[Indonesia] To Indonesia, to Southeast Asia, why Indonesia is the first place to go to Southeast Asia

Publish Time:2025-02-17 15:32:13Pageviews:349

abstract: Location advantage: Indonesia is located in the heart of Southeast Asia, adjacent to the important Strait of Malacca, connecting the Indian Ocean and the Pacific Ocean. Robust economy: Indonesia is the largest economy in Southeast Asia, with long-term steady GDP growth, a continuously improving economic environment, attracting a large influx of foreign investment, and increasing consumer spending power. The market is huge: the consumer group is large and the structure is excellent, the consumer will is strong, plastic products, daily necessities, machinery and appliances, toys

In 2023, Indonesia's GDP is about 1.37 trillion US dollars, ranking first in ASEAN for many consecutive years, accounting for 36% of ASEAN's economic aggregate, GDP growth rate is 5.05%, and per capita GDP is about 4,920 US dollars. As the largest economy in ASEAN, Indonesia is the only destination for Chinese enterprises to expand their territory in Southeast Asia. According to Yiwu Index statistics, in 2023, the total export of Yiwu market to Indonesia reached 8.56 billion yuan, and small commodity-related plastic products, daily necessities, machinery and appliances, toys and sports goods have become the top five commodities exported by Yiwu market to Indonesia, which is expected to continue to grow in the next few years.

However, Chinese companies also face a very different experience when they go overseas to Indonesia. Online celebrity collection store KKV opened across Indonesia, TikTok Indonesia was banned for 2 months, TEMU was "shut out" in Indonesia... Chinese enterprises going to Indonesia, is it a dimensionality reduction or difficult to enter the game?

I. Country introduction of Indonesia

1. Location advantage

The Strait of Malacca is the choke point of international trade, and its geographical position is superior

Indonesia is located at the intersection of the Pacific Ocean and the Indian Ocean, Asia and Oceania, composed of 17,508 islands, is the world's largest archipelagic country, known as the "land of ten thousand islands." Its land area is about 1.914 million square kilometers, 1.1 times the size of Xinjiang, and its ocean area is about 3.25 million square kilometers.

Indonesia is strategically located along the Strait of Malacca, the chokepoint for international trade. With the upgrading of major ports such as Jakarta's Tanjung Buluk Port, Indonesia's maritime infrastructure has continued to improve, strengthening its position in the regional logistics network. Indonesia's unique geographical advantages provide convenient transport routes for international trade, reduce logistics costs, and improve the efficiency of maritime transport with surrounding regions and global markets.

Map of Indonesia Source: Baidu Map

2. Demographic structure

The population is diversified and concentrated, and the middle class is growing

In 2023, Indonesia's total population will reach 278 million (+ 0.6%), accounting for 41% of ASEAN's total population, with an urbanization rate of 59%, and the population is mainly concentrated in Greater Jakarta, with more than 30 million people. About 145 million people live on the island of Java, with a population density of 1,045 people per square kilometer.

Due to overcrowding in the Jakarta area, on November 9, 2024, the Indonesian Parliament passed a resolution to officially cancel Jakarta's status as the capital and set it up as a special zone, and the new capital was moved to Nusantara in Kalimantan Island.

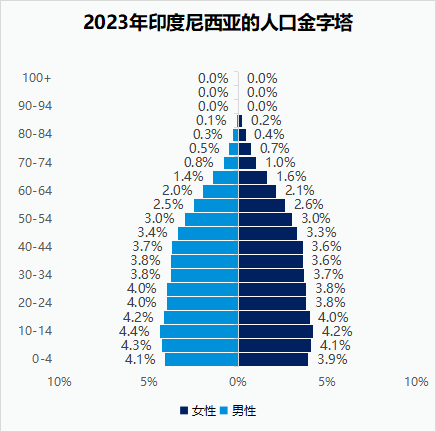

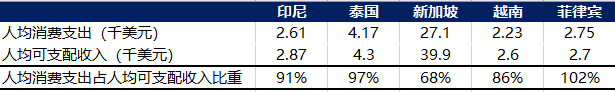

Indonesia's median age is 29.7 years, much younger than our country's 38.5 years. Among them, the Z generation accounts for 24%, the Alpha generation accounts for 23%, and about 70% of the population is of working age (15-64 years old).

