November small commodity industry information station

Publish Time:2025-02-17 14:06:15Pageviews:203

abstract: Continue to pay attention to Yiwu Index, we will provide you with exchange rate analysis, shipping prices, raw material market interpretation, enterprise policy, industry news and hot information and other latest developments to help you make decisions and development!

First, exchange rate dynamics

Yiwu Market is the world's largest collection and distribution center for small commodities, with exporting countries covering more than 220 countries and regions around the world. The following is the latest currency exchange rate analysis of major exporting countries in Yiwu Market:

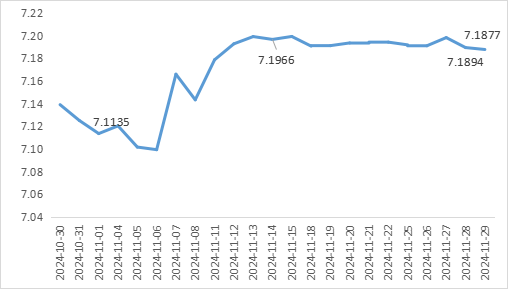

1. United States Dollar (USD)

On November 29, the exchange rate of USD/RMB was around 7.19 yuan, and the monthly average exchange rate of USD/RMB in October 2024 was 7.1058, and the RMB has depreciated against the US dollar. The Federal Reserve may cut interest rates by another 25 basis points in December, according to the minutes of its November meeting released. At the same time, the current market environment is highly uncertain, and investors' demand for US dollar assets has increased, thus pushing up the US dollar exchange rate.

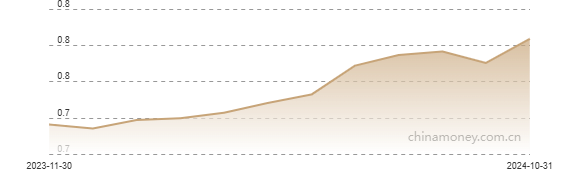

Chart of USD/RMB central parity rate

Data source: China Money Network

www.ywindex.com

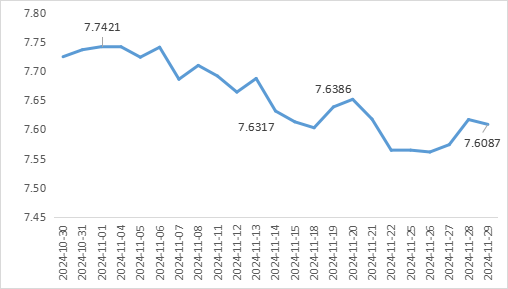

2. Euro (EUR)

On November 29, the exchange rate of the euro against the RMB was around 7.61 yuan, and the monthly average exchange rate of the euro/RMB in October 2024 was 7.72, and the exchange rate of the RMB against the euro was raised, and the RMB was relatively strong. According to analysis by the International Monetary Fund (IMF), the eurozone faces high inflation, tight energy supply chains and geopolitical instability, which have somewhat reduced the investment appeal of the euro. At the same time, the European Central Bank's monetary policy is becoming more cautious, and the market's expectations for future euro interest rate hikes have slowed down, and the euro trend has been further dragged down.

Chart of the euro/RMB central parity rate

Data source: China Money Network

www.ywindex.com

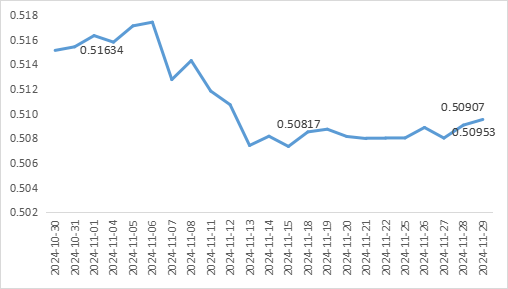

3. Uae Dirham (AED)

The exchange rate of RMB against UAE dirham was around 0.51 yuan on November 29, and the monthly average exchange rate of RMB/UAE dirham in October 2024 was 0.52 yuan, and the depreciation of RMB against UAE dirham was relatively small. As a major oil producer, the UAE's currency and economy are directly affected by international oil prices. When trading and investing in the UAE, Chinese companies can consider using local currency in their quotes to reduce the risk of exchange rate fluctuations.

