Nigeria: Window of opportunity for demographic dividend, tapping into the largest consumer market in West Africa

Publish Time:2025-12-10 15:00:39Pageviews:146

abstract: Nigeria has a huge population and economy, but it also faces high risks. If a company intends to make a presence in Nigeria, it must deeply engage in localized operations and continuously invest resources. This is a major project. Whether to enter this market or not still requires a careful assessment of one's own risk tolerance.

Nigeria, the most populous country in Africa, has a population of nearly 230 million. On average, one out of every five Africans is a citizen of it.

In fact, it is still the largest economy in West Africa.

The only oil-rich country in West Africa that has crossed the $400 billion GDP threshold;

The film and television industry is highly developed. It is the world's second-largest film producer, with its film output surpassing that of Hollywood.

The retail market size of 13.2 billion US dollars ranks second in Africa, only after South Africa.

This country, which is burdened with stereotypes while quietly undergoing industrial transformation, holds complex and alluring opportunities in the African market.

This issue of the Yiwu Index takes you to Nigeria, the largest consumer market in Africa.

01

West Africa's largest economy: From "Oil Dependence" to "Diversification Breakthrough"

Africa is usually divided into two major regions: one is the North African region mainly composed of Arab countries, and the other is sub-Saharan Africa located south of the Sahara Desert. In sub-Saharan Africa, apart from South Africa, Nigeria is the most representative country in terms of population size, economic aggregate and regional influence.

As the largest economy in West Africa, Nigeria was once solely dependent on oil for a long time, but now it is striving to embark on a diversified development path ranging from energy to consumption, fintech and more. This is inseparable from multiple factors behind it.

1. Geography: The "Golden Hub" of West Africa on the Gulf of Guinea

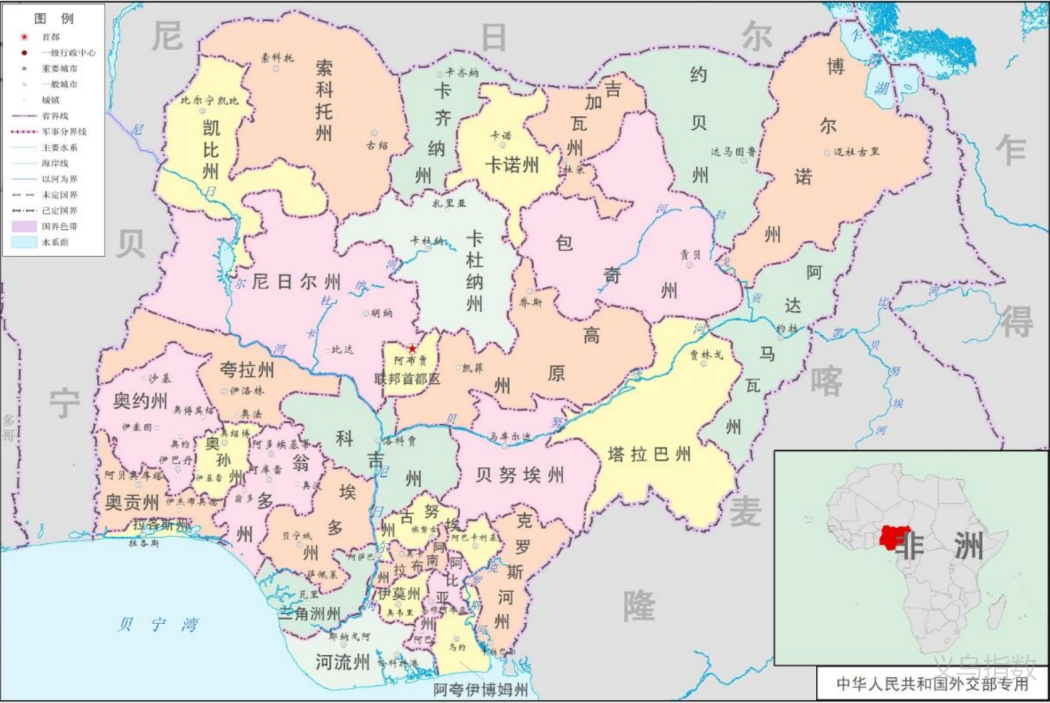

Nigeria, located in the southeast of West Africa, covers an area of approximately 920,000 square kilometers. It is bordered by the Gulf of Guinea, a golden trade area in Africa, to the south, the hinterland of sub-Saharan Africa to the north, Central Africa to the east and the Community of West African States to the west, forming a natural pattern of "two-way radiation from land and sea".

