China-eu new energy vehicle tariff game, Where should Yiwu new energy vehicle exports go?

Publish Time:2025-02-27 15:38:54Pageviews:26

abstract: In the face of the new energy vehicle tariff game between China and Europe, how is the export performance of China's new energy vehicles? For the Yiwu market, which has entered the new energy vehicle export track, how to break the game?

Since 2020, the market demand for new energy vehicles has continued to grow under the influence of the European Union's vehicle CO2 emission reduction targets. Sales of pure electric vehicles in the EU increased by 28% in 2022 and 37% in 2023, and are expected to maintain a high growth trend in 2024.

In 2023, the import rate of electric vehicle sales in the EU reached 20%, of which about 500,000 came from China, and the rapid rise of China's new energy vehicles has formed a strong competitive pressure on local car companies in the EU. In response to the sudden rise of China's new energy vehicles, EU countries have taken countermeasures - the imposition of "final countervailing duties". This measure means that the original price of a new energy vehicle of 200,000 yuan, the price of EU member states will increase tariffs, and the highest price may be raised to nearly 300,000 yuan for sale.

In this context, the technical teams of China and the EU held five rounds of consultations in Beijing from November 2 to 7, and conducted in-depth exchanges on the specific contents of the price commitment scheme of the EU's anti-subsidy case against electric vehicles in China, and made certain progress.

On November 23, Bernd Lange, chairman of the European Parliament's International Trade Committee, revealed in an interview with German press TV that the EU and China are close to reaching a solution on the cancellation of tariffs on imported electric vehicles imposed on China. "We are getting close to an agreement: China could commit to provide electric cars in the EU at the lowest price," he said.

In the face of the new energy vehicle tariff game between China and Europe, how is the export performance of China's new energy vehicles? For the Yiwu market, which has entered the new energy vehicle export track, how to break the game?

01 As a trade vane, how is the export performance of new energy vehicles in Yiwu?

Yiwu's vehicle exports started in 2020 and grew rapidly in 2023

At the end of 2020, Yiwu was approved as a national pilot city for used car export, Yiwu grasped the direction of trade export, and built the country's first new energy product market (i.e. the East market of the second District of the International Trade City) in 2023.

At present, the east market of the second district has more than 670 business entities, and has set up more than 2,000 square meters of new energy vehicle exhibition and sales area. Products cover photovoltaic modules, energy storage systems, new energy vehicles, intelligent hardware and electrical appliances and many other categories, the market mainly radiates the Middle East, Africa, Southeast Asia and South America and other regional countries.

International Trade City District 2 East new energy products market

According to the relevant data of Yiwu Index integration:

In terms of automobile export quantity, in the whole year of 2023, Yiwu's automobile export volume reached 5015, with a total value of 900 million yuan, and the number of exported vehicles increased by 11 times compared with 2022. From January to August this year, Yiwu's automobile exports reached 3,985, an increase of 1.4 times, of which the export volume of new energy vehicles increased by 59%. It is expected that by the end of 2024, Yiwu automobile exports will exceed 10,000 units.

In terms of the number of export enterprises, the number of enterprises specializing in the transformation of automobile export business in Yiwu has increased significantly, and as of now, Yiwu has 25 automobile export record qualified enterprises.

In terms of the main export market, according to the Yiwu Index reporter's visit, the main target market of Yiwu's vehicle exports is concentrated in Central Asia, the Middle East and Africa and other countries and regions. Specifically:

Central Asian market

With the advantages of port logistics transportation, brand recognition and tariff concessions, the Central Asian market has become an important starting market for Yiwu. According to the visit of Yiwu Index reporter, since 2022, some export enterprises in Yiwu have used the markets of Central Asia and other countries as the "blue ocean market" of new energy vehicle exports, and the new energy vehicles made in China have been transported to the local markets of Central Asia and other countries in a fast, convenient and low-cost way through the "golden channel" of Xinjiang port. Chinese-made new energy brands, such as Chery, Jianghuai, Great Wall and other domestic brands, have opened up sales in Central Asia and other countries, and have been favored by local consumers. At the same time, relevant countries have opened up space for the popularization of new energy vehicles in policies. For example, in Kyrgyzstan, the local country implements the policy of tariff preference or even reduction on the import of new energy vehicles to encourage the import and sales of new energy vehicles, which also brings new opportunities for "Made in China".

Middle East market

With the advantage of customer source, the change of local consumption concept and the advantage of tariff policy, Yiwu new energy vehicle export enterprises have accelerated their entry.

The Middle East region has maintained long-term trade exchanges with Yiwu market, and Yiwu export enterprises have a certain customer base in the Middle East market. Although there are many oil countries in the Middle East and oil vehicles are popular, there are still some young consumer groups that gradually favor and are willing to buy Chinese-made new energy vehicles. Taking the United Arab Emirates as an example, the vehicle import tariff is only 5%, which has attracted many Chinese car brands including Geely, BYD, Chery, Changan and so on to the sea. According to the overall market forecast of Yiwu Index, the demand for new energy vehicles in the UAE will maintain an annual growth rate of about 30% in the next five years. Yiwu Mall Group has already laid out in advance to introduce new energy vehicle areas in the Dubai sub-market to meet future market demand.