Data source: populationpyramid.net; Yiwu index

www.ywindex.com

The growing size of the middle class is the backbone of Indonesia's future economic development. According to Yiwu Index data, Indonesia has about 72 million middle class in 2023, accounting for about 26% of the total population, and a compound annual growth rate of about 10%. The increase of the middle class will enhance the overall consumption power and consumption level of Indonesia, while bringing broad consumption upgrade demand.

In summary, Indonesia has a large population base, young structure, no savings habit, and huge consumption potential, all of which are conducive to the development of small commodity industry.

3. Economic development

It has a large economy and rich natural resources such as minerals, but strong protectionism in domestic production

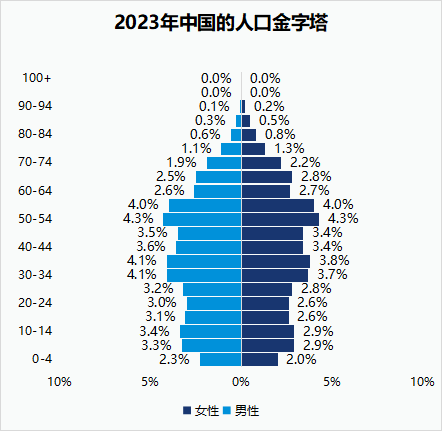

Indonesia is the largest economy in ASEAN, with a GDP of $1.37 trillion in 2023, accounting for 36% of ASEAN's total economy. The Indonesian economy has long been dominated by domestic demand, and the share of consumption in GDP has been maintained at 60-70% for nearly two decades.

Key economic data are as follows:

Gross Domestic Product (2023) : approximately $1.37 trillion;

Economic growth rate (2023) : 5.05%

GDP per capita (2023) : $4,920;

Currency name: Indonesian rupiah, commonly known as the Indonesian rupiah;

National GDP and Growth rate of Indonesia, 2019-2023

Source: World Bank; Yiwu index

www.ywindex.com

Indonesia is one of the world's largest agricultural countries, rich in resources, some of the energy, minerals and agricultural production and supply are in the forefront of the world. Indonesia is the world's largest nickel ore producer and the top five coal producers, as well as the largest natural gas supplier in Southeast Asia, and other major minerals including aluminum, nickel, iron, copper, tin, gold, silver, coal, etc., which is an important source of supply for the international metal mineral products market. The main agricultural products are palm oil, rubber, coffee, cocoa and so on.

Indonesia has strong local protectionism and a large number of domestic products in various fields. Although Indonesia's level of industrialization is not high, it mainly focuses on light industries such as clothing and cosmetics, and its commodities depend on imports. However, in order to protect its manufacturing industry, Indonesia has focused on developing a series of industrial fields from mining development to manufacturing to drive local employment and economic development. According to the field visit and sampling statistics of Yiwu Index editorial department, 60% of small commodities in Jakarta's large shopping malls are locally produced in Indonesia, and its import dependence is not high. The downstream production of resources such as nickel ore requires local production. In recent years, Chinese mineral industry enterprises have invested and built factories there.

KKV Jakarta commodity map Source: Yiwu Index

Ii. Market overview

1. Market size

Large consumer groups, consumption willingness and ability continue to improve, some products in short supply

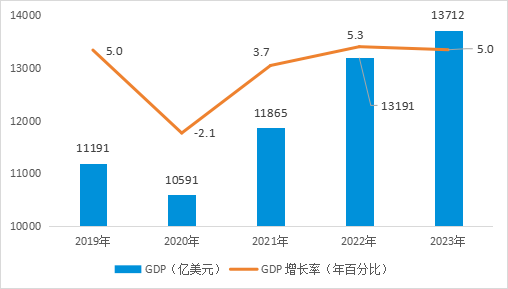

Indonesia is the fourth most populous country in the world and the most populous Muslim country, providing a broad consumer base for the retail market. According to World Bank data, in 2023, Indonesia's per capita consumption expenditure will be 2,608 US dollars, and the retail market size will reach 191.3 billion US dollars. In the same period, Indonesia's per capita disposable income was $2,868, with a compound growth rate of 4.0% from 2015 to 2023; Per capita consumption expenditure accounted for 91% of disposable income, much higher than Singapore's 68% and similar to Thailand and Vietnam. It can be seen that the huge consumer market is the cornerstone of Indonesia's economic development.

Economic indicators of major ASEAN countries in 2023

Data source: World Bank, Yiwu Index

www.ywindex.com

In the field of segmentation, consumer electronics, beauty care, household goods, toys and maternal and child pets and other segments demand is huge, the entire market is still in short supply stage, high import dependence.

