Monthly hot event in the small commodity industry - Foreign trade growth rate 4.1%; Consumption increased by 4.0%. Yiwu's import and export volume has reached a new high

Publish Time:2025-12-24 10:34:07Pageviews:302

abstract: Keep an eye on the Yiwu Index. We will provide you with the latest updates such as exchange rate analysis, shipping market conditions, raw material market interpretation, and industry news.

01

TOP5 Industry News

The growth rate of national foreign trade has picked up, and the import and export of Yiwu has reached a record high

According to data from the General Administration of Customs, in November 2025, the total value of China's goods trade imports and exports reached 3.9 trillion yuan, with the growth rate rebounding to 4.1%, an increase of 4 percentage points compared to the previous month. In terms of cumulative figures, in the first 11 months of this year, the total value of imports and exports was 41.21 trillion yuan, increasing by 3.6% year-on-year. Among them, exports were 24.46 trillion yuan, growing by 6.2% year-on-year. In terms of trading partners, in the first 11 months, ASEAN was China's largest trading partner, with a total trade value of 6.82 trillion yuan, an increase of 8.5% year-on-year, accounting for 16.6% of the total foreign trade value. The European Union is the second largest trading partner, with a total trade value of 5.37 trillion yuan, an increase of 5.4%, accounting for 13% of the total foreign trade value. During the same period, China's total imports and exports with the countries along the Belt and Road Initiative reached 21.33 trillion yuan, an increase of 6%.

In the first ten months of this year, the import and export volume of Yiwu City exceeded the 700 billion yuan mark for the first time in the same period of history, reaching 701.19 billion yuan. It has already surpassed the total import and export volume of 2024 and increased by 25.2% compared with the same period last year. Among them, exports reached 615.06 billion yuan, increasing by 24.4% year-on-year. In addition, Yiwu's imports and exports with emerging markets such as Africa, Latin America and ASEAN reached 123.94 billion yuan, 108.9 billion yuan and 79.36 billion yuan respectively, increasing by 21.8%, 14.0% and 51.0% year-on-year respectively. On December 3rd, Yiwu completed the packaging of its 100 millionth cross-border e-commerce import order in 2025, becoming the first county-level city in China to have an annual cross-border e-commerce import order volume exceeding 100 million.

Source: Xinhua News Agency

The Central Economic Work Conference was held in Beijing, sending out a clear signal

The Central Economic Work Conference was held in Beijing from December 10th to 11th. The conference summarized the economic work in 2025, analyzed the current economic situation, and made arrangements for the economic work in 2026. The meeting deployed eight key tasks, namely, adhering to domestic demand as the mainstay, innovation-driven development, reform-driven breakthroughs, opening up to the outside world, coordinated development, leading with carbon peaking and carbon neutrality, prioritizing people's livelihood, and maintaining the bottom line.

Several key statements at the meeting sent out clear signals. First, building a strong domestic market will be given top priority, and economic growth will rely more on domestic demand. For instance, we will further implement the special campaign to boost consumption, expand the supply of high-quality consumer goods and services, and optimize the implementation of the "two new" policies. Second, it explicitly emphasizes "improving quality and efficiency", and mentions high-quality development on multiple occasions. For instance, promoting high-quality development of the Belt and Road Initiative. Third, we will adhere to opening up to the outside world and focus on foreign trade and foreign investment. For instance, we should actively expand independent opening up, promote the quality and efficiency improvement of foreign trade, and expand the space for two-way investment and cooperation, etc.

Source: Xinhua News Agency

3. Economic data for November was released, indicating that consumption continued to heat up

The National Bureau of Statistics released that from January to November this year, the total retail sales of consumer goods reached 45,606.7 billion yuan, increasing by 4.0% year-on-year. The growth rate was not only faster than that of the same period last year but also faster than that of the whole of last year. This year, the special campaign to boost consumption has been implemented in depth, and the policy of trading in old consumer goods for new ones has taken effect, driving the continuous release of consumption potential.

