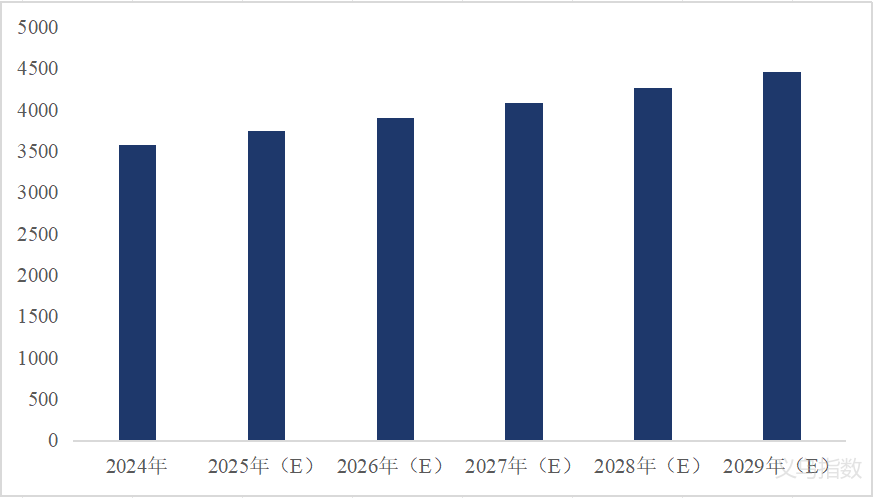

The global jewelry market size was 358.26 billion US dollars in 2024 and is expected to increase to 374.8 billion US dollars by 2025. It is projected to reach 446.33 billion US dollars in 2029, with a compound annual growth rate of 4.46%.

Global jewelry market size from 2024 to 2029 (Unit: billion US dollars)

Data source: China Gems Association Yiwu Index

www.ywindex.com

The market size of the Asia-Pacific region is far ahead. In 2024, the jewelry market size was 235.97 billion US dollars, accounting for approximately 65.87% of the global market size. Consumers in the Asia-Pacific region prefer jewelry made of warm and lustrous materials such as jade and pearls. Designs that are not overly flamboyant are more likely to win the favor of consumers in this region, especially jewelry with auspicious patterns like dragons, phoenixes, and auspicious clouds, which are widely popular.

Jade jewelry featuring dragon, phoenix and auspicious cloud elements. Image source: Yiwu Index

The jewelry market size in Europe and America was approximately 97.63 billion US dollars in 2024 and is expected to grow to 107.38 billion US dollars by 2029, with an average annual compound growth rate of about 1.88%. Europe and America have a unique gemstone culture. Their aesthetic orientation places more emphasis on simplicity, refinement and elegance, and they have higher requirements for the craftsmanship and manufacturing quality of jewelry. When it comes to material selection, consumers in Europe and America tend to prefer dazzling diamonds and gemstones.

The ruby crown worn by Queen Elizabeth II of the United Kingdom. Image source: Internet

The growth momentum in Latin America is strong. The jewelry market size was approximately 9.88 billion US dollars in 2025 and is expected to reach 13.13 billion US dollars by 2029, with an average annual compound growth rate of 7.36%. In terms of jewelry category preferences, those with rich colors and bold designs are more favored by consumers in Latin America. Rubies and sapphires are bright and vivid in color, which is in line with the passionate cultural atmosphere of Latin America and has attracted the love of a large number of consumers.

03

Yiwu jewelry has transformed over the past decade, from a "small commodity" to a "dream maker"

The fashion jewelry industry in Yiwu started in 2010. After more than ten years of development, it has attracted many jewelry enterprises from Zhuji, Guangzhou, Putian, Yunnan and other places to settle in. Today, the fashion jewelry industry, as a key investment attraction area of the Global Digital Trade Center of the sixth-generation market in Yiwu, covers the entire spectrum from "high-end luxury goods" to "national trend cultural and recreational items". Specifically, the fashion jewelry industry in Yiwu market is mainly subdivided into three categories:

-

Gold and silver handicrafts: Jewelry whose main body or components are made of precious metals such as gold, K gold, platinum, and silver.

-

Jewelry and jade: Gemstone jewelry, jade jewelry, organic gemstone jewelry, synthetic gemstone jewelry;

-

Wooden collectibles: Jewelry whose main body or components are made of materials such as agarwood, small-leaf red sandalwood, golden thread nanmu, sandalwood, Bodhi seeds, olive pits, collectible walnuts, and monkey head peach pits.

The image source of the fashion jewelry industry shops in Yiwu Market: Yiwu Index

From the perspective of the distribution within the venue, the merchants dealing in jewelry are mainly located on the second, third and fourth floors of the first zone of the International Trade City. Currently, there are approximately 520 business entities within the venue, among which about 310 are engaged in goldsmithing, about 140 in jewelry and jade, and about 70 in woodwork and cultural and artistic items.

From the perspective of product sales regions, the fashion jewelry industry in Yiwu mainly focuses on domestic sales, with the ratio of domestic to foreign trade sales being approximately 9:1. The main customer groups for domestic sales are spread all over the country, mainly consisting of jewelry wholesalers, jewelers, wholesalers of souvenirs for tourist attractions and individual customers, with small-scale wholesale and retail orders being the majority. The export is mainly targeted at the Asia-Pacific market and the European and American markets, and the industry's degree of openness is relatively low.