2. Demand for small commodities

According to Yiwu Index monitoring, Yiwu's exports to Indonesia in 2022 were 8.48 billion yuan, up 23.6% year on year. Among them, the export value of market purchase was 6.87 billion yuan, an increase of 21.6%. The export value of Yiwu to Indonesia in 2023 is 8.56 billion yuan.

In 2023, Yiwu will export TOP5 small commodity related categories to Indonesia

Data source: Yiwu Customs, Yiwu Index

www.ywindex.com

Small commodity-related plastic products, daily necessities, machinery and appliances, toys, sports goods and other categories will become the top five commodities exported from Yiwu market to Indonesia in 2023. Combined with the Yiwu index to capture the market dynamics, in addition to the above five categories, it is expected that electronic products, hardware tools, household goods, maternal and child products and pet products still have a large room for growth.

Electronic products and accessories: With the expansion of the middle class population and the acceleration of the digital process, consumer demand for electronic products is growing. According to the Yiwu Index, its market size will reach $11.58 billion in 2024.

Hardware tools: The Indonesian construction and home improvement market is booming due to economic growth, and small, easy to carry and ergonomic hardware tools are becoming more and more popular in the market.

Household goods: With the acceleration of urbanization, Indonesian households have a growing demand for household goods, with a special focus on beautiful design and environmentally friendly materials.

Maternal and infant products: According to Database, there will be 15.7 births per 1,000 Indonesians in 2024, and the number of births per year in Indonesia will remain above 4.3 million in the next decade. The potential demand for maternal and child products in Indonesia is huge.

Pet supplies: As of 2023, about 67% of households in Indonesia have pets. The number of pets is increasing rapidly, especially the rate of cat ownership has increased significantly in the past five years, and the market demand for pet food and care products is expected to continue to expand.

In the future, with the continuous development of Indonesia's economy and the deepening of bilateral trade cooperation, Yiwu's total exports to Indonesia are expected to continue to grow.

3. Sales channels

3.1 Wholesale Market

Most of the small commodity wholesale markets in Indonesia are concentrated in Jakarta and other developed cities, and there are many market segments in various industries, and there is a lack of comprehensive wholesale markets. Mangga Dua, for example, is an important wholesale clothing and electronics market in Jakarta; LTC Glodok is the center of hardware and electromechanical products in Jakarta. In addition, Indonesia's traditional sales channels also include a large number of street stalls and small grocery stores close to the community.

Mangga Dua Mall: A major wholesale and retail complex in Jakarta, with 7 floors, mainly selling clothing, electronics and household goods.

Mangga Dua Market chart Source: Yiwu Index

LTC Glodok: Indonesia's largest hardware and electrical wholesale center and distribution center, providing "one-stop trading", equipped with warehouses, the main sales categories include generators, valves, compressors, most of the goods from China.

LTC Glodok Market chart Source: Yiwu Index

In summary, according to Yiwu Index data research estimates that 70% of retail sales in Indonesia are traditional channels, 20% are mini-supermarkets, 6% are medium-sized supermarkets, and 4% are hypermarkets. Its development situation is similar to that of China at the beginning of 2000, the offline channel is still in a relatively benign development stage and the medium and large stores have a large space for development. Therefore, when we set foot in Indonesia, we will feel: Isn't this China 20 years ago?

3.2 E-commerce channels

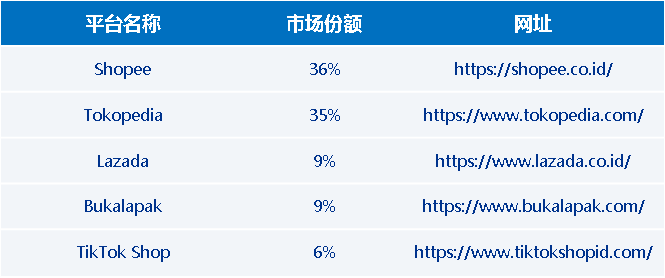

Indonesia is the largest e-commerce market in Southeast Asia. According to Euromonitor data, the retail volume of e-commerce in Indonesia will reach 60.4 billion US dollars in 2023, accounting for 49% of the entire ASEAN. Indonesia's e-commerce is growing fast, and its retail scale in 2023 accounts for 32% of the entire retail market in Indonesia, and the offline market is still the main force. Here are the main e-commerce platforms in Indonesia:

Shopee: In 2023, Shopee has the highest share of the Indonesian e-commerce market, with a business size of $21.8 billion, accounting for 36% of the Indonesian e-commerce retail volume. Shopee mainly sells products such as fast fashion and electronic products.

