From "Bestseller Manufacturing" to "Scene in-depth Cultivation" : A New Cycle for the Home Small Appliances Industry

Publish Time:2026-01-28 16:04:59Pageviews:20

abstract: From electric fans and humidifiers to sweeping robots and floor scrubbers... Generation after generation of best-selling products have emerged in response to the demands of the "lazy economy" and "quality life", constantly identifying new life pain points and application scenarios.

Household small appliances are being redefined.

Over the past five years, as the demand for living quality has continued to upgrade, the status of small household appliances has been constantly rising, completing a leap from "optional consumption" to "high-frequency essential need".

By 2025, the market size of small household appliances in China had exceeded 500 billion yuan.

Among them, the market size of small household appliances is approximately 196 billion yuan, accounting for nearly 40%, and has become the core force driving the growth of the small household appliances industry.

From electric fans and humidifiers to sweeping robots and floor scrubbers... Generation after generation of best-selling products have emerged in response to the demands of the "lazy economy" and "quality life", constantly identifying new life pain points and application scenarios.

In this article, Yiwu Index will take you through the development and trend changes of the home small appliances industry.

01

Home small appliances have entered a mature stage, with the rise of niche categories

Small household appliances usually refer to electrical products with relatively small power and volume, high usage frequency, and a focus on specific life scenarios or functional requirements. Unlike large household appliances such as air conditioners, refrigerators and color TVS that are related to the basics of life, small household appliances are more flexible in terms of price range, update cycle and usage scenarios.

According to their functions and uses, small household appliances can be classified into three major categories: home small appliances, kitchen small appliances and personal care small appliances. Among them, household small appliances represented by cleaning appliances, benefiting from the upgrading of consumer demands and the continuous penetration of intelligent technologies, are becoming the core force driving a new round of growth in the industry.

From the perspective of demand attributes and usage scenarios, home small appliances have gradually evolved into multiple sub-directions around living environment management and assisting with daily household affairs. Generally, they can be classified into the following three categories:

Air conditioning category: electric fans, electric heaters, humidifiers, dehumidifiers, air purifiers, bladeless fans, etc.

Cleaning category: Lighting and atmosphere vacuum cleaners (handheld/horizontal), sweeping robots, steam mops, mite removers, window glass cleaners, etc.

Lighting category: smart table lamps, ambient lights, aroma diffusers, mosquito-killing lamps, etc.

Air humidifier, smart aroma diffuser. Image source: Yiwu Index

From the perspective of the market competition pattern, the home small appliance industry as a whole shows the characteristics of an increased market concentration of leading brands and a significant differentiation among sub-categories. Among the core categories represented by cleaning appliances, Dyson, as a leading brand representative, holds a relatively high share in the mid-to-high-end market (approximately 19%). Brands such as Ecovacs and Roborock dominate the mid-to-high-end market segments, accounting for approximately 27% of the market share. However, in fields such as air conditioning and lighting, the technical barriers are relatively limited. Comprehensive home appliance brands like Midea, Gree, and Xiaomi coexist with a large number of small and medium-sized brands, and the market concentration is relatively low.

On the supply side, the industrial chain is composed of upstream raw materials and components, midstream small household appliance manufacturers, and downstream small household appliance sales channel providers. The industrial belts are mainly concentrated in regions such as the Pearl River Delta, the Yangtze River Delta and Zhejiang. They have formed differentiated divisions of labor in large-scale manufacturing, R&D and design, as well as the supply of multi-category and channel customized products, jointly constituting the basic supply system of the home small household appliances industry.

The industrial chain map of small household appliances in China

Source of information: Collation of public information

www.ywindex.com

02

Small household appliances, big market

Nowadays, household small appliances have become one of the most dynamic sub-sectors in the small appliance industry. Driven by the popularization of e-commerce channels, the acceleration of urbanization and the increase in the number of young families, small household appliances have gradually transformed from optional auxiliary products to frequently used daily necessities, and their market size has expanded rapidly.