New types of consumption have been growing steadily. Digital consumption, green consumption and healthy consumption have increasingly become new hotspots in consumption, and their leading and supporting roles in consumption have become increasingly prominent. From January to November this year, the national online retail sales reached 14,458.2 billion yuan, increasing by 9.1% year-on-year. The online retail sales of physical goods reached 11,819.3 billion yuan, increasing by 5.7%, accounting for 25.9% of the total retail sales of consumer goods in society.

Image source: CCTV

Mexico has passed a new tariff bill with a maximum rate of 50%

On December 10, 2025 local time, the Mexican Chamber of Deputies approved the draft of the new tariff bill proposed by President Claudia Simbaum in September with an overwhelming majority of votes in favor. This bill aims to amend the General Tax Law on Imports and Exports, imposing an additional tariff of up to 50% on imported products from countries without free trade Agreements (TLCS), such as China, India, Vietnam, Thailand, South Korea, etc., in order to protect domestic industries. Subsequently, the Mexican Senate also passed the tariff bill, which has been transferred to the federal enforcement department for promulgation. The new tariff rate will officially come into effect on January 1, 2026.

This tariff bill has adjusted tariffs on over 1,400 product categories, raising the rates from the original 0-20% to 10%-50%, covering approximately 17 industries including textiles and clothing, steel and products, automobiles and auto parts, plastic products, home appliances, toys, furniture, footwear and leather, paper and paperboard, cosmetics and soap, etc.

5. The EU: It will impose taxes on tax-exempt "small parcels" in advance

Recently, the Council of the European Union officially passed a resolution, proposing to abolish the tariff exemption for small parcels imported under 150 euros two years ahead of schedule, with the earliest effective date being 2026. After this change, all goods entering the European Union will be subject to corresponding tariffs. The European Council said that the current "duty-free for small parcels" rule has led to about 65% of inbound small parcels underreporting their value to evade import duties. In addition, non-EU enterprises' practice of splitting goods into multiple packages for shipment into the EU to avoid tariffs has also raised environmental concerns. Data from the European Commission shows that approximately 91% of e-commerce packages valued at less than 150 euros in 2024 will come from China.

02

An Overview of International Logistics

Trends in ocean freight rates

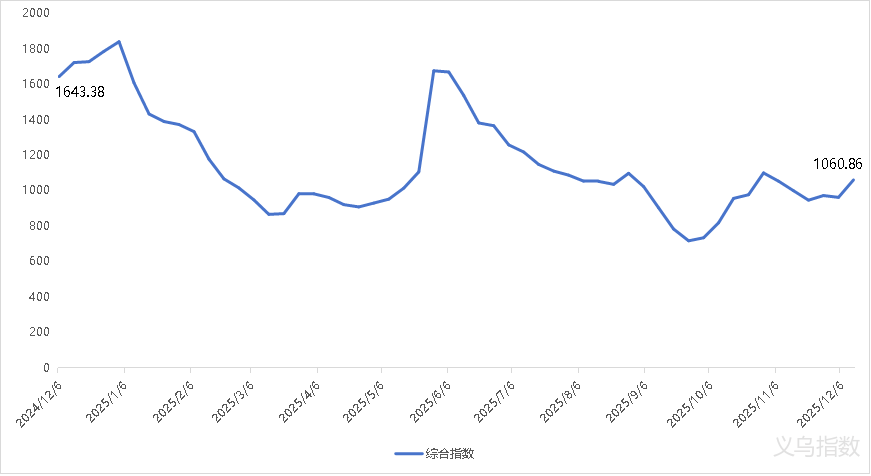

Ningbo Zhoushan Port undertakes a large amount of export business of small commodities from Yiwu and is an important seaport for Yiwu. According to the latest monitoring by Yiwu Index, on December 12, 2025, the Ningbo Container-based Freight Index (NCFI) closed at 1,060.86 points, up 0.7% from the beginning of November. In November, shipping market freight rates showed a differentiated trend: on the European route, freight rates rose significantly as cargo volume picked up and space became tight, while on the American route, market shipments weakened and freight rates continued to decline.

