Trump is back! Tariff, exchange rate, regional conflict, three keywords affect the future trend of Yiwu small commodity trade

Publish Time:2025-02-27 14:31:22Pageviews:159

abstract: At a time when global trade growth is slowing down and China's economy is rising, the attitudes of the two parties towards international trade are roughly the same, both protecting their own trade and deglobalization, which can be summed up in two points: tariffs and technological blockade. The difference is that Mr Trump is tougher on trade. In this article, we will understand the possible impact of Trump's administration on Yiwu trade through three key words.

After a series of events such as the shooting, Biden's withdrawal from the election and Musk's amplification, the Republican leader Trump won a big victory and entered the White House twice.

Just as Trump launched a trade war with China in the 1.0 era, his new term will have the most immediate impact on global trade. As the capital of small commodities in the world and an important window of international trade, what impact will be brought to Yiwu market in the second four years of Trump's administration?

Photo Source: Baidu

"We will make America great again" was one of Trump's signature quotes during the presidential campaign. From his speech, it can be seen that Trump's economic policy advocates "America first";, which is simply to promote U.S. economic growth and manufacturing Renaissance through domestic tax cuts, foreign tariffs and interest rate cuts to intervene in the weakening and depreciation of the U.S. dollar.

Harris said, "But America, We are not going back." Harris Economic policy advocates "outcome equity";, which simply means that the government should correct economic imbalances and make economic development more equitable.

In fact, the policy differences between Republicans and Democrats are mainly domestic. At a time when global trade growth is slowing down and China's economy is rising, the attitudes of the two parties towards international trade are roughly the same, both protecting their own trade and deglobalization, which can be summed up in two points: tariffs and technological blockade. The difference is that Mr Trump is tougher on trade. In this article, we will understand the possible impact of Trump's administration on Yiwu trade through three key words.

Key word one: tariff

He advocated an "America First" strategy and significantly increased tariffs across the board

For a long time, the United States has had trade imbalances with many trading partners, and the trade deficit with China in particular has continued to widen. Therefore, Trump, a businessman, advocates imposing tariffs to narrow the trade deficit, and promote the return of manufacturing to protect American local industries.

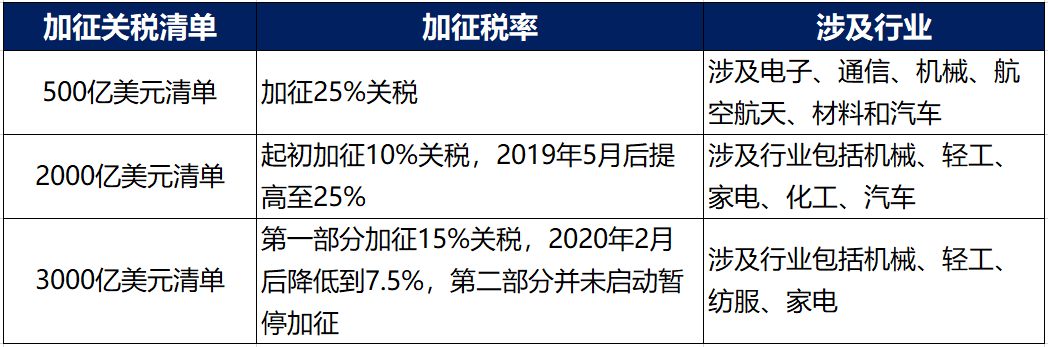

During Trump's 1.0 administration, the 2018-2019 Sino-US trade friction was divided into three rounds, corresponding to the list of $50 billion, $200 billion and $300 billion, respectively, with tariffs ranging from 10% to 25%, involving industries including electronics, communications, machinery, home appliances, light industry, textile and clothing.

List of tariffs imposed during Trump's 1.0 administration

Source: Public data collation

www.ywindex.com

Judging from the tariff policy advocated by Trump during this election, imposing tariffs is still the main means of trade protection, including:

- A base tariff of 10 percent on goods entering the United States without discrimination;

- Possible additional tariffs of 60 percent or more on "Made in China";

- Impose "specific taxes" on certain regions or industries, such as a 100 percent tariff on Chinese cars made in Mexico.

