"King of Latin America" Brazil, the trend of trade with China after Trump 2.0

Publish Time:2025-02-13 14:51:58Pageviews:67

abstract: Brazil is one of the few countries that runs a trade surplus with China. In 2024, Brazil's trade surplus reached $74.6 billion, of which Brazil's trade surplus with China was $44 billion, accounting for 59% of Brazil's surplus. In the Trump 2.0 era, as the "king of Latin America" Brazil, how will its trade policy be affected?

In 2024, Brazil's GDP is expected to reach $2.24 trillion, accounting for 31% of the total economic output in Latin America, and it is an absolute "carrier" of the Latin American economy. In 2024, Yiwu's exports to Brazil are expected to reach 20 billion yuan, and Brazil is firmly in the forefront of Yiwu's major export countries.

Brazil ranks seventh in the world in population, has the world's largest tropical rainforest, the world's fifth proven iron ore reserves, the world's fifteenth proven oil reserves, but also has vast grasslands and arable land, is a country blessed by God.

Brazil is one of the few countries that runs a trade surplus with China. In 2024, Brazil's trade surplus reached $74.6 billion, of which Brazil's trade surplus with China was $44 billion, accounting for 59% of Brazil's surplus.

In the Trump 2.0 era, as the "king of Latin America" Brazil, how will its trade policy be affected?

I. Introduction of Brazil

1. Location advantage

Adjacent to the Atlantic Ocean, with rich port resources and modern logistics network

Brazil is located in the eastern part of South America, with a total area of 8.51 million square kilometers, which is the largest country in South America and the fifth largest country in the world. Brazil borders 10 countries with a total border length of more than 16,000 kilometers, has convenient land trade routes, and has close trade cooperation with neighboring countries such as Argentina, Uruguay and Paraguay.

Map of Brazil Source: Baidu Map

Brazil is close to the Atlantic Ocean, with 7491 kilometers of coastline and many ports, including the port of Santos as the busiest port in Latin America, the throughput accounts for one-third of the country's total port handling. In terms of road and rail, Brazil's railway capacity ranks first in Latin America, with a total railway network length of more than 30,000 kilometers. The total length of roads is 1.75 million kilometers, carrying more than two-thirds of the country's cargo traffic.

Superior geographical advantages and developed transportation networks have further enhanced Brazil's position as an economic center in Latin America.

2. Demographic structure

Young people, high urbanization, the middle class continues to expand, and the demographic dividend is still there

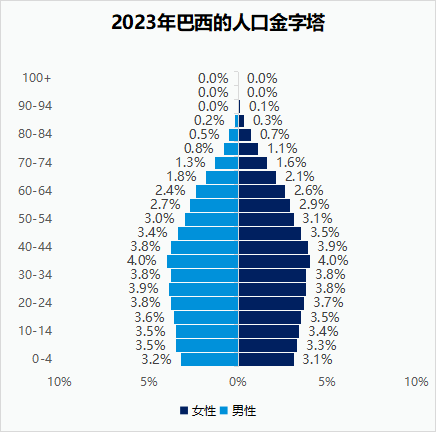

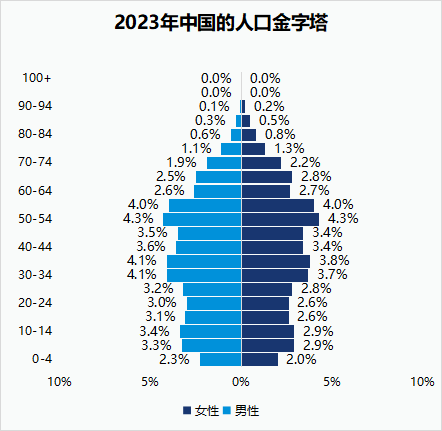

Brazil is the most populous country in South America, accounting for nearly 50% of the total population and ranking seventh in the world. Among them, the average age of Brazil's population is 33.8 years old, and the working-age population between 15 and 64 years old accounts for 69%, and the population structure is characterized by a younger age.

Data source: populationpyramid.net; Yiwu index

www.ywindex.com

The level of urbanization in Brazil is quite high, with the urbanization rate reaching 87.79% in 2023, which is higher than the 83.1% in the United States. Among them, Sao Paulo city is Brazil's largest city, urban population of more than 12 million, is the main distribution center of Chinese products in Brazil, its location in Sao Paulo state is Brazil's most economically developed state, GDP accounted for 30.2% of the country.