Chart of Yuan/UAE Dirham central parity

Data source: China Money Network

www.ywindex.com

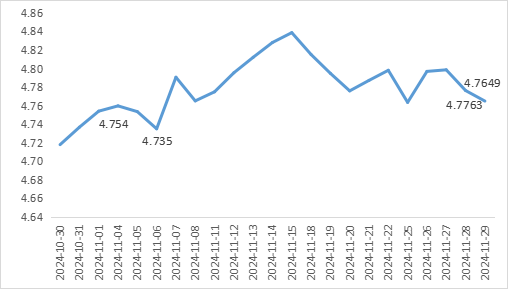

4. Thai Baht (THB)

The exchange rate of the yuan against the baht on November 29 was around 4.77 yuan, and the monthly average exchange rate of the yuan/baht in October 2024 was 4.7128, with the yuan appreciating relative to the baht. As the US dollar rises, emerging market currencies around the world are under downward pressure, with the Thai baht in particular. In addition, Thailand has recently faced greater challenges in economic recovery, including the slow recovery of tourism and the unstable inflow of foreign capital, which has further increased the pressure on the depreciation of the Thai baht.

Chart of RMB/Baht central parity rate

Data source: China Money Network

www.ywindex.com

5. Brazilian Real (BRL)

On November 29, the exchange rate of the renminbi against the Brazilian real was around 0.837 yuan, and the renminbi showed an overall appreciation trend against the real. The Brazilian government's plan to raise the income tax threshold to R $5,000 is likely to exacerbate Brazil's fiscal deficit, and market confidence in the government's fiscal strategy is likely to continue to decline, putting more downward pressure on the real.

Brazilian real (CNY/BRL) Reference exchange rate chart

Data source: China Money Network

www.ywindex.com

Second, international logistics overview

1. Ocean freight trend

Ningbo Zhoushan Port undertakes a large number of Yiwu small commodity export business, and Yiwu is being built into the "sixth port area" of Ningbo Zhoushan Port. Ningbo Zhoushan Port, as an important outlet of Yiwu market, has jointly built an efficient logistics channel. Yiwu Index monitors it based on relevant data and interprets the latest international shipping freight trends.

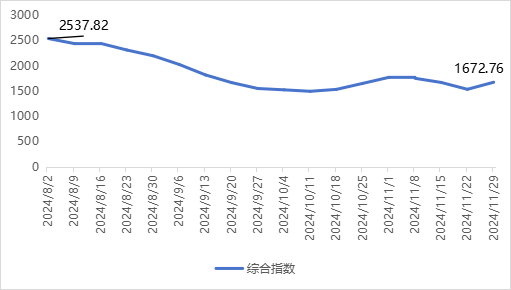

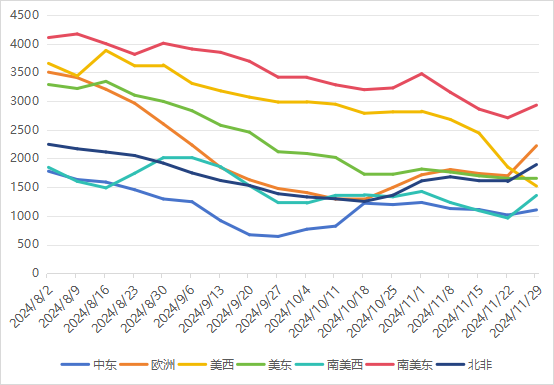

Since August, the tension of shipping capacity has eased, and the overall freight rate of various routes has shown a downward trend. In November, the demand for specific routes increased, and the supply of capacity was relatively tightened (such as European routes and Middle East routes), which led to the overall freight rate rebound. At the end of November, the Ningbo export container Freight Index (NCFI) closed at 1672.8 points.