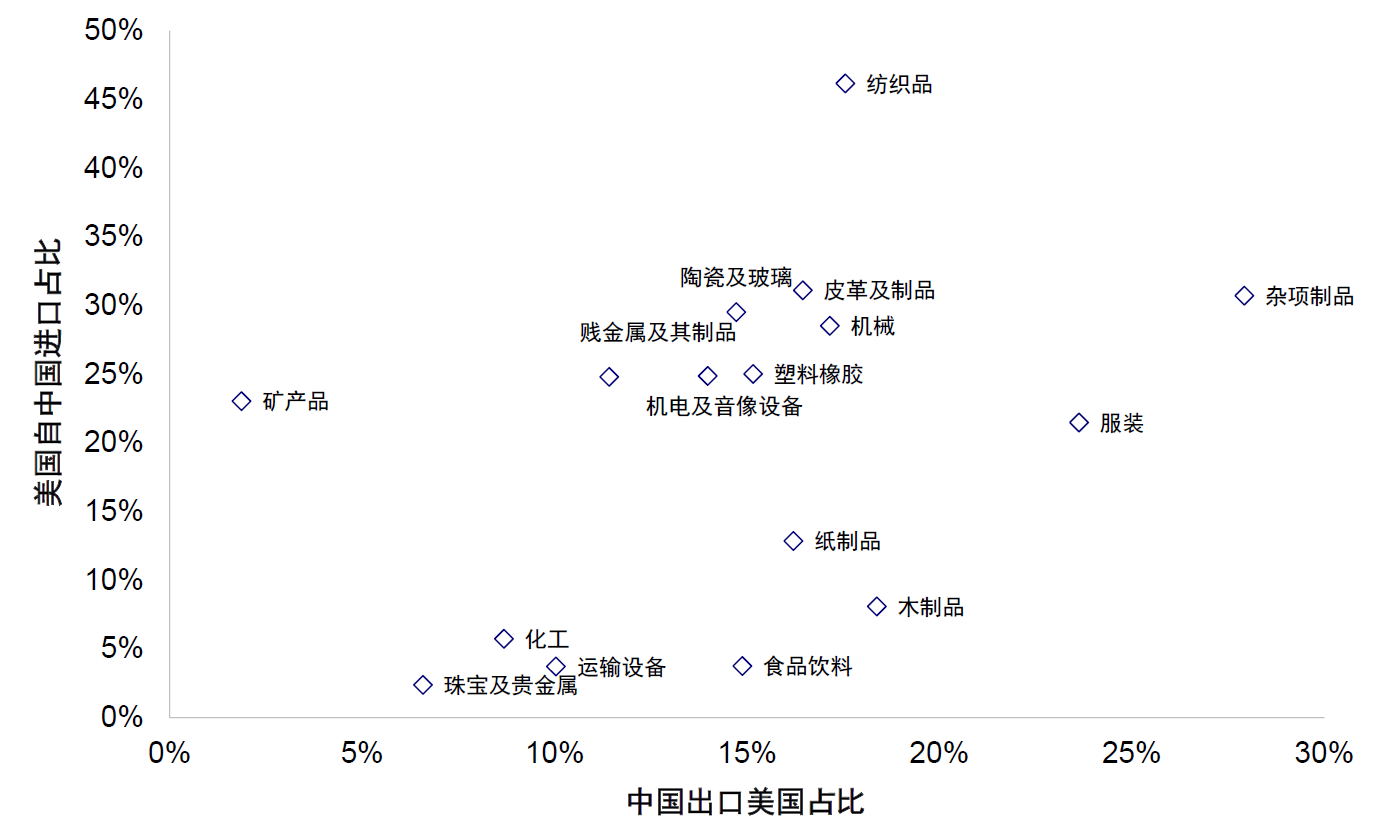

In recent years, the United States imports more than $500 billion of goods from China each year, many of which are "just needed" in the US local market, such as textiles, hardware, ceramics, clothing, toys and sporting goods, miscellaneous products. In general, the United States has a high proportion of imports and a high degree of dependence on China.

Bilateral trade between China and the United States accounts for the majority of the map

Data source: Wind; Yiwu index

www.ywindex.com

Trump's tariff increase during the 1.0 administration is targeted, giving priority to imposing tariffs on high-end manufacturing industries to protect domestic industrial advantages, and then imposing additional tariffs on labor-intensive products to attack China's key nodes in the global supply chain.

This is also true in the policies announced by Trump during the current election campaign, which advocates a gradual and complete ban on imports of major categories of Chinese-made goods such as electronics, steel and pharmaceuticals, and strict controls on exports in industries such as chips, semiconductors and biomedics.