According to the data, the number of middle-class people in Brazil reaches nearly 100 million, about half of the total population. The increase of the middle class will enhance the overall consumption power and consumption level of Brazil, in order to drive a broader room for consumer demand growth.

In summary, Brazil has a large population base, young structure, no savings habit, and huge consumption potential, all of which are conducive to the development of small commodity industry.

3. Economic development

Latin America's largest economy is rich in natural resources and its new energy industry is developing rapidly

Brazil is the largest economy in Latin America, accounting for about 31% of the region's GDP and ranking ninth in the world. Brazil is a major producer and exporter of a wide range of agricultural products, the world's largest exporter of soybeans and coffee; With a large number of iron ore, manganese ore, chromium ore, bauxite, etc., is one of the world's most important iron ore exporters.

Brazil has a relatively complete industrial system, covering light industry, steel, automobile manufacturing and petrochemical fields, and ranks first in Latin America's industrial strength. According to the Yiwu Index of Yiwu exports to Brazil traders visited to understand, "Brazil's local production capacity is relatively weak, the production quality is more general, most concentrated in clothing, footwear and some daily hardware supplies." And the raw materials needed for its production are highly dependent on imports from China, which makes local consumers prefer light industrial goods exported from Yiwu."

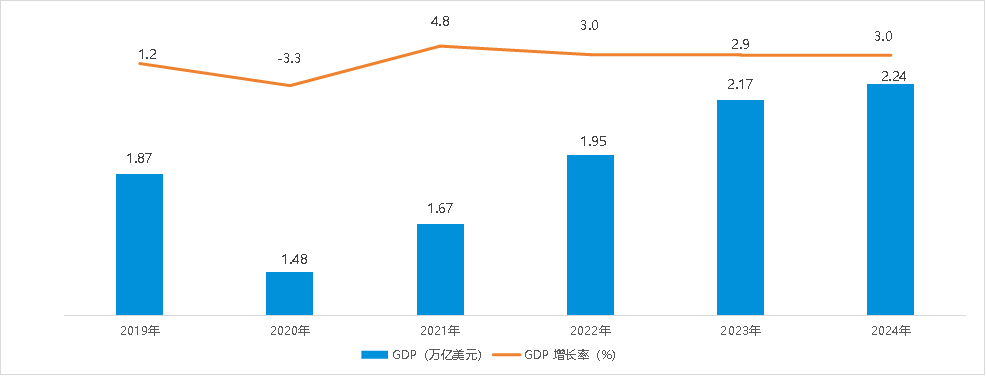

Key economic data for Brazil are as follows:

Gross Domestic Product (2024) : Estimated at $2.24 trillion

Economic Growth rate (2024) : 3.0%

GDP per capita (2024) : Projected to reach $10,500

Currency name: Brazilian Real

GDP and growth in Brazil, 2019-2024

Source: World Bank; Yiwu index

www.ywindex.com

In addition, Brazil's new energy market has huge potential, of which the new energy vehicle market is developing particularly rapidly. Although Brazil is still in the early stages of transportation electrification, the adoption of new energy vehicles has been extremely rapid. As of July 2024, sales of new energy vehicles in Brazil have exceeded its total sales of new energy vehicles in 2023. Political resistance to Chinese-made cars has been relatively weak in Brazil, where trade tensions with the European Union and the United States have blocked access to new energy vehicles, but where no such barriers exist. In the first half of 2024, new-energy vehicles produced in China accounted for 91 percent of total imported new-energy vehicle sales in Brazil. Nine out of every 10 new energy vehicles in Brazil are made in China.

Ii. Market overview

1. Demand for small commodities

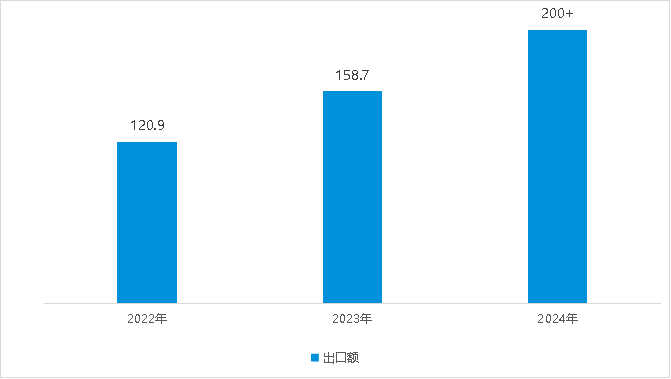

According to Yiwu Index monitoring, Yiwu's exports to Brazil are expected to reach 20 billion yuan in 2024. In the past three years, Yiwu's exports to Brazil have maintained a high growth state.