The trend chart of the NCFI Composite Index

Data source: Ningbo Shipping Exchange

www.ywindex.com

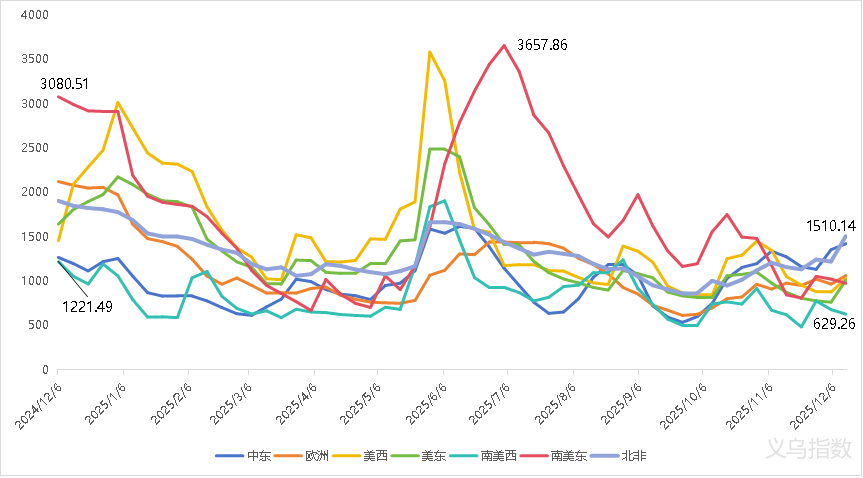

According to Freightos data, in early December 2025, the Ningbo-Europe route was adjusted to $2,449 per FEU for the month, with the route freight rate index at 967.55 points, an increase of 0.2% compared to the previous month. The freight rate index for the Ningbo-US West Coast route was 878.1 points, a decrease of 39.6% compared to last month. The price of the Ningbo-US East Coast route is $3,150 per FEU, and the freight rate index is 763.67 points, a decrease of 30.7% compared with last month. The freight rate index for the Ningbo-Middle East route stood at 1,355.86 points, up 13% from last month.

Trend chart of the main route index changes of NCFI

Data source: Ningbo Shipping Exchange

www.ywindex.com

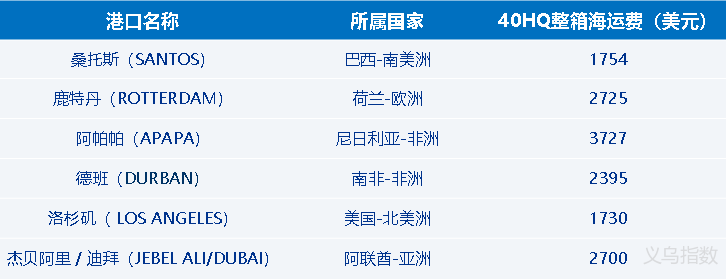

The following chart shows the freight rates for some sea routes from China (Ningbo Port) to overseas ports on the Jianyiyun freight platform recently. It is for reference only.

Data source: Collation of public information

www.ywindex.com

2. Maritime Affairs

Maersk and Hapag-Lloyd have recently successively announced the increase of the Peak Season Surcharge (PSS). Starting from December 15th, Maersk has imposed additional charges on multiple routes from Asia to the Middle East, with the standard being $600 or $800 per TEU. Hapag-lloyd will impose an additional charge of $2,000 per TEU on goods from Asia and Oceania to the Port of Conakry in Guinea starting from the shipment date of December 15.

Cosco Shipping Lines has launched a brand-new China-Australia route. This route provides biweekly services from Yangpu and Nansha in Hainan to the South Pacific and northern Australia. Among them, direct flights to Nansha Port have been added, and the frequency of flights to Yangpu Port has been increased. The upgraded route offers a 10-day express flight service from Ningbo to Townsville. The maiden voyage is scheduled to set sail from Xiaochantan, Hainan on January 1, 2026.