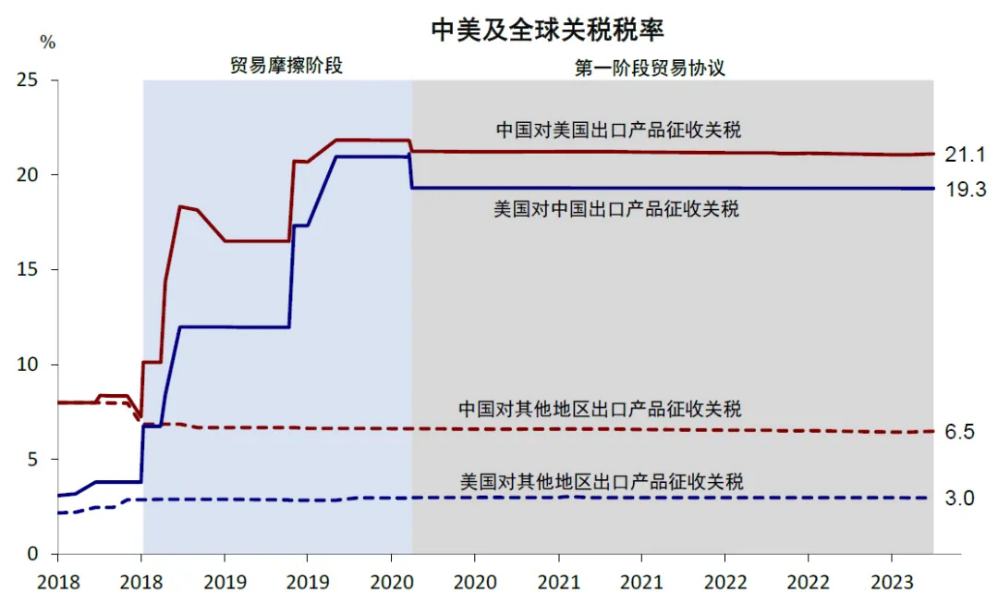

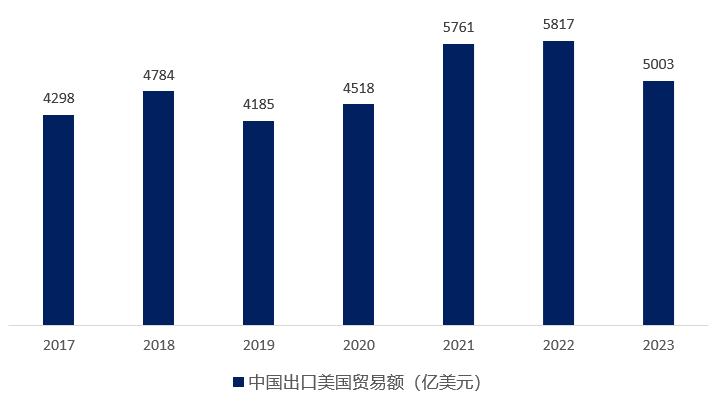

After the Sino-US trade friction, the US imposed tariffs on Chinese exports of about 20% on average, and the trade volume of Chinese exports to the US decreased by 59.9 billion US dollars from 2018 to 2019, a decrease of 12.5%, indicating that the direct impact of the imposition of high tariffs on Sino-US trade is huge.

Data source: PIIE; Yiwu index

www.ywindex.com

Data on the volume of China's exports to the United States from 2017 to 2023

Data source: China Customs; Yiwu index

www.ywindex.com

In general, because the president has a large discretionary power in the field of trade, Congress cannot make a strong intervention and restraint. Trump's attitude to adopt a tough trade policy not only impacts high-end manufacturing industry products, but also has a certain impact on "just-needed" goods with livelihood attributes.

But they will also lead to higher domestic inflation and, from the perspective of American consumers, they are likely to spend more.

After analyzing various external data, Yiwu Index predicts that the 60 percent tariff increase could increase the core PCE price index (a key measure of private consumer inflation in the United States) by more than 1.0 percent. In the future, tariff barriers between China and the United States may become higher and higher, and generally higher than other countries and regions.

Yiwu market: The direct impact of "high tariffs" on Yiwu's exports is limited

From the Yiwu market visit, although the "high tariff" is not conducive to Yiwu's export trade to the United States, market operators are more optimistic about the future tariff policy after the election of Trump. Some Yiwu enterprises with the United States as the main export market (such as textile industry) have set up factories in Southeast Asia, Mexico and other places to export raw materials and intermediate products, and then transfer to the United States. In the future, the proportion of re-export trade is likely to further increase, and Yiwu will face both opportunities and challenges.