Nigeria has a coastline of 800 kilometers and is rich in port resources. Lagos Port, as the largest port in West Africa, is not only the import and export gateway of Nigeria, but also a shared seaport for landlocked countries such as Benin, Niger, Chad and Cameroon. Goods from all over the world are gathered and distributed here and then transferred to the landlocked countries of West Africa.

Today, Nigeria's geographical value has long transcended its single label as the center of West Africa and has become a key node connecting the African interior with the global market.

Map of Nigeria Source: Internet

2. Population: Fast growth, large base, and young age

As the most populous country in Africa and the sixth most populous in the world, Nigeria's competitiveness goes far beyond its population of 230 million. It lies more in the triple structural dividends of "high growth, youth and urbanization" it holds.

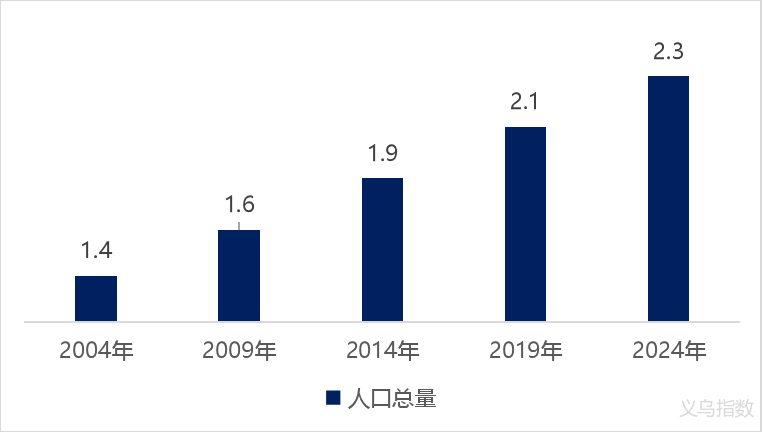

A high-growth population size. Over the past 20 years, its total population has increased by nearly 62%, with an annual growth rate of 2.08%, far exceeding the global average (1.0%). For every six new people in Africa, one is from Nigeria.

The total population of Nigeria from 2004 to 2024 (in billions)

Source: World Bank

www.ywindex.com

A younger demographic structure. In Nigeria, people under the age of 30 account for over 70% of the total population, with a median age of 18.1 years. In contrast to the world median age of 30.9 years, Nigeria's population structure is extremely young. Meanwhile, the proportion of its population under the age of 14 is as high as 41%. Such a young population structure not only provides Nigeria with a huge labor reserve but also constitutes the absolute main force of the consumer market in the coming decades.

The urbanization process is advancing rapidly. In 2024, Nigeria's urbanization rate is expected to be approximately 55%, and it is projected that by 2050, the total urban population will nearly double. Meanwhile, the population is highly concentrated in a few major cities: the top five cities, Lagos, Kano, Ibadan, Abuja and Port Harcourt, have gathered nearly a quarter of the country's urban population.

In summary, Nigeria's large population base, young structure, and rapid urbanization all contribute to the development of the small commodity industry.