Yiwu's exports to Brazil in 2022-2024 (RMB 100 million)

Data source: Yiwu Customs

www.ywindex.com

In 2023, Yiwu will export TOP5 small commodity related categories to Brazil

Data source: Yiwu Customs

www.ywindex.com

Plastic products, electrical appliances, luggage, toys, sports goods have become the top five categories of goods exported from Yiwu to Brazil in 2023. Combined with the Yiwu index to capture the market dynamics, in addition to the above five categories, beauty cosmetics, daily necessities, hardware, clothing and accessories, electronic products and accessories are expected to have a large room for growth.

Beauty products: Data show that the Brazilian beauty and personal care products market size reached 33 billion US dollars in 2024 and is expected to reach 44.03 billion US dollars by 2029, with a compound annual growth rate of 5.85%.

Commodities: Brazil's light industrial base is relatively weak, and most of the various commodities rely on imports. In recent years, Brazil's household commodities market has been expanding.

Hardware supplies: The construction industry in Brazil is booming, and the demand for construction hardware is high. According to statistics, the annual growth rate of its construction market is about 3%. The recovery of the manufacturing industry has also promoted the expansion of hardware demand, and the amount of industrial hardware is also rising.

Clothing and accessories: Including clothing, hats, wigs, scarves, accessories and other products, Brazil mainly imports clothing and textiles from China, Bangladesh and India and other countries, Chinese goods are better quality, occupy an expanding market share.

Electronics and Accessories: Data show that the consumer electronics market in Brazil reached $42.4 billion in 2024 and will expand at a CAGR of 8.4% between 2024 and 2029.

2. Sales channels

2.1 Wholesale market

Brazil's wholesale markets are dominated by agricultural products, clothing and daily necessities, mainly concentrated in large cities such as Sao Paulo, radiating local and surrounding countries, such as Uruguay, Paraguay and other countries. Some markets have more advanced facilities, equipped with warehousing and logistics distribution centers. On the whole, the development level of Brazil's wholesale market is similar to that of Yiwu's third generation (trellises market) and fourth generation market (indoor market), and the completeness and modernization level of the market are uneven.

Bras Neighbourhood: Located in the southeast of Sao Paulo, it is the largest clothing and textile wholesale center in Brazil. Bras Block has a total of 55 streets and more than 5,000 shops, of which about 4,000 shops are mainly engaged in clothing production and sales. According to the data, Bras block will have an average daily traffic of 300,000 people in 2023, with an annual turnover of 26 billion reais (about 34.7 billion yuan).

Bras District clothing market map Source: Public information

Sao Paulo 25th Street: Brazil and even South America's most famous wholesale and retail center, with nearly 4,000 shops, known as the "Yiwu Market"; version, the variety of business is quite rich, including jewelry, toys, household goods and electronic products, most of the goods originated from China.

25th Street source: Yiwu Cross-border E-commerce Association

2.2 E-commerce channels

2.2.1 Major e-commerce platforms

According to the Brazilian Electronic Commerce Association (ABComm), the retail e-commerce market in Brazil will reach 185 billion reais ($34.5 billion) in 2023, more than doubling from 70 billion reais in 2018. According to Brazilian analytics firm ECBD, online retail sales in Brazil accounted for about 16 percent of total retail sales in the first quarter of 2024, a share comparable to the U.S. market in the same period.

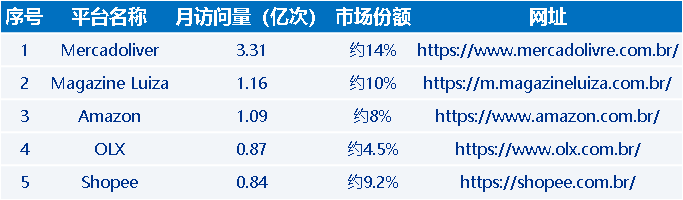

The main e-commerce platform in Brazil in 2023

Data source: Public data collection, Yiwu Index

www.ywindex.com

2.2.2 Cross-border e-commerce policy trends

In August 2023, Brazil's compliance plan came into effect, strengthening supervision of the purchase of imported goods through cross-border e-commerce platforms;

In June 2024, the tax reform bill was approved to impose a 20% import tax on goods purchased by Asian e-commerce platforms for no more than $50.

