Chile: With a population of 20 million, what makes it one of the top ten export destinations in Yiwu?

Publish Time:2026-02-11 09:41:58Pageviews:67

abstract: For Chinese enterprises, Chile is not a transitional market that can be briefly explored, but a "long-term battlefield" worth delving into. Chile's persistent supply gap presents a suitable opportunity for small commodity trade to enter and is worth paying attention to.

Chile, the world's largest exporter of cherries, is also the country with the largest reserves and export volume of copper resources globally, and is known as the "Kingdom of Copper".

By 2025, Chile's total GDP is expected to reach 324 billion US dollars, with a per capita GDP of approximately 17,000 US dollars.

In 2025, Chile's total import and export trade volume reached 199.7 billion US dollars, with trade accounting for as high as 60% of its GDP.

According to the monitoring of Yiwu Index, in 2025, Yiwu's export volume to Chile is expected to reach 16 billion yuan, with a year-on-year growth of 23%.

As an "outstanding student" in the Latin American economy, this highly open and high-income country is becoming an important destination for Chinese enterprises to go global, thanks to resource upgrading and policy dividends.

This issue of the Yiwu Index takes you into Chile.

01

National Profile: The gateway to the Pacific Ocean in South America

Geography: A trade hub created by the long coastline

Chile has a land area of approximately 757,000 square kilometers, which is equivalent to the size of Qinghai Province in China. At the same time, Chile is one of the countries with the longest and narrowest land shape in the world. It stretches over 4,352 kilometers from north to south and spans 38 degrees of latitude, while its average width from east to west is less than 200 kilometers. Therefore, it is called "the stockings of South America".

Chile is located in the southwest of South America, bordering the Pacific Ocean to the west and adjacent to important global shipping channels such as the Strait of Magellan, the Beagle Strait and the Drake Passage at its southern end. It is one of the important natural passages connecting the Pacific Ocean and the Atlantic Ocean. Unlike some Latin American countries that rely on the Panama Canal, Chilean ports can directly access the main shipping routes from Asia-Pacific to South America, and connect to East Asia, the west coast of North America and Oceania to the west. At the same time, it forms land connections with Argentina through multiple mountain passes in the Andes.

Chilean ports are highly concentrated and transportation is convenient. The country has over 50 modern ports, among which the Port of SAN Antonio has become the largest container hub in the country and, together with the Port of Valparaiso, undertakes the national foreign trade container transportation. Statistics from the World Bank and the United Nations Conference on Trade and Development (UNCTAD) show that over 90% of Chile's foreign trade volume is completed by sea, and this proportion has remained at a relatively high level among the major economies in Latin America for a long time.

Valparaiso image source: Internet

Population: Highly urbanized + dominated by the middle class + rising female consumer power

Chile has a total population of approximately 19.9 million. Although it is less than that of major Latin American countries such as Brazil and Mexico, it boasts a high-quality population consumption structure.

Highly urbanized: Chile is one of the countries with a relatively high population density in South America. Its population distribution is influenced by its long and narrow terrain and is highly concentrated in the central river valley region. Chile's urbanization rate is approximately 88%. The Santiago metropolitan area, the capital alone, concentrates nearly 40% of the country's population and contributes about 45% of the national GDP.

High proportion of the middle class: Chile has an extremely high proportion of middle-class population, exceeding 60%, making it one of the countries with the highest proportion of the middle class in Latin America. The demand of this group for smart devices, consumer electronics and other high-quality goods continues to rise, becoming the core driving force for consumption upgrade.

The rise of female consumption power: According to Equifax data, women account for 55% of the middle class in Chile, surpassing the male group. Meanwhile, the labor force participation rate and consumption participation rate of women in Chile are at a relatively high level in Latin America. Women have a strong say in areas such as household consumption, personal care, beauty, clothing and home furnishings, and the market consumption potential is huge.

Economy: Transformation from "resource dependence" to "Diversity and openness"

As an economic "top student" in South America, Chile's GDP is expected to reach 334 billion US dollars in 2025, an increase of over 30% compared to 2020. Its per capita GDP is approximately 17,000 US dollars, ranking among the top in Latin American countries and firmly remaining in the ranks of high-income nations.

Chile's GDP situation from 2020 to 2025 (in billions of US dollars)

Data source: World Bank

www.ywindex.com

From the perspective of Chile's economic structure, it shows a distinct feature of "resource-driven and export-oriented", among which the service industry accounts for as high as 74.8%.

Mining is the ballast stone of Chile's economy. As one of Chile's pillar industries, over the past decade, the mining industry has averaged more than 10% of Chile's GDP composition. Chile leads the world in copper reserves, production and export volume, supplying about one-third of the global copper. In the lithium product sector, Chile holds the top position in the world with a global export share of 42% (combined for lithium carbonate and lithium hydroxide). In addition, as a key material in the aerospace industry, the reserves of the rare metal rhenium also account for more than half of the global total.