NCFI composite index change trend chart

Source: Ningbo Shipping Exchange

www.ywindex.com

In late November 2024, the price of the Ningbo-US-East route was 5,387 US dollars /FEU, and the freight index was 1,659.95 points; The price of Ningbo-Europe route in the month was 4491 USD /FEU, and the freight index of the route was 2222.27 points; The freight index of Ningbo-US-West route is 1519.84 points; Ningbo-middle East route freight index is 1103.92 points.

NCFI main route index change trend chart

Source: Ningbo Shipping Exchange

www.ywindex.com

Although shipping prices continue to decline, they are still relatively high. The following figure is the container price of the export route of Jianyiyun freight platform (Ningbo to the following ports) in November, for reference only.

Data source: Public data collation

www.ywindex.com

2. Current affairs of shipping

Domestic dynamics

- On November 27, the container throughput of Shenzhen Port exceeded 30 million TEUs, an increase of 7%.

- On November 22, Ningbo Zhoushan Port Meishan Port Area reached the milestone of 10 million TEU, becoming the only port in the world with two "ten million container level" single container terminals.

- Maersk has imposed a surcharge of US $500 / box during peak season for shipments from eastern China ports (including Shanghai, Ningbo, Xiamen, Fuzhou and the Yangtze River Basin area) to Cambodia's Westport, effective on December 6.

- On November 22, Yiwu-Ningbo Zhoushan Port container hot metal combined transport line was selected as a state-level typical case.

- On November 20, the Hungarian Budapest Overseas Cargo Station of Shenzhen Airport was officially inaugurated, which will provide one-stop logistics services for "Made in Shenzhen" to overseas markets and help Shenzhen accelerate the construction of a logistics center with global influence.

International dynamics

- Canadian ports still have a huge backlog of container cargo. Canadian ports affected by the strike in late November have gradually resumed operations, but the shutdown has caused a large backlog of containers, and shippers may face a new round of demurrage and demurrage. The Port of Montreal Authority revealed that there is currently a backlog of more than 5,000 TEUs of cargo at the port's Termont terminal, while there is a backlog of 2,750 TEUs of rail freight.

- From 1 December, CMA CGM Ships will apply new All Types of Freight (FAK) rates for cargoes originating from all major Asian ports and destined for all basic Mediterranean ports.

- The Mexican port of Manzanillo will be expanded. Mexico's Port of Manzanillo will undergo a massive $3.15 billion expansion by 2030, making it the largest port in Latin America and nearly tripling container throughput to 10 million TEUs. According to the U.S. Department of Commerce, Mexico will replace China as the largest trading partner of the United States in 2023, amid significant growth in container shipping from Asia to Mexico.

- SeaLead launched a new Dubai-Kenya (DUKE) route on 4 November 2024, connecting Karachi, Jebel Ali, Mombasa and Karachi.

Iii. Overview of raw material market

The production of small commodities in Yiwu market involves the procurement of a large number of raw materials such as textiles, plastic products, hardware accessories and electronic components, and is particularly sensitive to fluctuations in the cost of upstream raw materials, which will directly affect the procurement cost and sales pricing of commodities. The following is the dynamic situation of important basic raw materials such as steel, cotton, polyethylene (PE) in November:

1. Steel

Price shock adjustment: Recent steel market sentiment is general, as the weather in northern China turns cold, outdoor construction is limited, steel demand further declines, the market gradually enters the off-season of consumption, and terminal demand continues to shrink, forming a certain pressure on steel prices.