3. Economy: Multiple industries lead Africa

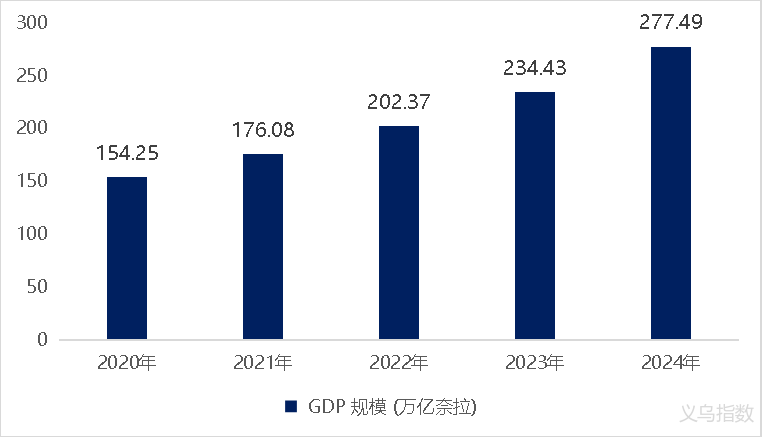

In 2024, Nigeria's GDP is expected to be approximately 277.49 trillion naira, accounting for over 70% of the Economic Community of West African States (ECOWAS). Nigeria was once solely dependent on the oil industry for a long time, but nowadays the driving force of its economic growth is no longer limited to this.

Nigeria's GDP (trillion naira) from 2020 to 2024

Source: National Statistics Agency of Nigeria

www.ywindex.com

From the perspective of industrial structure, Nigeria's economy has formed a pattern with the energy industry as the pillar, agriculture as the basic structure, and the service industry developing rapidly.

Petroleum energy is the pillar of the economy. As an energy giant in Africa, Nigeria has the second largest proven crude oil reserves in Africa and the largest natural gas reserves. This industry supports approximately two-thirds of the country's government fiscal revenue and 80% to 90% of its foreign exchange earnings, generating a cumulative revenue of 305 billion US dollars over the past decade.

Agriculture is the foundation. Agriculture contributes approximately 20% of Nigeria's GDP. It is the world's fourth-largest producer of cocoa beans and has export advantages in economic crops such as cocoa, cashew nuts, palm oil and sesame.

The service industry takes the lead. The service industry contributes more than half of Nigeria's GDP. Among them, the digital economy centered on ICT (Information and Communication Technology) has become a key growth pole, contributing 16% to 18% to GDP. In the entertainment industry, the film and television industry is relatively developed. It is the world's second-largest film producer, with its film output surpassing that of Hollywood.

Fintech leads Africa. Nigeria has over 200 fintech enterprises, the most in Africa. By the end of 2024, the total market capitalization of stocks on the Nigerian Stock Exchange (NGX) will exceed 62 trillion naira, making it one of the largest stock exchanges in Africa.

Despite this, Nigeria's manufacturing industry is still at a weak and primary stage. Its structure is relatively simple, mainly concentrated in labor-intensive industries such as food processing, cement and building materials. Most small commodities such as clothing, electronic products and household goods rely on imports from external markets like China.

02

Trade Hub: The "Golden Key" to Unlocking the West African Market

Nigeria is a trade hub in West Africa. Its economic center, Lagos, is not only the main gateway for the country's imports and exports but also the first stop for a large number of goods entering West Africa. The goods are transported by sea and land to neighboring countries such as Benin, Togo and Niger.

The largest trading nation in West Africa

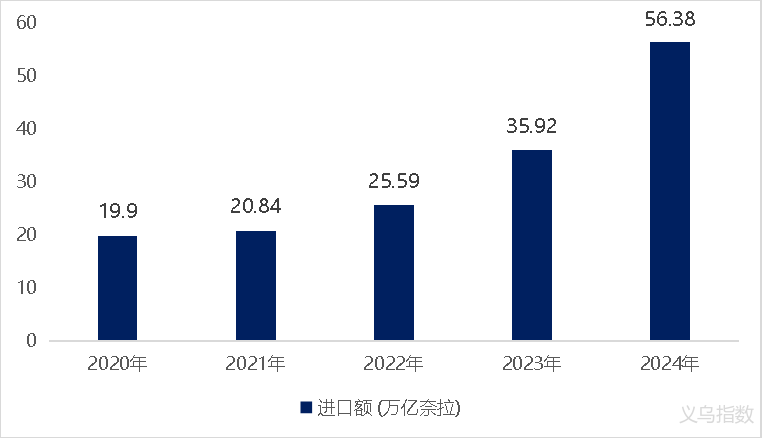

Nigeria is the largest trading country in the Economic Community of West African States. In 2024, its export volume reached 79 trillion naira and its import volume reached 56 trillion naira (up 57% year-on-year), accounting for more than 40% of the total volume of the organization.