The Escondida copper mine, located in the Atacama Desert in northern Chile, is the world's largest copper mine. Image source: Internet

Agriculture is one of the pillar industries in Chile. Data shows that in 2024, Chile's exports of agriculture, forestry and animal husbandry reached 20.454 billion US dollars, an increase of 15% year-on-year. Chile is the largest exporter of fresh fruits in the Southern Hemisphere, exporting over 70 kinds of fruits to more than 100 countries. Among them, cherries, grapes, blueberries and others have obvious off-season supply advantages, providing seasonal supply supplements to the Northern Hemisphere market. About 90% of its cherries are sold to China. At the same time, it is also the world's most important wine region and the second largest supplier of salmon.

The main wine-producing region of Chile - Aconcagua Valley. Image source: Internet

The transformation of the new energy industry is accelerating. The green hydrogen industry is becoming a new pillar of the national industry. According to the "2050 Carbon Neutrality Plan" and the "National Strategy for Green Hydrogen", Chile is committed to becoming one of the world's major suppliers of green hydrogen after 2030 and the first developing country to achieve "carbon neutrality" after 2025. This transformation has unleashed a huge demand for equipment and technology, providing enterprises with full industrial chain opportunities ranging from renewable energy power generation to electrolytic hydrogen production, storage and transportation applications.

Chile's manufacturing industry is mainly based on resource-based manufacturing such as food processing, metal smelting, mining-related chemicals and forest product processing. In the light industry sector (such as clothing, daily necessities, household items and small electronic products), the production scale and diversity are insufficient, and related goods have long relied on import channels for supplementation.

02

Trade dividends: From regional hubs to global openness

As the first country in Latin America to comprehensively promote trade liberalization, Chile has built a trade ecosystem with great growth potential and strong stability by leveraging a combination of "resource endowment + open policy + consumption upgrade".

Chile's trade: A Model of an "open economy"

Chile has one of the world's most open trade systems and officially joined the OECD as early as 2010. At the same time, Chile is also one of the countries that have signed the most bilateral free trade agreements in the world, including relevant agreements with major economies such as China, the United States, the European Union, and Japan And implement a free trade policy with a uniform low tariff rate (with an average tariff rate of 6% since 2003).

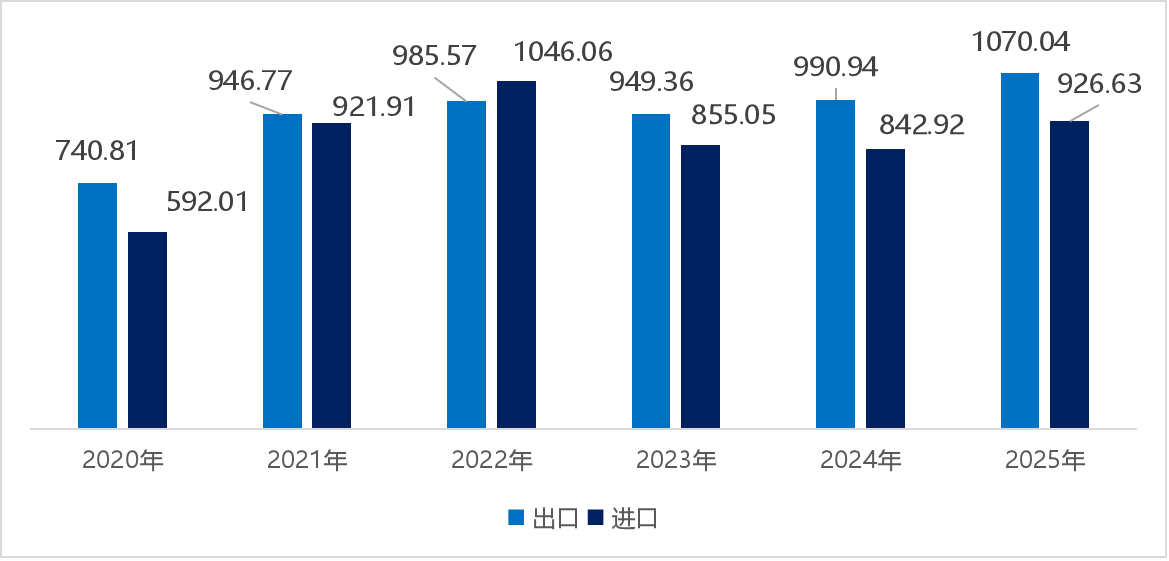

In 2025, Chile's total import and export volume reached 199.7 billion US dollars, among which the export volume was 107 billion US dollars, increasing by approximately 7.9% year-on-year and setting a new historical record.