Tokopedia: Indonesian local e-commerce, is also the largest and highest traffic C2C e-commerce platform in Indonesia. According to Euromonitor data, in 2023, Tokopedia's Indonesian business scale reached 21.1 billion US dollars, accounting for 35% of Indonesia's e-commerce retail scale, and surpassed Lazada to become the second largest e-commerce platform in ASEAN with its Indonesian market business alone.

Lazada: Alibaba's e-commerce platform. According to Euromonitor, Lazada's Indonesian business will reach $5.6 billion in 2023, accounting for 9% of Indonesia's e-commerce retail sales.

Bukalapak: B2B platform that helps smes enter the online marketplace.

TikTok Shop: In 2023, it controlled Tokopedia, Indonesia's largest e-commerce platform, which mainly sells products including beauty care, fashion products, electronic products and food and beverage.

2023 Indonesian e-commerce market share Top5 platform

Data source: Euromonitor; Yiwu index

www.ywindex.com

Iii. Overview of trade between China and Indonesia

1. Bilateral trade cooperation between China and Indonesia

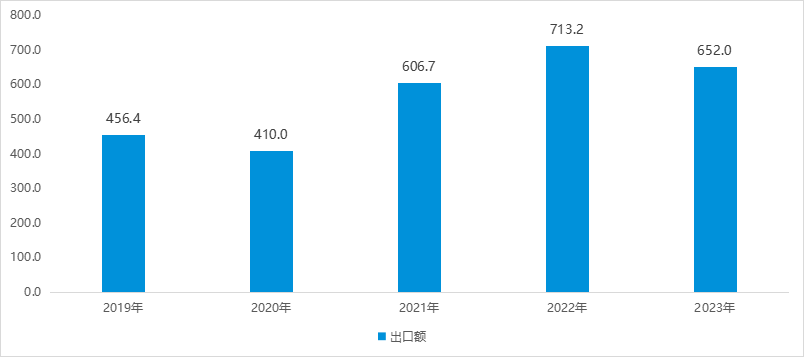

China is Indonesia's largest trading partner and its second largest source of foreign investment. In 2023, the bilateral trade volume between China and Indonesia reached 139.42 billion US dollars, of which China's exports to Indonesia amounted to 65.2 billion US dollars.

China's exports to Indonesia, 2019-2023 (unit: USD 100 million)

Data source: China Customs; Yiwu index

www.ywindex.com

China has been Indonesia's largest trading partner for more than a decade. Indonesia mainly imports from China machinery and equipment and parts, textile raw materials and textile products, plastic products, electronic products and other products; Exports oil, mineral energy, agricultural products and food to China.

China's top 10 export categories to Indonesia in 2023

Data source: China Customs; Yiwu index

www.ywindex.com

2. Trade cooperation between Yiwu and Indonesia

Indonesia is an important export market for Yiwu enterprises, and the bilateral trade volume between Yiwu and Indonesia has maintained rapid growth for many years in a row. At the same time, Yiwu has taken a series of measures to promote trade with Indonesia.

Policy support to improve the international business environment. In 2023, Yiwu Municipal government launched a number of policies to support foreign trade, such as "Ten Measures to optimize International Business Environment Foreign-related services", including improving the living and working conditions of foreign investors in Yiwu, providing foreign trade legal services and policy consultation, aiming to simplify the operation process of foreign-funded enterprises and enhance the convenience of foreign investment in Yiwu.

Exhibition cooperation promotes market docking. In 2023, Yiwu successfully held the first overseas industry exhibition in Indonesia, the Indonesian Stationery and Gift Expo, bringing together hundreds of enterprises to directly connect with local merchants and expand the market. Yiwu Cultural Supplies Industry Association also actively promoted cooperation, printing more than 300 stationery enterprises to participate in the exhibition, enhancing brand awareness.

Cross-border e-commerce to expand sales channels. Yiwu has further expanded its coverage of the Indonesian market through cooperation with cross-border e-commerce platforms, and platforms such as Shopee and Lazada have become important channels for Indonesian consumers to directly purchase Yiwu goods.