China has launched its first "container shipping route with punctuality and cost reduction" to ASEAN. On December 12th, the "Container Sea Freight punctuality and Cost Reduction" route from Ningbo Zhoushan Port in China to Ho Chi Minh Port in Vietnam was officially launched. The newly launched "Container Sea Freight Punctuality and Cost Reduction" route from Ningbo Zhoushan Port to Ho Chi Minh City Port will significantly reduce the time ships stay in port and the cargo transshipment cycle through precise schedule management, efficient port connection, and in-depth collaboration between port and shipping enterprises, providing customers with more punctual, reliable and economical sea freight services.

03

Exchange rate dynamics

The Americas, Europe, the Middle East and other regions are the key export areas of Yiwu. The following is the latest currency exchange rate analysis of Yiwu's major export countries:

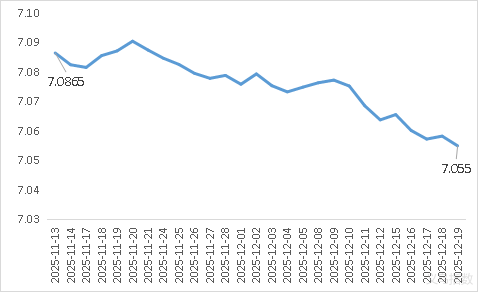

Us dollar (USD

On December 19th, the exchange rate of the US dollar against the Chinese yuan was around 7.1 yuan. The average monthly exchange rate of the US dollar to the Chinese yuan in November 2025 was 7.0848, indicating a weakening of the US dollar against the Chinese yuan. At its December interest rate meeting, the Federal Reserve announced a 25 basis point cut in the federal funds rate (to a range of 3.50% to 3.75%), which has led to continuous pressure on the US dollar.

The trend chart of the central parity rate of the USD/CNY

Data source: China Money Net

www.ywindex.com

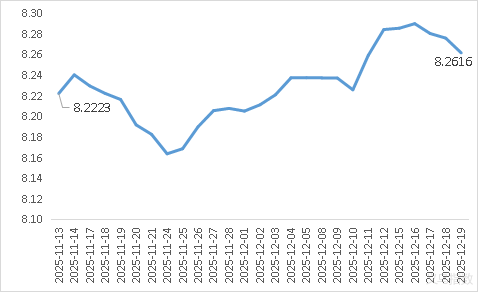

2. Euro (EUR

On December 19th, the exchange rate of the euro against the Chinese yuan was around 8.3 yuan. The average monthly exchange rate of the euro to the Chinese yuan in November 2025 was 8.1960, indicating that the euro has strengthened against the Chinese yuan. While the Federal Reserve announced a rate cut, the European Central Bank kept interest rates unchanged. This policy difference has led some international funds to shift their allocation to euro assets in pursuit of relatively higher returns, thereby providing support for the euro exchange rate.

Euro/RMB central parity rate trend chart

Data source: China Money Net

www.ywindex.com

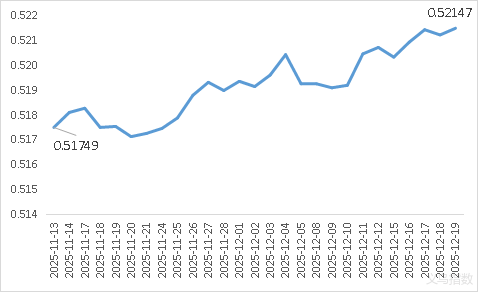

3. Uae Dirham (AED)

On December 19th, the exchange rate of the RMB against the dirham was around 0.52 yuan. The average monthly exchange rate of the RMB against the UAE dirham in November 2025 was 0.52. Although the UAE dirham has shown a synchronous "weakness" due to the fixed exchange rate mechanism with the US dollar, its domestic economic fundamentals have remained strong. According to the prediction of the International Monetary Fund (IMF), the GDP growth rate of the United Arab Emirates is expected to reach 4.8% in 2025. This interest rate cut will further reduce the cost of funds in the local market and is expected to attract more abundant external liquid funds to flow in.