(1) The continuously expanding fashion jewelry industry in Yiwu

On the morning of June 17th, the bidding for commercial Spaces in the fashion jewelry industry at the Global Digital Trade Center came to an end, with thousands of merchants gathering at the bidding site. The "Fashion Jewelry Zone" of the Global Digital Trade Center in Yiwu's Sixth-generation Market integrates multiple functions such as design, exhibition and sales, and live streaming, injecting new digital vitality into the traditional jewelry industry. Mr. Zhu, who has been deeply involved in the Southeast Asian market for over a decade, said on the spot, "The Sixth Zone is an excellent stage for building a brand in the jewelry industry and increasing the added value of jewelry. It is expected to help the jewelry and jade industry in Yiwu further go international." In the future, with the entry of nearly 400 fashion jewelry industry business positions in the sixth-generation market Global Digital Trade Center, the industry scale will continue to expand.

The bidding site of the fashion jewelry industry at the Global Digital Trade Center. Source: Yiwu Index

(2) Yiwu's Jewelry Business Philosophy - "Dreaming"

According to a business owner in Yiwu Market, "Often, what people like is not the product itself, but when it is endowed with special meanings such as' the promise to witness a long-term love 'or' the warmth to carry the family's inheritance ', consumers will be willing to pay for this value that goes beyond the material itself." More and more merchants in Yiwu are endowing jewelry products with differentiated design concepts by creating brand stories, reaching the value recognition and emotional resonance deep in consumers' hearts. By leveraging the cultural potential accumulated through "dream-making", they ultimately achieve a deep integration of brand stories, cultural connotations and consumers' dreams.

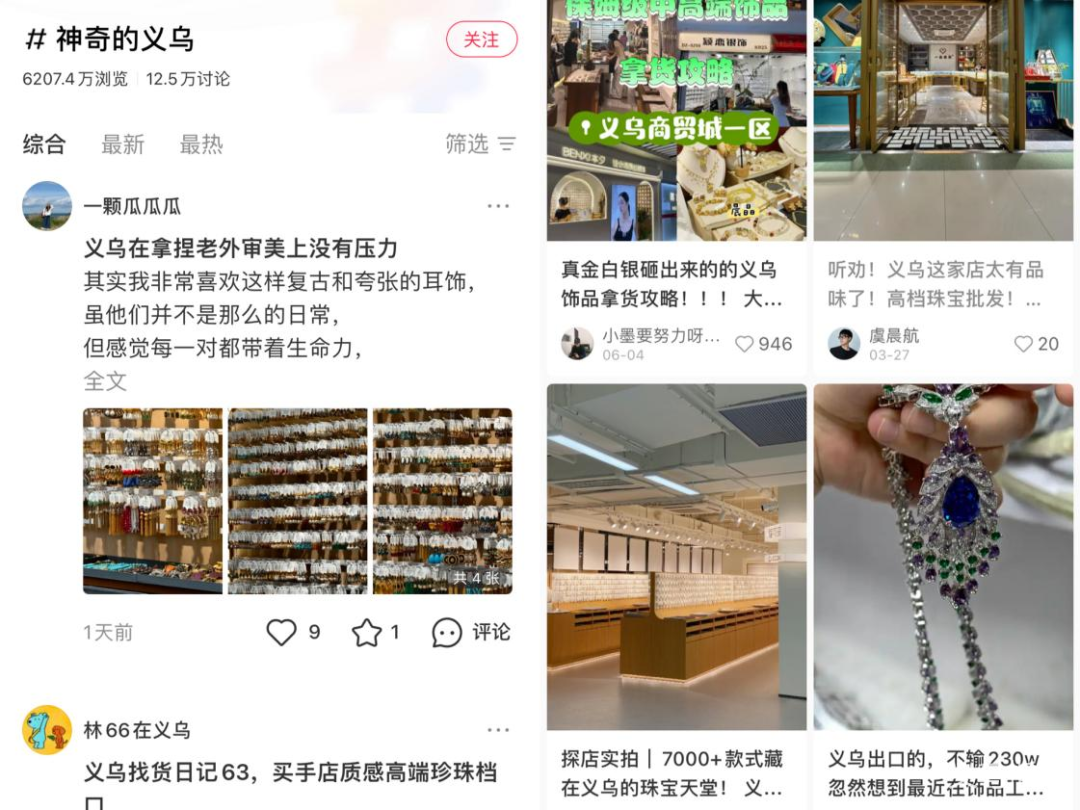

(3) Build a multi-channel marketing matrix

Social media platforms such as Xiaohongshu and Douyin have become the bases for precise traffic diversion for jewelry merchants in Yiwu. According to a business owner in Yiwu Market, "Apart from my regular business operations, my routine is to post some design inspirations and matching tips on Xiaohongshu. By building my personal IP, I indirectly promote my store and attract potential online customers." On social media platforms such as Xiaohongshu and Douyin, search terms related to "Magical Yiwu" jewelry are becoming increasingly popular, and the number of related notes and review videos is constantly increasing. Online traffic is being transformed into real purchasing power, injecting strong impetus into the development of Yiwu's jewelry industry.

The jewelry notes under the topic "Magical Yiwu" on Xiaohongshu are sourced from Yiwu Index

Summary

Market: With the further segmentation of consumer groups, market differentiation will become increasingly evident. Generation Z is gradually becoming the main consumer force, meticulously cultivating the existing market.

Sales: The integration of online and offline channels has made social e-commerce the core purchasing channel for young consumers. Short videos and live-streaming sales have become key paths for jewelry brands to reach users.

Category: Jade series jewelry may usher in a breakout year, and metaphysical products have become a new growth driver for the industry.

—— The content of this article is translated by Al ——

My favorites

My favorites