Nigeria's imports (trillion naira) from 2020 to 2024

Data source: National Statistics Agency of Nigeria

www.ywindex.com

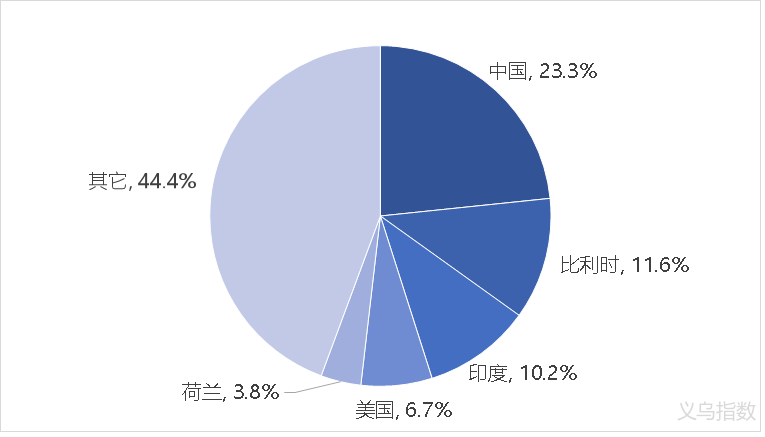

From the perspective of its major import sources, China, Belgium and India are its top three import sources, accounting for 23.3%, 11.6% and 10.2% of Nigeria's total import value in 2024 respectively.

The situation of Nigeria's main import source countries in 2024

Data source: United Nations Commodity Trade Database

www.ywindex.com

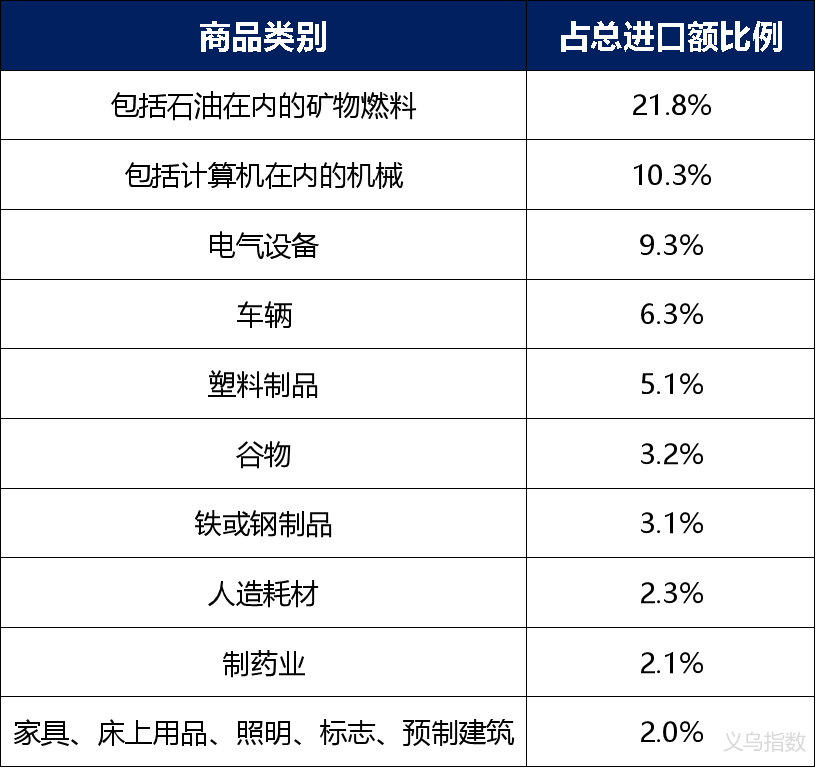

From the perspective of import structure, mechanical equipment, refined petroleum products and transportation vehicles are the main categories. Among them, the import value of products such as furniture, bedding, lighting, signs and prefabricated buildings increased rapidly, with a year-on-year growth of over 500%.