(1) Domestic market: Demand-driven, market growth is expected

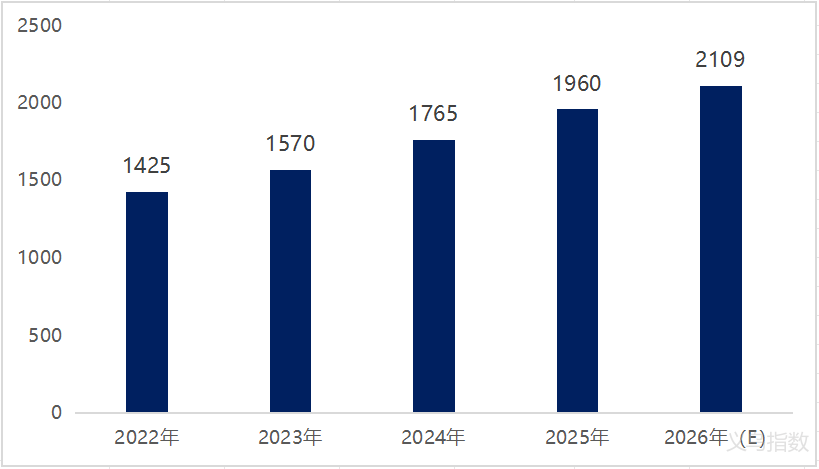

According to the data monitoring of Yiwu Index, the market size of small household appliances in China will be approximately 196 billion yuan in 2025, with an increase of 37.5% compared to 2022, accounting for about 40% of the overall market size of the small household appliances industry.

The market size of China's home small appliances industry from 2022 to 2026 (in billions of yuan)

Data source: Yiwu Index

www.ywindex.com

With the continuous segmentation of family life scenarios, the application boundaries of small household appliances are constantly expanding, gradually becoming an indispensable and important part of daily family life. Their growth momentum is mainly driven by the following two major factors:

"Lazy economy". In contemporary society, with the accelerated pace of life, the popularization of new lifestyle concepts such as the "lazy economy" and "healthy living" has made small household appliances that "free hands" one of the important sources for the public to enhance their sense of happiness in life. Consumers' concern for their living environment is no longer confined to basic functions but has extended to dimensions such as living comfort and usage experience. Focusing on small household appliances in home scenarios like cleaning, air quality, and environmental regulation, they are gradually moving from improvement-oriented consumption to essential needs, driving the continuous growth of sales in related categories.

Floor scrubbers, window guards, air circulation fans. Image source: Yiwu Index

"Quality life". With the increase in residents' income levels and the continuous enhancement of their awareness of quality of life, consumers are increasingly pursuing intelligence and quality. Take the sweeping robot as an example. In the first three quarters of 2025, the average price of sweeping robots on traditional mainstream e-commerce platforms in China was as high as 3,344 yuan, up 9.4% year-on-year. Among them, the sales volume of the price range of 3,500 to 4,499 yuan increased by 62.3%. Not only did it lead in growth rate, but it was also the price range with the highest sales volume, with a market share of 29.2%, an increase of 4.2% compared with the same period last year.

(2) Overseas Market: Demand differentiation, enterprises go global to seek growth

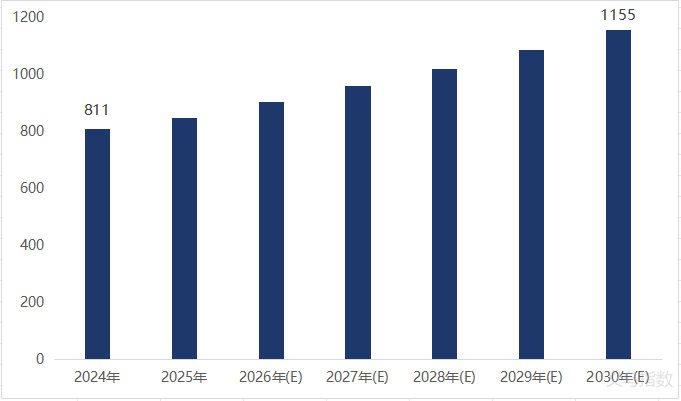

According to the data from Yiwu Index, the global market size of home small appliances was approximately 81.1 billion US dollars in 2024. It is projected that the market will grow from 84.9 billion US dollars in 2025 to 115.5 billion US dollars in 2030, with a compound annual growth rate of about 7.32% during the forecast period.