The trend chart of the central parity rate of RMB/UAE dirham

Data source: China Money Net

www.ywindex.com

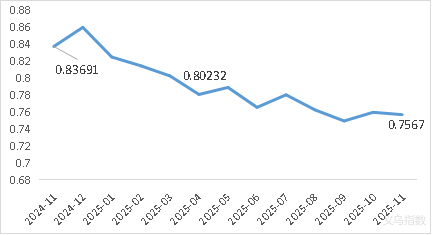

4. Brazilian Real (BRL

On November 30th, the exchange rate of the RMB against the Brazilian real was around 0.759 yuan. The RMB generally showed a trend of first appreciating and then weakening against the real. Since 2022, the Central Bank of Brazil has maintained the benchmark interest rate Selic at a high level of 15%, leading among major economies. High interest rates combined with the relatively stable macro environment in Brazil have made the Brazilian market continuously attractive to foreign capital. Investors maintain a certain level of confidence in the Brazilian market, which supports the stability of the real exchange rate.

The reference exchange rate chart of the Brazilian Real (CNY/BRL)

Data source: China Money Net

www.ywindex.com

04

Overview of the Raw Materials Market

The production of small commodities in Yiwu involves the procurement of a large amount of raw materials such as textiles, plastic products, hardware accessories and electronic components. The following focuses on the developments of important basic raw materials such as steel, cotton, and polyethylene (PE)

1. Steel

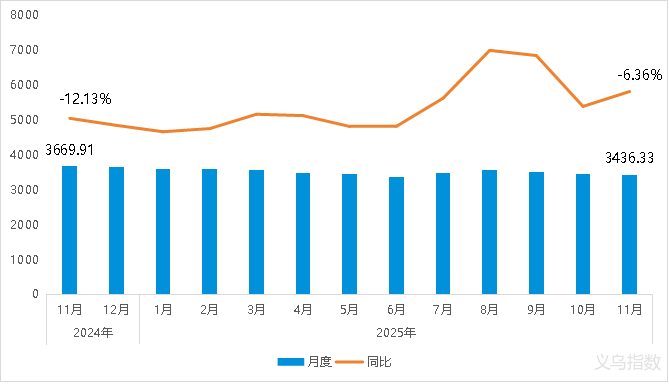

In November, prices generally declined slightly: As the peak season comes to an end, steel demand is facing a seasonal drop. The overall decline in construction demand and industrial demand has suppressed the upward space for steel prices. In the context of a general increase in raw material prices, it provides certain cost support for steel prices.

The comprehensive average price index of domestic steel from November 2024 to November 2025

Data source: My Steel

www.ywindex.com

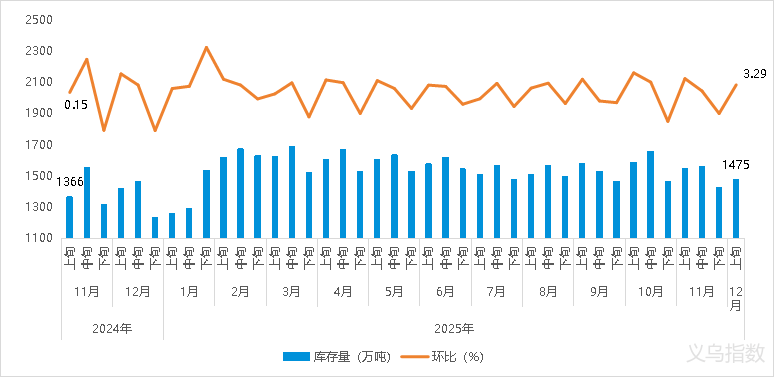

Steel inventory increases: According to data from the China Iron and Steel Association, by the first ten days of December 2025, the steel inventory of key steel enterprises reached 14.75 million tons, a 3.3% increase compared to the previous period. Compared with the beginning of 2025, it has increased by 19.2%. It decreased by 4.8% compared with the same period last month.