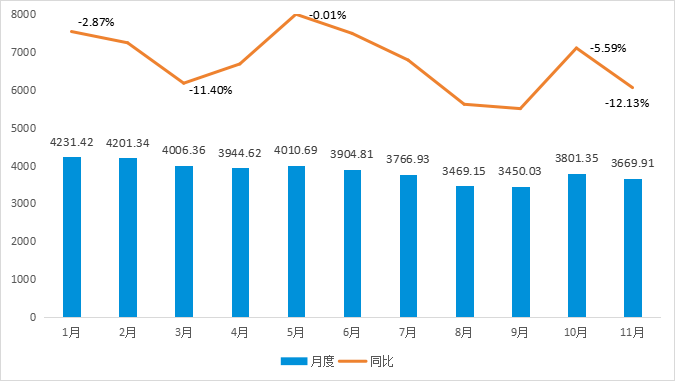

2024 domestic steel composite average price index monthly index

Source: My Steel

www.ywindex.com

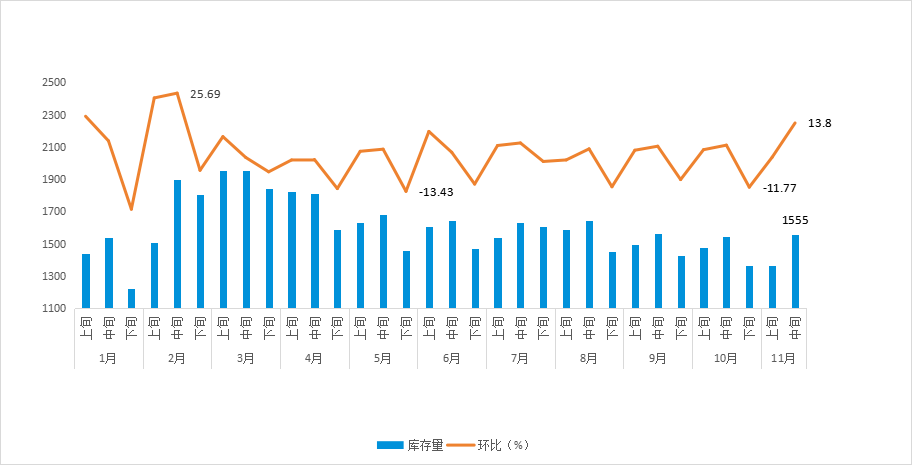

Inventory growth: According to the China Steel Association data show that in mid-November 2024, the key statistics of steel enterprises steel inventory reached 15.55 million tons, an increase of 13.8%. Inventories are up 25.8% from the start of the year; Compared with the same period last month, inventories increased by 0.6%.

Inventory of steel enterprises in 2024 (10,000 tons)

Data source: China Iron and Steel Association

www.ywindex.com

2. Cotton

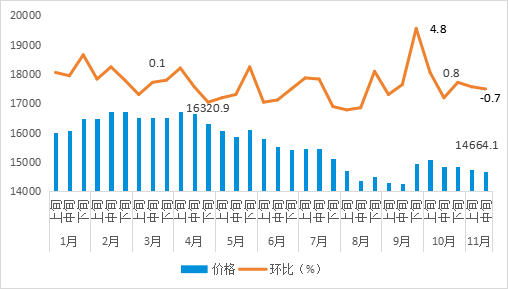

Price pressure: In early November, the price of cotton (leather cotton, white cotton three levels) in the national circulation field was 144,464.1 yuan/ton, down 97.2 yuan/ton from the previous period, a drop of 0.7%. The domestic new cotton picking is basically over, the international market cotton supply remains abundant, and the textile market has entered the off-season, the cotton mill opening probability, the production and sales rate have declined, and the downstream demand is weak, which is a drag on cotton prices.

Changes in domestic cotton Market Price in 2024 (Yuan/ton)

Source: National Bureau of Statistics

www.ywindex.com

Easy supply: the average yield of cotton per unit area in China in 2024 is 154.3 kg/mu, an increase of 8.2% year-on-year; According to the monitoring system survey area of 40.833 million mu, the total output is expected to reach 6.302 million tons, an increase of 6.8%; Among them, Xinjiang's output is expected to be 5.909 million tons, up 7.5% year-on-year. In terms of inventory, as of November 15, 2024, the total commercial inventory of cotton was 2,913,900 tons, an increase of 344,900 tons from the previous week, an increase of 13.43%.