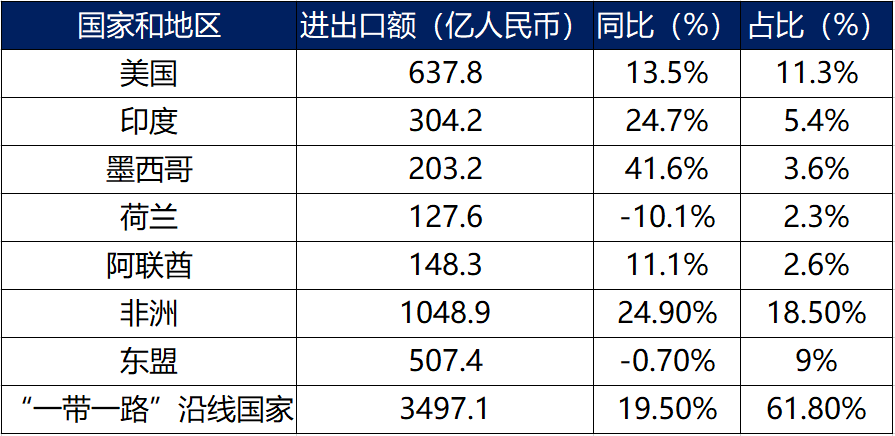

From the import and export data of Yiwu city, in 2023, the import and export volume of Yiwu to countries along the "Belt and Road" increased to 349.71 billion yuan, an increase of 19.5%, accounting for nearly 62%, and the weight continued to increase. Africa is one of Yiwu's main markets. In 2023, Yiwu's import and export value to Africa reached 104.89 billion yuan, up 24.9% year on year, accounting for 18.5%. In 2023, the import and export volume of Yiwu to the United States increased by 13.5% year-on-year, accounting for 11.3%.

Major countries and regions of Yiwu's imports and exports in 2023

Data source: Yiwu Bureau of Statistics; Yiwu index

www.ywindex.com

From the perspective of Yiwu's export commodity industry distribution, it can be roughly divided into two categories. The first is the United States led by European and American countries, the main export categories for clothing, cosmetics, prints, paintings and other "weak demand" products. The second is the developing countries led by India and Iran (Iran, Iraq), the main export categories for kitchen utensils, hardware, daily necessities and other "strong and rigid" products as well as machinery, raw materials, accessories and other products suitable for the development of primary processing industry.

From the perspective of export countries and the distribution of export commodity industries, the exports of Yiwu market are characterized by diversification, strong resilience to trade shocks, and not easily affected by changes in tariff policies of individual countries. Moreover, after more than 40 years of development, Yiwu market has established its own advantages, such as sound supporting industrial chain cluster of small commodities, export trade facilitation, industrial scale, etc. Trade entities can make use of existing advantages, flexibly adjust business strategies, gradually realize business upgrading, and avoid the impact of tariff increase.

Key word two: exchange rate

Advocates a "weak dollar" and pushes the Federal Reserve to cut interest rates

During the Republican administration, the tone of economic policy was not the same as that of the Democratic Party, such as expanding the scale of fiscal deficit, cutting taxes and cooperating with the start of the US dollar interest rate reduction policy, which is simply to encourage economic development and send money to stimulate consumption. This tends to lead to an overall weakening of the dollar, causing domestic funds to flow to overseas markets.

Exchange rate measures are a key factor affecting bilateral trade. Trump followed suit during his administration, supporting the weakening of the dollar in monetary policy for a long time, promoting the competitive devaluation of the dollar through intervention, promoting the growth of US exports, and thus enhancing the competitiveness of US domestic goods.

Chart of the dollar during the Trump administration from 2017 to 2021

Photo Source: Sina Finance

After Trump's election, this trend of "dollar weakening" is likely to be repeated. The most direct impact of the depreciation of the US dollar and forcing the Federal Reserve to cut interest rates is to improve the liquidity of the global market, thus stimulating the growth of global consumer demand to a certain extent, and then driving the increase in the demand for international trade in small commodities, which tends to be positive for the market trade activity. For more details on the impact of the US dollar interest rate cut on the Yiwu market, please refer to the 8th issue of the "Yiwu China Small Commodity Index" 2024.