Chile's import and export situation from 2020 to 2025 (in billions of US dollars)

Data source: United Nations Commodity Trade Database

www.ywindex.com

In terms of the main source countries of imports, the top three regions for Chile's imports in 2024 are China, the United States and Brazil, accounting for 24.9%, 18.9% and 8.8% respectively.

The main sources of imports for Chile in 2024

Data source: United Nations Commodity Trade Database

www.ywindex.com

From the perspective of major imported products, mineral energy is an important import category for Chile. In addition, mechanical equipment, electronic equipment and chemical-related products also account for a large proportion of the import structure.

The top ten categories of imported goods in Chile in 2024

Data source: Collation of public information

www.ywindex.com

2. China-chile trade is highly complementary

As the first Latin American country to sign a free trade agreement with China and upgrade it, trade between China and Chile has maintained a stable development trend. Since 2012, China has been Chile's largest trading partner, largest export market and largest source of imports, and has maintained these positions. Meanwhile, Chile is China's third largest trading partner in Latin America.

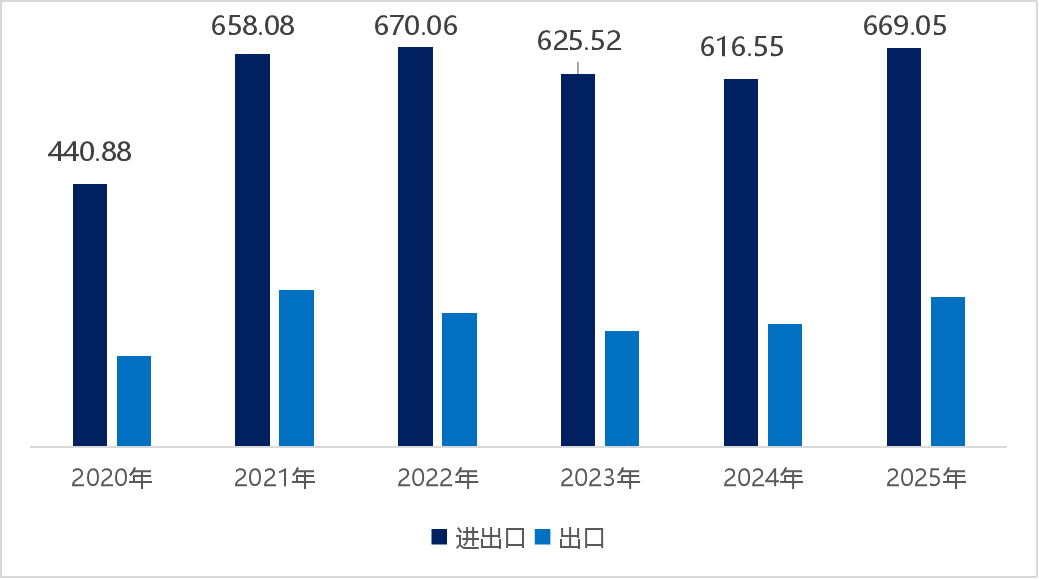

In 2025, the bilateral trade volume between China and Chile reached 66.9 billion US dollars, an increase of 51.8% compared with 2020. Among them, Chile's imports from China amounted to 25.13 billion US dollars. Meanwhile, Chile has maintained a long-term trade surplus with China in bilateral trade, which is the main source of its foreign trade surplus.

China's imports and exports to Chile from 2020 to 2025 (in billions of US dollars)

Data source: Chinese Customs

www.ywindex.com

Trade between China and Chile shows a highly complementary feature. Chile mainly exports resource-based products and some agricultural products to China, while China mainly exports industrial manufactured goods to Chile. Specifically, China's exports to Chile mainly consist of machinery and electronic products, while also including textiles, clothing and footwear, metals and their products, as well as transportation equipment and components. China's imports from Chile are mainly focused on metal products, especially copper, lithium, iron and other minerals and their products, and also cover cellulose as well as agricultural products such as cherries, pork and wine.

03

Small commodity trade: Demand driven by the continuous supply gap

The retail market in Chile is considerable in scale and highly efficient in circulation. It is one of the few places in Latin America that combines a mature market with multiple channels. However, Chile's industrial structure has not yet formed a wide-ranging small commodity manufacturing system, so its domestic demand for small commodities is mainly met through imports. Among them, China, as Chile's main source of imports, holds a key position in its small commodity sector.

In 2024, Chile's retail market size reached 89 billion US dollars, ranking third among Latin American countries, only after Brazil and Mexico, and its per capita retail sales were among the top in Latin America. During the period of 2024-2025, the total retail sales of consumer goods will maintain a steady growth. The main products driving the growth include electronic products, household goods, technology products, as well as categories such as clothing and footwear.

1. Offline channels: Traditional and modern coexist

Offline retail remains the main channel for selling small commodities in Chile. Despite the rapid growth of e-commerce, it has not yet replaced the dominant position of physical retail. Offline retail activities are highly concentrated in big cities, especially in the San Diego metropolitan area.