The top ten categories of imported goods in Nigeria in 2024

Data source: Collation of public information

www.ywindex.com

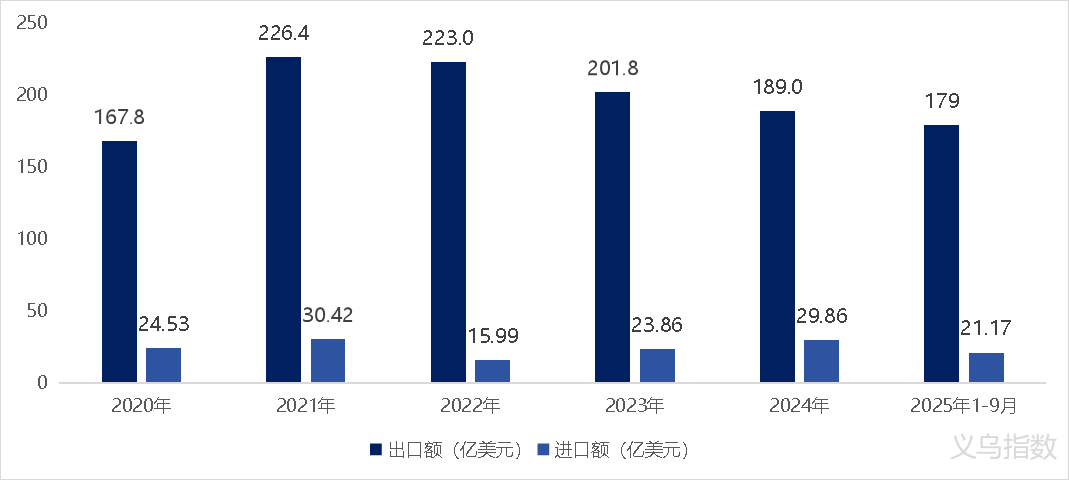

2. China-nepal Trade: Mutual Pursuit

Nigeria is China's second largest export market and third largest trading partner in Africa. From January to September 2025, China's exports to Nigeria reached 17.9 billion US dollars, up 38.2% year-on-year. China's exports to Nigeria mainly consist of mechanical and electrical products, textile and apparel, automobiles and mechanical equipment, while its imports include crude oil and liquefied natural gas, etc.

China's imports and exports to Nigeria from 2020 to September 2025 (in billions of US dollars)

Data source: Chinese Customs

www.ywindex.com

03

Small commodity market: Riding the express train of demographic Dividend

Nigeria is the second-largest retail consumption market in Africa, second only to South Africa. In 2024, retail sales reached 13.2 billion US dollars, with a growth rate as high as 30.4%, surpassing South Africa and setting a record for the largest retail market growth in Africa. Meanwhile, Nigeria has a population of nearly 50 million of the "emerging middle class", which drives the rapid growth of the local consumer market.

At present, the retail market in Nigeria is still dominated by traditional markets, and its development stage is similar to that of China in the 1990s. The current market competition is not yet saturated, and the profit margin is higher than that of other mature markets. In addition, local consumers are more sensitive to prices, so small-sized and low-priced goods are more likely to quickly open up the local market space.

The market situation in Nigeria. Image source: Internet

1. Potential category: Demand supported by the purchasing power of young people

Nigeria's "youthfulness" not only drives the long-term growth of consumer goods demand, but also gives rise to diverse category demands centered on the interests and lifestyles of young people. Based on the analysis of the local consumer market by the Yiwu Index, the market data of categories such as electronic products, beauty and personal care products, stationery, and furniture are impressive, and it is expected that there will be considerable room for growth in the future.

Electronic products: The market size is expected to be 18.7 billion US dollars in 2024 and will continue to expand at an annual growth rate of 6.32% from 2024 to 2028. Products such as power banks and Bluetooth headphones are in high demand due to unstable local power supply and the accelerated popularization of mobile networks.

Beauty and personal care products: The market size reached 3.43 billion US dollars in 2024 and is expected to grow to 5.15 billion US dollars by 2033, with a compound annual growth rate of 4.69%. Among them, wigs/hair products are the core essential category in Nigeria's beauty market, mainly consisting of durable high-temperature silk/chemical fiber wigs.

Stationery: The government's vigorous promotion of basic education has driven up the demand for learning supplies such as pens and notebooks. The market size was 680 million US dollars in 2024 and is expected to reach 1.08 billion US dollars in 2033, with an annual growth rate of 5.33%. Among them, paper products are the largest subcategory.