3. Polyethylene (PE)

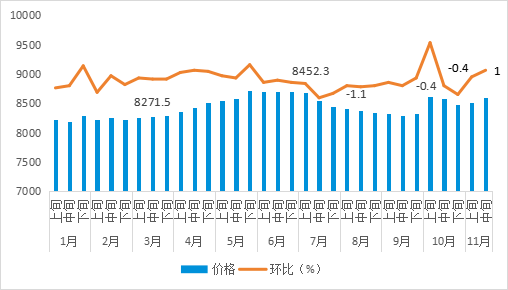

The price showed a strong trend: in mid-November 2024, the price of polyethylene in the national circulation field was 8601.7 yuan/ton, an increase of 1%. In mid-early November, the upstream production enterprises were intensively overhauled, the superimposed agricultural film season was delayed, and the downstream goods were actively taken, and the polyethylene fundamentals showed a strong trend. In mid-to-late November, with the seasonal weakening of agricultural film demand, the upstream supply side may become a key factor affecting the price of polyethylene.

Price changes of domestic polyethylene market in 2024 (Yuan/ton)

Source: National Bureau of Statistics

www.ywindex.com

Low social inventory: as of mid-November, PE total inventory was 924,200 tons, down 6.16% from the beginning of the month, at a low level. Affected by the delay of the agricultural film season, the terminal orders performed well, and the social inventory was significantly reduced. At present, the number of agricultural film orders has begun to weaken, and the demand side is gradually transiting to the off-season, and there are expectations of accumulation.

Four, Yiwu Hui enterprise policy overview

- For overseas certification, overseas trademark registration, overseas patent application and other projects, 60% of the actual cost of the project will be subsidized. (Source: Yiwu Commerce Bureau)

- For units or individuals who apply for invention patents abroad and obtain authorization through PCT channels, a subsidy of 10,000 yuan will be given for each case. (Source: Yiwu Market Supervision Bureau)

- Enterprises that obtain the international registration of trademarks through the Madrid Agreement on the International Registration of Trademarks shall be subsidized by 50% of the actual registration fee of each trademark, and the maximum subsidy for each enterprise shall not exceed 100,000 yuan per year. (Source: Yiwu Market Supervision Bureau)

- Enterprises insured with "short-term export credit insurance" (including "short-term export special insurance") shall be subsidized by 60% of the actual premium paid; The foreign trade comprehensive service enterprises identified by the Commerce Department shall be subsidized by 80% of the actual premium paid. The VAT deduction is not included in the actual premium paid. Support market procurement export credit insurance projects and general trade small and micro enterprises export credit insurance government insurance projects. General trade small and micro enterprises blanket coverage increased from 0-5 million US dollars to 0-6 million US dollars, the relevant enterprises can obtain the policy free of charge. (Source: Yiwu Commerce Bureau)

- Enterprises purchasing intellectual property insurance will be subsidized by 50% of the annual premium, with a maximum subsidy of 100,000 yuan per year for a single enterprise. (Source: Yiwu Market Supervision Bureau)

- Support enterprises in coping with trade frictions. For enterprises to carry out overseas lobbying, early response, professional legal advice and administrative response and other trade friction-related legal fees, technical expert fees, translation fees, hearing, defense, lobbying, exclusion (exemption) and other costs shall not exceed 50% of the subsidy, the US-related cases shall not exceed 70%, and the final absolute victory of the case shall be granted an additional 20% subsidy. Each enterprise or industry association shall not exceed 1 million yuan per year. (Source: Yiwu Commerce Bureau)

Continue to pay attention to Yiwu Index, we will provide you with exchange rate analysis, shipping prices, raw material market interpretation, enterprise policy, industry news and hot information and other latest developments to help you make decisions and development!

—— The content of this article is translated by Al ——

My favorites

My favorites