African market

Promoted by the policy of "limiting oil and drum electricity", Yiwu new energy automobile export enterprises take advantage of the trend to layout the emerging market in Africa.

According to the visit of Yiwu Index reporter, at present, the automobile brand agents in the East new energy market of Yiwu District 2, such as BYD and Geely, have laid out the emerging markets in Africa and have a good export share. This is mainly due to a number of African countries have launched policies to support new energy vehicles, such as Ethiopia and other countries issued new regulations to restrict the sale of oil vehicles and encourage the development of trams, which is a major positive for Yiwu's new energy vehicle exports. However, at the same time, Africa's overall infrastructure is relatively backward, the level of industrial electrification is relatively low, and there is still a lack of basic security for new energy vehicles. It is also imperative to promote electric storage equipment in addition to new energy vehicles as soon as possible.

In general, the countries exporting new energy vehicles through Yiwu market are widely distributed, and the EU's tariff increase on new energy vehicles made in China has not caused a great impact on Yiwu's export of new energy vehicles. With the acceleration of the layout of overseas advantageous markets, Yiwu's new energy vehicle export trend is optimistic, and it is expected that in 2024, Yiwu's automobile export will exceed 10,000 (oil-containing vehicles).

- How should Yiwu market give full play to its advantages and promote the "global flowering" of new energy vehicle exports?

In the face of tariffs imposed by the EU, Yiwu's new energy vehicle exports play their advantages and enhance their competitiveness

According to the European Automobile Manufacturers Association data show that in September, the EU hybrid car market accounted for 32.8%, exceeding the market share of gasoline vehicles for the first time, the EU market volume is large, fast growth, high level of resident income, and the new energy vehicle consumer market has great potential. At the same time, the domestic Oems (automobile manufacturers) have been deeply cultivated in the local market of the EU for many years, and Yiwu new energy export enterprises can also give play to the advantages of the industrial chain agglomeration of the new energy market, work together to open up the EU market, and promote the export of new energy vehicles "global flowering".

Yiwu's industrial advantages can be summarized into the following three points:

Channel resource advantage. Relying on Yiwu's vast global trade network, new energy vehicle export enterprises have stable customer sources and channel advantages. On the one hand, they have certain bargaining power when facing Oems, and often have certain price advantages compared with export dealers in other domestic markets. On the other hand, different new energy vehicle brands in Yiwu have certain differences in their main export markets, but most of them have stable customer resources and are easy to form resource complementary advantages.

Industrial supporting advantages. From the perspective of enterprise capacity, some new energy automobile export enterprises in Yiwu have complete industrial supporting service advantages such as trade exhibition, logistics, e-commerce services, spare parts and so on. From the perspective of market agglomeration effect, the east market of the second district gathers the display and sales of various new energy vehicle spare parts products such as photovoltaic modules, motor batteries, and energy storage, providing one-stop new energy vehicle aftermarket services, which can effectively realize the linkage and play the effect advantage.

Advantages of state-owned platforms. In order to better integrate the export resources of new energy vehicles, in October 2024, Mall Group established Yiwu "Mall Used Car Export Base" in Binwang market, where foreign investors are more active, and is committed to building a used car distribution and export platform integrating brand display, cooperation consultation, procurement negotiation, car rental test ride and other full-link services. An interview with an automobile export company said, "Not long after the opening, there have been customers from Sichuan, Henan and other places to negotiate, they know that Yiwu is very famous for small commodities, but they did not expect that automobile exports also have such a base."

Yiwu Mall used car export base Source: Yiwu Index

China's new energy vehicle enterprises have taken positive measures to deal with this incident:

Yiwu traders refused to roll in, together with the sea to increase market share. Some countries in Southeast Asia, Africa and the Middle East are important target markets for Yiwu's automobile exports. Yiwu traders can make use of their resource advantages to achieve differentiated competition, increase the share of competitive markets, and jointly explore other international markets.

Many automobile brands carry out the strategy of building factories overseas, bringing new opportunities for Yiwu's vehicle and spare parts export business. Some domestic automobile enterprises choose to establish Oems and supporting maintenance service providers in third-party countries or EU countries, creating a very favorable after-sales service environment for Yiwu new energy vehicle traders, which will strongly promote Yiwu vehicle exports. At the same time, domestic new energy vehicles landed overseas, and relevant consumers will have a large amount of new demand for domestic new energy product accessories, which will bring new opportunities for the export of new energy vehicle parts in Yiwu.