Furniture: Urbanization has driven the furniture market to grow at an accelerated pace. Among them, smart furniture has grown rapidly. Although its scale was only about 13.9 million US dollars in 2023, it is expected to increase to approximately 23.9 million US dollars by 2030, with a compound annual growth rate of about 8%.

2. Market layout: The offline market dominates, while the online market is growing rapidly

(1) Offline market

Wholesale markets in Nigeria are concentrated, with key cities such as Lagos and Kano as the main nodes. Lagos is home to nearly a quarter of the country's wholesale markets. Typical wholesale markets include:

Trade Fair Market: A large commercial cluster located in the Lagos Port area, with its core centered around the International Convention and Exhibition Center, gathering multiple specialized wholesale markets. It mainly covers important categories such as auto parts (Aspamda Market), beauty and hair care products (Ebonyi Plaza), daily chemicals, shoes and hats, and hardware tools.

Trade Fair market image source: Internet

Alaba International Market: A core distribution center for electronic products in Nigeria and even West Africa, with a product range covering 3C mobile phone accessories, household appliances, solar photovoltaic, small generators and electrical and electronic products, etc.

(2) Online market

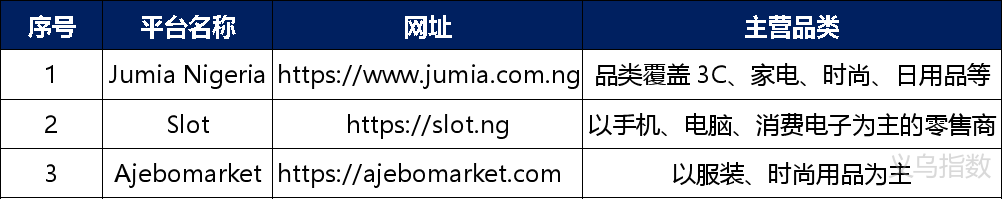

Nigeria is one of the largest e-commerce markets in Africa. Several representative local e-commerce platforms in Africa originated from or have their headquarters in Nigeria, such as Jumia and Konga.

The major e-commerce platforms in Nigeria

Source of information: Collation of public information

www.ywindex.com

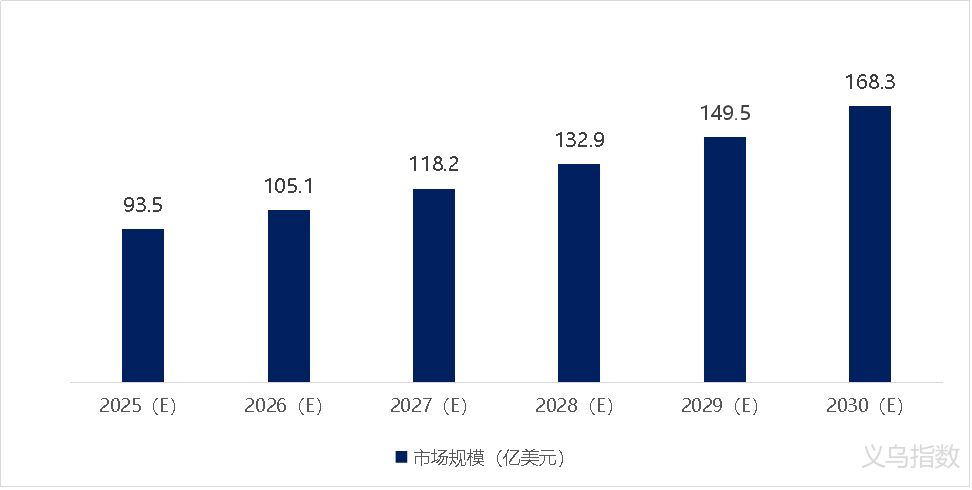

In recent years, the transaction volume and growth rate of e-commerce in Nigeria have maintained double-digit growth for a long time, gradually transforming from a "marginal channel" to an important growth engine in the retail system. Data shows that the e-commerce market size in Nigeria will be approximately 9.35 billion US dollars in 2025, with online sales accounting for about 6% of the total retail sales. It holds a leading position in Africa and is expected to maintain a compound annual growth rate of 12.46%, reaching 16.83 billion US dollars by 2030.