Iii. Overview of trade between China and Brazil

1. Bilateral trade cooperation between China and Brazil

In 2024, the bilateral trade volume between China and Brazil was $188.17 billion, of which China's exports to Brazil were $72 billion. Looking around the world, Brazil is one of the few countries with a significant trade surplus with China.

China has been Brazil's largest trading partner for 15 consecutive years and an important source of direct investment in Brazil. Brazil is the first Latin American country whose trade with China has exceeded $100 billion.

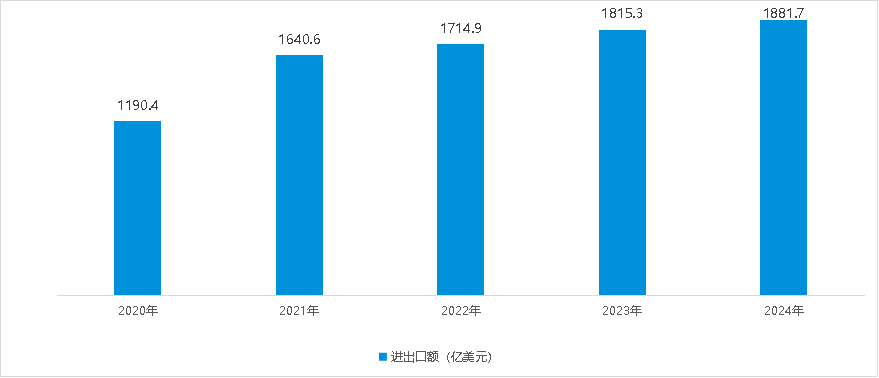

2020-2024 China-Pakistan bilateral goods import and export

Data source: China Customs; Yiwu index

www.ywindex.com

Top 10 categories of Chinese exports to Brazil in 2024

Data source: China Customs; Yiwu index

www.ywindex.com

2. With Trump coming to power, China-Pakistan bilateral trade may usher in new opportunities

Trump will officially take office as president of the United States again in January 2025, and his trade protectionism policy may bring new opportunities to China-Pakistan trade:

Growth in commodity exports: Some of China's agricultural products, mineral products and other commodities imported from the United States have become key commodities in the Sino-US trade game during Trump's 1.0 administration, and this situation will continue after Trump takes office in 2025. As an important exporter of these products, Brazil can take this opportunity to further expand its exports to China. Resources such as Brazil's soybeans and iron ore can fill the market gap caused by China's reduction of imports from the United States, thus promoting Brazil's export trade volume to China. Data show that during the Trump administration of 1.0, due to the intensification of trade friction between China and the United States, Brazil's exports of soybeans, cotton and other agricultural products to China increased significantly.

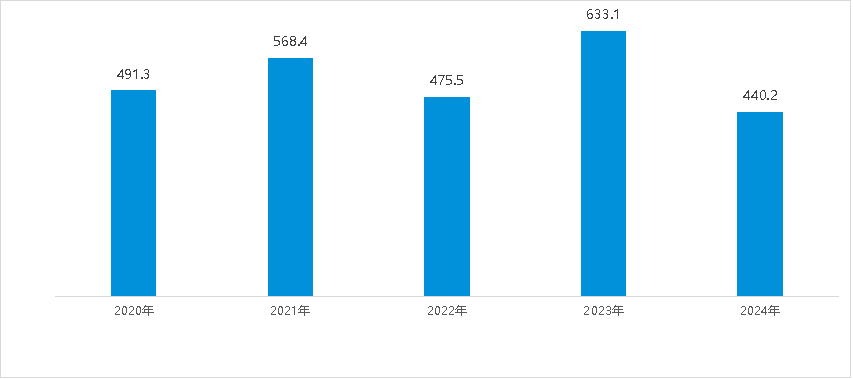

Trade surplus remains high: In 2020-2024, Brazil's overall trade surplus with China is at a high level. In 2024, the bilateral trade volume between China and Brazil was 188.17 billion US dollars, of which Brazil's exports to China were 116.1 billion US dollars, with a trade surplus of 44 billion US dollars. Three products - soybeans, iron ore and oil - account for more than 80 percent of Brazil's exports.