Although the president of the United States has a significant influence on economic policy, the Federal Reserve, as the central bank of the United States, sets and implements monetary policy independently of the White House. Therefore, the final direction of the US dollar exchange rate is the result of the game between the policy positions of the Trump administration and the Federal Reserve, and there will be greater uncertainty.

Yiwu Market: The weak US dollar is good for the global small commodity market demand

From the view of the "weak dollar" advocated by the Republican Party and the Trump administration and the policy of promoting the Federal Reserve to cut interest rates, the direct impact of the active depreciation of the US dollar is to increase the liquidity of the global market and stimulate consumption, thus enhancing consumer demand worldwide, which will bring certain benefits to the export-oriented Yiwu small commodity market, and most of the small commodities exported by Yiwu are necessities for people's livelihood. Overseas market demand is stable and extensive, and the consumption growth brought by the "weak dollar" will further expand the demand for international trade.

For export enterprises, the depreciation of the US dollar will lead to a reduction in local currency income when settling foreign exchange. However, Yiwu market can effectively resist the impact of the depreciation of US dollar by using many hedging strategies, such as pricing export commodities in RMB, using capital pool to manage funds, and flexible foreign exchange settlement.

Key word three: Regional conflict

Regional conflicts may be alleviated, and the impact of foreign trade exports on war conflicts will be reduced

In today's world, geopolitical conflicts continue, and Russia, Ukraine and the Middle East are still in a state of war. Trump, too, deftly shifted the blame to the Biden administration's weakness. In this presidential election speech, Trump also mentioned that if he is elected president, he will solve the Russia-Ukraine war within 24 hours.

Trump is a typical businessman who does not want a conflict between Russia and Ukraine and is not willing to continue to invest a lot of resources and financial resources in the war. Therefore, after Trump takes office, aid to Ukraine may be stopped. If so, the conflict between Ukraine and Russia is more likely to end. The same is true in the Middle East.

Photo Source: Baidu

The influence of regional conflicts on international trade is multifaceted, which brings great pressure to foreign trade export.

Uncertainty about the development of global trade is rising. The geopolitical conflict has a butterfly effect, and the Russia-Ukraine conflict makes the cost of commodities rise, which is transmitted to the rise in the production cost of China's manufacturing industry. The breakdown of Russia-EU relations and US-Russia relations behind the Russia-Ukraine conflict affects the pattern of world trade. The Israeli-Palestinian conflict has led to the deterioration of the security situation in the Middle East. Under the attack of the Houthi armed forces in Yemen, merchant ships in the Red Sea have been attacked, and maritime security has been threatened. The world tension is increasing, and the development of global trade is facing great uncertainty.

The reduction of international logistics capacity and the rise of freight rates. In the past two years, due to international oil price shocks, port congestion, cargo backlog, airline safety issues and other factors, resulting in significant fluctuations in international logistics freight. In addition, regional conflicts have caused the closure of national airspace and strengthened security control of ports, resulting in the reduction of shipping companies' capacity and a significant increase in shipping costs and transportation cycles.

If regional conflicts are alleviated, as an important international trade window in the world, Yiwu's foreign trade exports will also be affected by war and conflict.

Yiwu exports to Russia market or will be good

Market operators have high expectations for a peaceful resolution of the "Russia-Ukraine conflict" after Trump takes office. In 2023, Yiwu's exports to Russia reached 8.67 billion, up 50.3% year on year, showing significant growth. In 2024, Yiwu's export performance to Russia is still very strong, if the "Russia-Ukraine conflict" can be ended in advance, it will usher in a new opportunity for Yiwu to further explore the Russian market. For example, hardware tools, small machinery and equipment and other post-disaster reconstruction necessities, or will usher in a wave of explosive growth in demand.

Sum up

Yiwu is the beneficiary of China's accession to WTO. In the 23 years since China joined the WTO, Yiwu's exports have increased by 234 times and its imports by 300 times. In 2023, Yiwu's trade volume reached more than 560 billion yuan. In the face of proud trade achievements, Yiwu is also prepared for danger in peace, and actively faces the changing international trade environment.

The trade friction between China and the United States is carried out under the continuous influence of the two presidents Trump and Biden. The changing trade relationship between China and the United States has brought a lot of pressure and uncertainties to the trade between the two countries. We firmly believe that Yiwu will maintain the long-term growth of its trade with the United States by virtue of its many years of accumulated international trade resources and sound industrial clusters. We will also call on the world to jointly build a new global economic order based on the principles of openness and inclusiveness.

—— The content of this article is translated by Al ——

My favorites

My favorites