The global market size of home small appliances from 2024 to 2032 (in billions of US dollars)

Data source: Yiwu Index

www.ywindex.com

There are significant differences in the consumption preferences for small household appliances among different countries and regions:

The market size and demand for small household appliances in the Asia-Pacific region vary greatly. Mature markets such as Japan and South Korea pay more attention to functional segmentation and the level of intelligence. Emerging markets such as Southeast Asia and South Asia are more sensitive to prices and prefer small household appliances that are compact, energy-efficient and have clear functions. Due to the hot climate and relatively compact living space, electric fans, air coolers, humidifiers and small kitchen appliances are quite popular in the Asia-Pacific region.

North America is a mature consumer market. In North America, the size of family residences is generally large, and consumers pay more attention to usage efficiency, durability and safety certification. The demand for small household appliances for cleaning and air purification products remains stable. In terms of product design, there is a preference for simple styles with clear operation logic. At the same time, they are willing to pay a premium for performance improvement and experience optimization. The market space for mid-to-high-end and functional small household appliances in this region is vast.

Image source of various air humidifiers in Yiwu Market: Yiwu Index

In the European region, energy conservation, environmental protection and quality standards are the core orientations. Influenced by energy prices and environmental protection policies, consumers have strict requirements for energy efficiency grades, service life and safety certifications. In terms of design, the European market prefers a low-key and function-oriented product style, and the acceptance of overly complex or decorative designs is relatively limited.

The Middle East region has a relatively high reliance on small environmental appliances. Due to the influence of high-temperature and dry climate and lifestyle, small household appliances for air conditioning and cleaning have become essential products for Middle Eastern families. The demand for humidifiers, electric fans, air purifiers and dust removal products has remained stable for a long time. At the same time, family living Spaces are relatively concentrated, and they have a higher acceptance of small household appliances that are of moderate size and easy to maintain. In terms of product appearance, the Middle East market is more sensitive to decoration and visual presentation. Small household appliances with lighting effects or design sense are more likely to be favored.

Image source: Yiwu Index. Multi-functional humidifier in Yiwu market

03

Demand reshapes the market, and the industry is ushering in new trends

Under the dual influence of technological iteration and demand upgrading, the home small appliance industry has ushered in new development trends, among which intelligence is one of the most representative development directions.

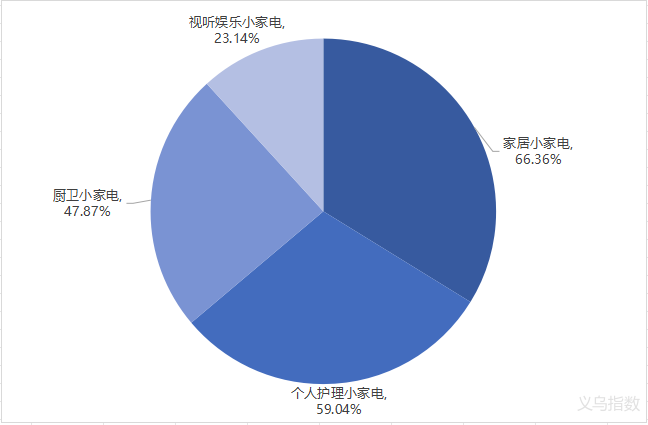

Data shows that in 2025, among Chinese consumers' purchasing preferences for smart small household appliances, home appliances accounted for the highest proportion, reaching 66.36%. From the early "functional intelligence" characterized by timing, remote control and simple sensing to the gradual introduction of algorithmic decision-making, environmental perception and cross-device collaboration in recent years, the intelligent path of small household appliances is evolving from controllability to collaboration.