The size of Nigeria's e-commerce market from 2025 to 2030 (in billions of US dollars)

Data source: Mordor Intelligence

www.ywindex.com

3. Yiwu exports to Nepal

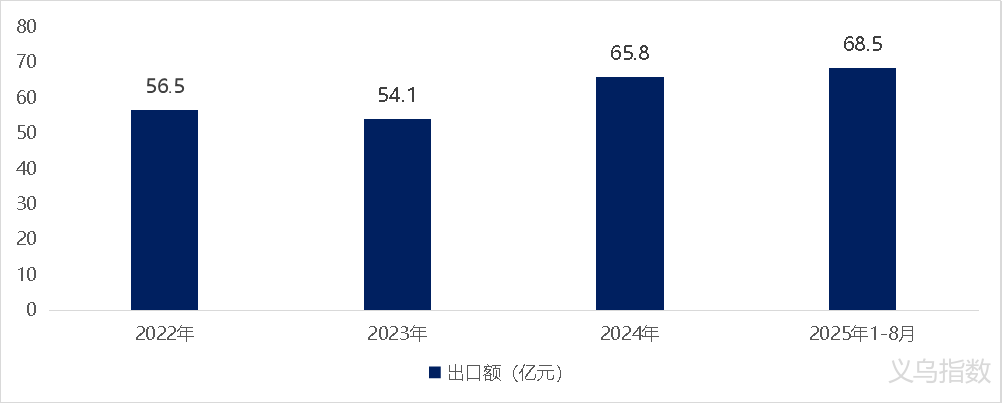

Nigeria is the largest export destination of Yiwu in West Africa. According to the data monitoring of Yiwu Index, from January to August 2025, Yiwu's export volume to Nigeria reached 6.85 billion yuan, increasing by 57.71% year-on-year, which has already surpassed the total export volume in 2024.

Yiwu's export volume to Nigeria from January to August 2022-2025 (in billions of yuan)

Data source: Yiwu Index

www.ywindex.com

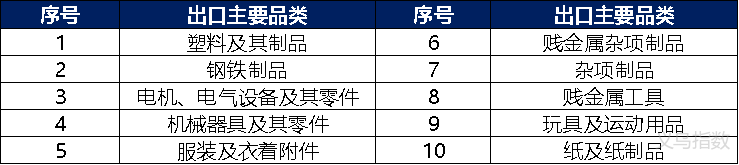

From the perspective of the types of goods exported from Yiwu to Nigeria, plastic and its products, clothing and clothing accessories, toys and sports goods have been the main categories of goods exported to Nigeria in recent years.

The main categories of goods exported from Yiwu to Nigeria

Data source: Yiwu Index

www.ywindex.com

04

Risk Tips

The security situation in Nigeria is severe, and power shortage is one of the key constraints. World Bank research shows that for every 10% increase in the village electricity rate, the penetration rate of extremism drops by 7.2%. However, as of 2025, there are still approximately 84 million people in Nigeria who do not have stable power supply, accounting for about one-third of the country's population. The shortage of electricity not only restricts economic development but also easily breeds unstable factors in society.

The risk of exchange rate fluctuations is significant. The Naira depreciated significantly by approximately 69% against the US dollar in 2024. Such sharp fluctuations directly erode corporate profits and bring a high degree of uncertainty to quotations and cost accounting. However, due to the fact that local enterprises generally lack the ability to pay in US dollars and are accustomed to settling in their own currencies, Naira collection remains a market necessity and dominates local transactions.

Trade protectionism is constantly strengthening. Nigeria imposes import controls on certain goods or imposes relatively high import tariffs, such as prohibiting the import of soap and detergents, corrugated paper and cardboard, shoes, ballpoint pens and their parts, etc. The World Trade Organization pointed out in its country report on Nigeria that trade protectionism in Nigeria has been continuously strengthening over the past few years.

Abuja, the capital of Nigeria. Image source: Internet

Conclusion

Nigeria has a huge population and economy, but it also faces high risks. If a company intends to make a presence in Nigeria, it must deeply engage in localized operations and continuously invest resources. This is a major project. Whether to enter this market or not still requires a careful assessment of one's own risk tolerance.

—— The content of this article is translated by Al ——

My favorites

My favorites