Brazil's trade surplus with China, 2020-2024 (US $100 million)

Source: China Customs

www.ywindex.com

Trade policy adjustment: In recent years, the Brazilian government has made adjustments to China's trade policy. On the one hand, Brazil has reduced or exempted tariffs on products with no domestic production or insufficient production, such as mechanical products such as electric motors. On the other hand, tariffs or tariffs will be imposed on domestic advantageous products, such as photovoltaic modules, steel products, etc., in order to protect domestic related industries and reduce the impact of imported products on domestic industries.

4. Trade tips

Tax Strategy Choice: Sunshine Compliance or the Law of the Jungle

Brazil is known as the "country of ten thousand taxes", the tax system is very complex, a variety of taxes and tax rates coexist, rules and requirements are cumbersome, which requires very high tax processing ability of enterprises. Brazil has thus developed two very different rules for tax strategy. Some enterprises act in accordance with regulations, although the investment is large, but the tax cost is controllable, and even control to 6%-8% of sales, so as to obtain a competitive advantage and smooth integration. Another part of enterprises pursue short-term benefits, and illegal operations such as the sale of corporate ownership, legal person transactions, and tax underreporting are common here. Although this approach is low-cost and effective in the short term, it is suitable for some small and medium-sized enterprises that have just started or are still testing the market, but the risk is like a sword hanging on the top, which can fall at any time.

The national system is complex, and the "strong dragon" needs to borrow the power of the "local snake"

Brazil's system is complex, the gap between the rich and the poor is significant, the business environment is gray, even if the strength of foreign enterprises, but also because of the existence of some "invisible rules" and everywhere limited, still need to rely on the partner familiar with the local rules to help, through legal ways, with reasonable interests to replace their local relationship network, such as letting the partner familiar with the local rules to open a shop. The partner is familiar with the local situation, including the law of gang activity, the problems that may be encountered in the circulation of goods in the market, and the corresponding circumvention methods. Such information is often difficult for companies to obtain on their own. With the help of partners, we can make the operation of the company in the Brazilian market more smooth.

Rooted in local, long-term localization operation

If foreign companies want to succeed in the Brazilian market, localization is the key. First, cross-border businesses face high tariffs and complex tax policies in Brazil. In order to protect the living space of local small and medium-sized enterprises, the Brazilian government has adjusted the tax on imported goods for many times, such as imposing 28% import tax on low-priced goods, thereby increasing the price of goods and reducing the profit margin of cross-border businesses. Localized production can effectively reduce the import tax burden and form a competitive price advantage. Second, there are significant cultural differences between Brazil and China, and the social situation is complex. Diligence and low profile are the two most prominent characteristics of Brazilian Chinese businessmen. For Chinese enterprises, when entering the Brazilian market, they should fully implement the localization strategy, adhere to the long-term principle, actively integrate into the local society, and respect the local culture and business habits. In addition, the overall public security situation in Brazil is not optimistic, especially in central cities such as Rio de Janeiro and Sao Paulo, robbery and theft are frequent, and violent robberies against Chinese citizens also occur from time to time. Therefore, foreign Chinese businessmen still need to maintain high vigilance and strengthen security precautions.

V. Summary

Location advantage: Brazil is located in the eastern part of South America, the territory across the equator to the Tropic of Capricorn, with more than 7,000 kilometers of coastline, numerous ports, borders with 10 countries, and smooth sea and land trade channels.

Vast market: Brazil has a large population, high urbanization rate and diversified consumption levels.

Economic development: Brazil is the largest economy in Latin America, is a major producer and exporter of a variety of agricultural products, at the same time, the manufacturing industry is gradually rising, products are sold around the world, these industries together to promote Brazil's economic boom.

Diplomatic stability: China and Brazil are each other's comprehensive strategic partners. In recent years, bilateral relations have been developing steadily and the two countries have maintained close coordination in international and regional affairs.

In today's global business wave, Brazil has become one of the most popular destinations for many companies to go overseas. Due to the complexity of customs policies and tax policies, the Brazilian market has maintained its unique diversity and complexity, becoming the "unfinished land" for most Chinese merchants. With the ever-changing international trade environment, Chinese enterprises are facing both broad market opportunities and a series of challenges when they go to Brazil. Through the implementation of strategies such as in-depth research into the local market and strengthening localized operations, Chinese enterprises are expected to achieve more significant business results in the Brazilian market.

—— The content of this article is translated by Al ——

My favorites

My favorites