The type preferences of Chinese consumers when purchasing smart small household appliances in 2025

Data source: iResearch Consulting Group

www.ywindex.com

In December 2025, Woan Robot was listed on the main board of the Hong Kong Stock Exchange. Within three days of its listing, its share price rose by more than 24%, and its total market value exceeded 20 billion Hong Kong dollars, making it the first listed company in the global AI embodied home robot field.

From the initial "SwitchBot Bot" - a finger robot weighing only 35 grams that can simulate human hands pressing switches, to the humanoid robot Onero H1 that can attempt to achieve more complex interaction and service capabilities in the home environment, its development path reflects the possibility of the application of intelligent technology in the home scene.

Although there are still practical constraints such as cost, reliability and application scenarios for the related products to be widely popularized in households, the emergence of Onero H1 indicates that the home scene is gradually becoming an important testing ground for the implementation of intelligent technologies.

The image source of the related products of Woan Robot: Yiwu Index

Meanwhile, the sales channels for home small appliances are also showing a trend of gradually shifting from offline to online. From the perspective of the proportion of online sales in the overall small household appliances industry, it has risen from 29.6% in 2015 to 79% in 2024, developing rapidly and driving the continuous growth of the proportion of online sales channels in the home small household appliances industry. According to Douyin's e-commerce data in 2024, the sales of small household appliances for daily life increased by 76.5% year-on-year. Window-cleaning robots, floor scrubbers and other cleaning small household appliances are currently the best-selling categories in the market.

The logic of industry competition has also shifted accordingly. In recent years, driven by the rise of the "lazy economy" and the changing cleaning habits of Generation Z consumers, the floor scrubber market has taken a lead and become one of the most significantly growing subcategories in household small appliances. Data shows that floor scrubbers are the top choice in the home small appliance market, with a market share of approximately 30%. The related brands are currently in an important development window period. Its growth mainly stems from consumers' preference for an integrated and continuous cleaning experience of "washing, mopping and vacuuming", and the scale of alternative vacuum cleaners and sweeping robots has shrunk. Overall, compared with the early products that emphasized multi-functional integration, the current home small appliance market is gradually forming a competitive path centered on "super single products".

04

Yiwu Market Home Small Appliances Industry 2.0

The small household appliances industry in Yiwu market started in 2005. After more than two decades of development, it has formed a small household appliances market system covering multiple categories and with a relatively complete structure. At present, the small household appliances industry is mainly concentrated on the third floor of the second zone of the International Trade City, with nearly 500 business stalls available. The small household appliances category is the largest subcategory in the small household appliances market in Yiwu, accounting for approximately 56%. The main products include electric fans, air coolers, oil-filled radiators and various types of heaters, etc.

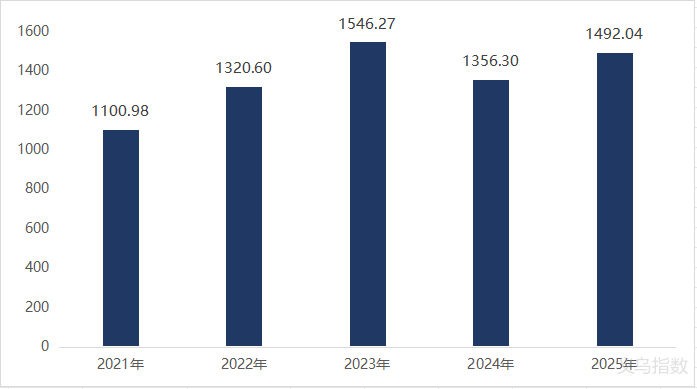

According to the monitoring of Yiwu Index, since 2021, the prosperity index of small household appliances has generally shown a fluctuating upward trend. It rose from 1,100.98 points in 2021 to 1,492.04 points in 2025, an increase of 35.5%.

The average prosperity index of small household appliances from 2021 to 2025

Data source: Yiwu Index

www.ywindex.com

According to the visit and understanding of Yiwu Index Market, the small household appliances industry in Yiwu has a relatively high degree of openness, with the ratio of domestic and foreign trade sales being 2:8. The export market is mainly concentrated in countries and regions such as the Middle East, Africa and South America, while the domestic market radiates to all parts of the world.