The market layout of the EU has gradually grown from easy to difficult. Judging from the voting situation of whether to impose tariffs, the opinions within the EU are not unified, mainly because of the differences in the acceptance of new energy vehicles and the scale of market demand in EU countries. Yiwu new energy export enterprises can gradually open up the EU tram export market according to their own advantages, from easy to difficult. From the export data of China's new energy vehicles to EU countries in 2023:

Germany

The share of China's new energy vehicle exports to Germany occupies the top three. Germany, a traditional powerhouse of the auto industry, argued against the tariffs. Yiwu index analysis believes that the layout of the German market is relatively low.

Spain & Belgium

The share of China's new energy vehicle exports to Belgium and Spain ranked first and second respectively. Belgium and Spain abstained from the tariff vote. Yiwu index analysis believes that the layout of Spain and Belgium market difficulty is relatively low.

Slovenia

China's new energy vehicle export market share to Slovenia also has a good performance, ranking fifth. Slovenia also voted against. According to the analysis of Yiwu Index, the difficulty of the Slovenian market layout is relatively low.

Netherlands

The market share of Chinese new energy vehicles exported to the Netherlands is low, and local consumers prefer new energy vehicle brands such as Tesla. The Netherlands voted in favour in this vote. Yiwu index analysis believes that the layout of the Dutch market is relatively difficult.

France

China's new energy vehicles have a place in the French market with price advantages, and the French government hopes to support the local and European auto manufacturing industry through the new subsidy policy to reduce its dependence on China's electric vehicles. France also voted in favour. Yiwu index analysis believes that the layout of the French market is relatively difficult.

(Note: This Yiwu Index is only based on objective analysis of data and does not represent subjective market investment advice)

- Under the encircle of the EU, how is China's new energy vehicle export performance?

Looking at the entire Chinese new energy vehicle export market, the EU's imposition of tariffs does not mean that exports are "killed with one rod".

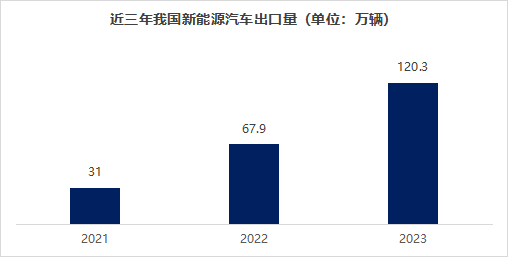

According to data released by the China Association of Automobile Manufacturers, from January to September 2024, China's export volume of new energy vehicles has reached 928,000 units, an increase of 12.5% year-on-year. The competitiveness of China's new energy vehicles in the international market is constantly improving, and the market demand continues to be strong. According to the data released by the General Administration of Customs, China's new energy vehicle exports in 2023 were 41.812 billion US dollars, with a year-on-year growth rate of 73.35%.

Data source: Yiwu Index, public data

www.ywindex.com

From the perspective of sub-categories, China's new energy vehicles have performed well in various market segments. In 2023, the export value of hybrid electric vehicles was 5.998 billion US dollars, an increase of 105.20%. Exports of pure electric vehicles reached 35.814 billion US dollars, an increase of 68.95%.

From the perspective of export countries, Europe is still one of the key markets for Chinese car companies. According to Chinese customs data, nearly half of China's electric vehicle exports in the first half of 2024 went to Europe, with the EU accounting for 36% and the UK accounting for 12%. In 2023, China exported nearly 500,000 electric vehicles to the EU market, with Belgium, Spain, Germany and the Netherlands being the main export destinations.

It is precisely because the explosive growth of China's tram exports has moved the cake of traditional car companies such as France and Italy in the EU market, the EU will launch this round of trade game on China's new energy vehicles to protect its own auto industry.

In addition to the EU countries, the "Belt and Road" co-construction countries represented by Eastern Europe, Central Asia and the Middle East are also the main target markets for China's new energy vehicle exports.

In 2023, China's main export countries or regions and exports of hybrid electric vehicles

Data Source: China General Administration of Customs, Yiwu Index

www.ywindex.com

In 2023, China's main export countries or regions and exports of pure electric vehicles

Data Source: China General Administration of Customs, Yiwu Index

www.ywindex.com

Closing remarks

In fact, there are no real winners under high tariffs, and the ultimate result of trade barriers is to bite. The influence of Chinese car companies in Europe is far more than market share, but also has an impact on the upstream and downstream of the industrial chain and the holding of local car companies. The imposition of tariffs will only backfire and increase the consumer burden of car buyers.

Trade and economic cooperation between China and the EU could inject new vitality into the global electric vehicle market, as the two sides have made positive progress in negotiations on electric vehicle tariffs. Yiwu new energy automobile traders should also refuse the internal volume, give full play to their advantages to go to sea, accelerate the development of the EU market, establish their own sustainable income generation capacity, create Yiwu new energy automobile export "golden card", and work together to promote Chinese automobile brands to go to sea.

—— The content of this article is translated by Al ——

My favorites

My favorites