4. Risk warning

Policy continuity is weak. There are many political factions in Indonesia, the term of office is short, and the military government is relatively strong, which may cause existing policy changes, and the continuity is not strong, and it has the characteristics of political family factions. When Chinese companies go overseas to Indonesia, they not only need to pay attention to the ruling philosophy of the current government, but also to anticipate multi-party governance and future political forms.

The phenomenon of de-Chinese is obvious. The third generation of local Chinese, in addition to the appearance or Chinese face, basically can not speak Chinese, only can speak Indonesian, and do not use Chinese names. Indonesia has also introduced restrictions against speaking Chinese in public. Chinese companies entering Indonesia should implement a localization strategy and adhere to long-term principles.

Strong domestic protectionism. The Indonesian government has always emphasized supporting the development of local industries and protecting domestic enterprises. For example, in October 2023, in order to protect local e-commerce, TikTok Shop Indonesia suffered a "ban storm", and finally TikTok Shop was able to return to the Indonesian market through the acquisition of 75.01% of Tokopedia's shares. Recently, the Indonesian government announced a ban on iPhone 16 sales in the country, citing Apple's failure to meet government rules on local investment. Indonesia's industry ministry said Apple's current investment in Indonesia was 1.5 trillion rupiah ($95 million) - less than the 1.7 trillion rupiah it had pledged. And Apple's latest smartphone does not meet Southeast Asian countries' legal requirements of 40% localization of components or related workers for phones and tablets.

5. Practical Guide to trade

1. Indonesian import regulations

Import management: The Indonesian government mainly adopts two forms of quota and license when implementing import management. The subject of quota management is mainly alcoholic beverages and direct raw materials containing alcohol, whose import quotas are only issued to approved domestic enterprises. Products subject to license management include industrial salt, ethylene and propylene, explosives, motor vehicles, waste and hazardous goods, and enterprises that obtain import licenses for these products can only use them for their own production.

Import licensing system: In 2010, Indonesia started to implement a new import licensing system, which divided the existing licenses into two types, namely general import licenses and manufacturers import licenses. General import licenses are mainly for importers importing for third parties, while manufacturers import licenses are mainly for importers importing for their own use or use in the production process.

2. Indonesian tariffs

Trade between China and India is eligible for tariff reductions through the ASEAN-China Free Trade Agreement (CAFTA) and the Regional Comprehensive Economic Partnership (RCEP). With the entry into force of RCEP, China and Indonesia will implement the RCEP agreement tax rate. According to the agreement, Indonesia implements zero tariffs on 65.1 percent of goods originating in China, and China implements zero tariffs on 67.9 percent of goods originating in Indonesia. Under the agreement, Indonesia has implemented zero tariffs on about 700 categories of Chinese products, including auto parts, motorcycles, televisions, clothes and shoes, plastic products and bags.

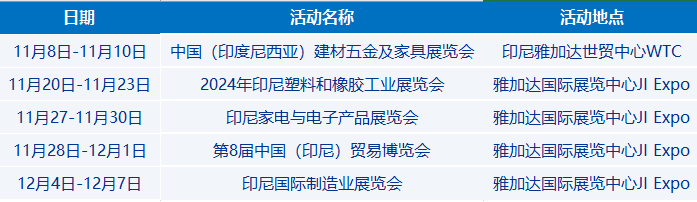

3. Important economic and trade exhibitions

Data source: public data collation; Yiwu index

www.ywindex.com

Sum up

Location advantage: Indonesia is located in the heart of Southeast Asia, adjacent to the important Strait of Malacca, connecting the Indian Ocean and the Pacific Ocean.

Robust economy: Indonesia is the largest economy in Southeast Asia, with long-term steady GDP growth, a continuously improving economic environment, attracting a large influx of foreign investment, and increasing consumer spending power.

Huge market: large consumer groups and excellent structure, strong willingness to consume, plastic products, daily necessities, machinery and appliances, toys and sports goods and other small commodity import demand is strong, for Yiwu's foreign trade exports have a certain good.

Diplomatic stability: The relationship between Indonesia and China has become increasingly close, and the two sides have maintained close diplomatic cooperation under multilateral frameworks such as ASEAN and G20, and the fields of economic cooperation and investment have continued to expand.

But as in the history of Chinese exclusion events, the protection of local resources, and the irregular exclusion of foreign enterprises, all highlight the cultural undertone of Indonesia's indigenous protectionism.

Therefore, in order to deeply cultivate the huge Indonesian market, localization will be the subject that Chinese enterprises must face.

—— The content of this article is translated by Al ——

My favorites

My favorites