The vice president of Yiwu's small household appliances Industry said, "The advantages of Yiwu's small household appliances lie in their rapid product updates and complete range of categories, which can meet the diverse demands of different countries and regions. This is also an important reason for the continuous expansion of the market scale."

The small household appliances industry in Zone 2 of Yiwu International Trade City. Source: Yiwu Index

(1) The "warm economy" is heating up, and a solid winter depends on Yiwu

In recent years, small household appliances from Yiwu have been selling well in overseas markets, among which heating appliances have become one of the most representative export highlights. Due to factors such as climate conditions in Russia and some European countries, fluctuations in energy prices, and changes in residents' heating methods, the demand for small heating equipment has significantly increased. Customs data shows that from January to November 2025, the export value of electric heaters from Yiwu reached 290 million yuan, increasing by 32% year-on-year. The growth rate was significantly higher than that of some traditional home appliance categories during the same period.

From the perspective of product categories, small and medium power heating and auxiliary heating products such as warm air fans, oil-filled radiators, adjustable brightness warm lamps, foot warmers and winter humidifiers have performed outstandingly. This type of product has a controllable unit price and a low usage threshold, which better meets the needs of overseas families in specific scenarios such as supplementary heating and local heating. Meanwhile, on overseas social media platforms such as TikTok, Yiwu heating appliances have gained considerable attention through scenario-based content like "quick temperature rise" and "heating in small Spaces". Products with obvious visual presentation effects such as warm air outlet, ambient lighting changes, and steam atomization are more likely to achieve demand conversion through short videos.

The small heating appliances in Yiwu market. Image source: Yiwu Index

(2) Improve product quality internally and expand channels externally

Against the backdrop of intensified fluctuations in external market demand and continuously intensifying competition, the Yiwu market is strengthening its long-term competitiveness by adjusting its own development path.

Improve products internally and build core competitiveness. As the requirements for safety, energy efficiency and certification in major export markets continue to rise, Yiwu's home furnishing small appliances are gradually moving away from the model mainly based on price competition and turning to continuous upgrading in terms of quality, safety and compliance to increase the added value of products. Meanwhile, the enterprise's capabilities in product design and iteration are constantly strengthening. Through rapid research and development and functional integration, it launches new products that better meet the needs of specific segments. Some leading enterprises have developed their own brand products around core functions, driving the focus of competition to shift from price to product strength.

The image source of the small household appliances industry in Yiwu market: Yiwu Index

Expand external channels and establish a full-domain sales network. In response to global market demands, small home appliance enterprises in Yiwu are accelerating the expansion of external channels and proactively seeking new growth. On the one hand, enterprises enhance their fulfillment efficiency and customer loyalty by going global to expand their overseas markets, conducting localized sales and customer expansion in key regions, participating in overseas exhibitions, developing agents and channel partners, and improving overseas warehouses and after-sales services. On the other hand, strengthen the coordinated development of online and offline, rely on cross-border e-commerce platforms such as Amazon and TikTok Shop, and quickly promote new products to overseas markets. In addition, actively lay out emerging domestic channels. By cooperating with live-streaming e-commerce, content platforms and offline new retail systems, the brand products of "Yiwu-Made" can reach end consumers more directly.

At the end

Industry: Home small appliances are evolving from "optional consumption" to "high-frequency essential demand". Driven by the trends of the lazy economy, quality life and smart home, product forms are continuously being segmented, and super single products and intelligence have become the core development directions.

Market: The domestic market has entered a structural growth stage mainly characterized by replacement and upgrading, with the proportion of small household appliances continuously increasing. The overseas market demand is highly differentiated. The Asia-Pacific, Europe, America and the Middle East regions are the main sources of growth, providing a broad space for enterprises to go global.

Trend: The home small appliances industry is accelerating its transformation towards "technology-driven + scenario-driven". Relying on mature industrial belts and efficient channel networks, enterprises with the ability to respond quickly and adapt products are expected to continuously expand their competitive advantages.

—— The content of this article is translated by Al ——

My favorites

My favorites