From November 2024 to the first ten days of December 2025, the inventory situation of key steel enterprises will be statistically analyzed

Data source: China Iron and Steel Association

www.ywindex.com

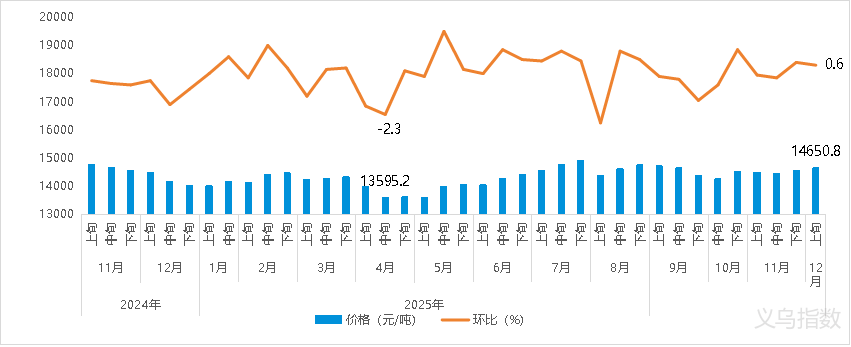

2. Cotton

The price rose slightly in December: The price of cotton (lint cotton, white cotton grade three) in the national circulation field in the first ten days of December 2025 was 14,650.8 yuan per ton, an increase of 80.6 yuan per ton compared with the end of November. With the rapid advancement of new cotton sales, the sales progress is faster than that of the same period last year. The pressure of high production is gradually being digested, and the spot market quotations remain relatively firm. Meanwhile, the convening of the Central Economic Conference has brought confidence to the market, and domestic cotton prices have continued to rise.

The changes in domestic cotton market prices from November 2024 to early December 2025

Data source: National Bureau of Statistics

www.ywindex.com

Overall inventory increased in December: Cotton commercial inventory continued to rise in November, remaining at the second-highest level in nearly five years. The peak season for downstream textile enterprises has come to an end, and most of them choose to replenish their inventories based on essential needs. In some areas, the growth rate of existing inventory in warehouses has relatively slowed down. As of December 12, 2025, the total commercial inventory of cotton was 4.7023 million tons, an increase of 237,300 tons compared with the previous week, representing a growth rate of 5.31%.

3. Polyethylene (PE

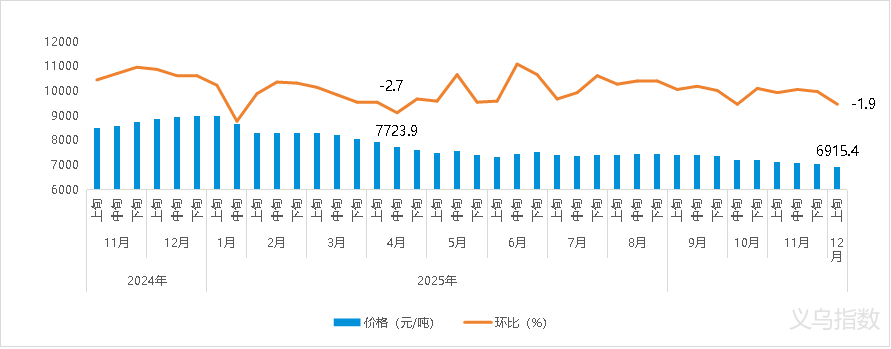

Prices slightly declined in December: As market demand weakens at the end of the year, it is expected that prices will continue to be under pressure. In November, the demand for greenhouse film in the north gradually weakened, and it remained weak in December. The demand for agricultural films has entered the traditional off-season, and most downstream factories mainly place small orders for purchase. Packaging films are mainly purchased based on essential needs, and the price support is relatively limited.

The changes in domestic polyethylene market prices from November 2024 to early December 2025

Data source: National Bureau of Statistics

www.ywindex.com

Inventory increase in December: As of December 10th, the sample inventory of polyethylene producers in China was 470,600 tons, an increase of 18,000 tons compared with the previous period, and a month-on-month increase of 3.98%.

Keep an eye on the Yiwu Index. We will provide you with the latest updates such as exchange rate analysis, shipping market conditions, raw material market interpretation, and industry news.

—— The content of this article is translated by Al ——

My favorites

My favorites