Barrio Meiggs (Barrio Meiggs) : Composed of multiple streets and pedestrian walkways, it forms a high-density commercial belt and is one of the most important city-level wholesale commercial areas in Chile. This is a major source of goods for a large number of small merchants, mobile vendors and community retailers. The core product categories include clothing, shoes and hats, stationery, toys, electronic accessories, household goods and festival supplies (such as Christmas and Halloween decorations), etc.

The Megges district in San Diego. Image source: Internet

Patronato: It is a multicultural business district on the north side of Santiago, mainly engaged in the wholesale and retail of clothing. The merchants are mostly run by Middle Eastern, Asian (Chinese, Korean) immigrants and local people. They mainly sell clothing, shoes, hats, bags, scarves, belts and other clothing accessories, as well as relatively affordable accessories and some imported daily necessities.

Patronato Image source: Internet

2. Online market: A rapidly developing growth pole

Chile is the country with the highest per capita e-commerce consumption in Latin America. Although its population size is relatively small compared to other Latin American countries, it is the fifth largest market. Data from Mordor Intelligence shows that the e-commerce market size in Chile is expected to reach 14.21 billion US dollars in 2025 and maintain a compound annual growth rate of 11.36%. It is expected to reach 24.3 billion US dollars in 2030.

The size of Chile's e-commerce market from 2025 to 2030 (in billions of US dollars)

Data source: Mordor Intelligence

www.ywindex.com

In terms of the market share of e-commerce platforms, in the local e-commerce sector, the Latin American giant Mercadore maintains a leading position with approximately 30% of the market share. In the field of cross-border e-commerce, Aliexpress holds an absolute dominant position, with cross-border order volume accounting for as high as 78%. Shein, Aliexpress and Temu are quite well-known among Chilean consumers, but their combined actual market share is only 6%.

The major local e-commerce platforms in Chile

Source: Economic and Commercial Office of the Embassy of China in the Republic of Chile

www.ywindex.com

3. Yi-zhi Trade: Entering a fast growth lane

In recent years, the trade volume between Yiwu and Chile has shown a rapid growth trend. According to the monitoring of Yiwu Index, in 2025, Yiwu's export volume to Chile is expected to reach 16 billion yuan, with a year-on-year growth of 23%.

Yiwu's export volume to Chile from 2022 to 2025 (in billions of yuan)

Source: Yiwu Index

www.ywindex.com

From the perspective of the main export categories from Yiwu to Chile, clothing and clothing accessories, plastics and their products, toys and sports goods, household items and lighting fixtures are the main commodity categories that Yiwu has exported to Chile in recent years.

The main categories of products that Yiwu exports to Chile

Source of information: Collation of public information

www.ywindex.com

04

Trade Risk Tips

Strict compliance and inspection requirements. Spanish is the official language of Chile, with a usage rate of over 99%, and Chile has distinct dialects and local expressions. Chilean laws and regulations require that all labels, instructions, ingredient lists, etc. of imported goods sold locally must be in Spanish. If they do not meet the language requirements, the goods may be refused to be put on the shelves, detained or returned. For electrical products (such as small household appliances), the Chilean electrical regulatory authority mandatorily requires that certification be completed before export, and the product labels must contain Spanish descriptions and safety parameters, including electrical specifications and manufacturer information.

The differences in local policies lead to low approval efficiency. In Chile, although the legal system is unified by the state, the multi-departmental decentralized approval system and insufficient institutional coordination have led to differences and uncertainties in the implementation of the licensing process at the local level. In 2024, Chile will have a total of 380 various licenses, involving 16 ministries and 37 service agencies. The industry has long called on the government to simplify administrative procedures. The newly passed "Departmental Authorization Framework Law" is aimed at addressing the issues of the current approval system. Its goal is to achieve a structural reduction in approval time without lowering regulatory standards, such as expecting a maximum reduction of 70% for small and medium-sized enterprise projects

The exchange rate of the Chilean peso against the US dollar fluctuates significantly. The exchange rate of the US dollar against the Chilean peso declined from 952.38 CLP in October 2025 to approximately 880CLP around January 2026, with a fluctuation range of more than 6%. Given that this exchange rate is highly susceptible to external factors such as the global US dollar trend, copper price fluctuations, and changes in trade policies, it is recommended to use the US dollar or other currencies with relatively stable exchange rates as much as possible in transactions and pricing to avoid the exchange rate risks brought about by directly using the Chilean peso.

Written at the end

For Chinese enterprises, Chile is not a transitional market that can be briefly explored, but a "long-term battlefield" worth delving into. Chile's persistent supply gap presents a suitable opportunity for small commodity trade to enter and is worth paying attention to.

—— The content of this article is translated by Al ——

My favorites

My favorites