Small toys how to play the global market, data exploration "world supermarket" Yiwu

Publish Time:2025-02-14 15:49:54Pageviews:265

abstract: Industry: The overall prosperity is stable, the overall price has declined, the competition in the low-end market is fierce, and all kinds of costs have increased slightly Market: The overall domestic market shows an upward trend, the growth rate is slowing down, the foreign European and American markets occupy a dominant position, and the emerging markets have increased Channels: Online and offline simultaneous sales, third - and fourth-tier cities demand growth is obvious, consumer groups show all ages Category: Educational, educational, interactive toys or become the most popular three categories, brand value day

Yiwu is one of the world's largest toy distribution centers, one out of every four toys in the world comes from Yiwu, and related products are exported to more than 220 countries and regions.

According to Yiwu Index monitoring, the global toy market has grown steadily in the past three years. In 2024, the toy prosperity index in Yiwu market increased steadily, and the passenger flow continued to be high. Under the factors such as upgrading consumption concepts and upgrading technology, the toy industry is undergoing changes. How will practitioners grasp the consumption trend and tap the growth opportunities of the toy market at home and abroad?

I. Overview of toy industry in Yiwu market

1. Overview of the venue

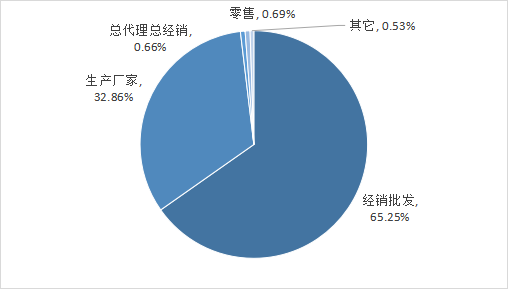

Yiwu market toy industry started in the mid-1980s, is now distributed in the first district of the International Trade City, is one of the earliest to achieve the "zoning regulation of the city" of the industry, a total of more than 3000 market operators, operating area of more than 20,000 square meters. Business model to distribution wholesale, factory production.

In the past five years, the relevant business model

Data source: Yiwu Index

www.ywindex.com

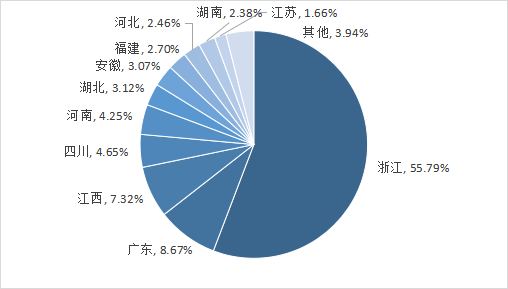

Related businesses from all over the country, mainly in Zhejiang, Guangdong, Jiangxi, Sichuan, Henan merchants are also a large number of settled business.

Registered place of relevant business households in the past five years

Data source: Yiwu Index

www.ywindex.com

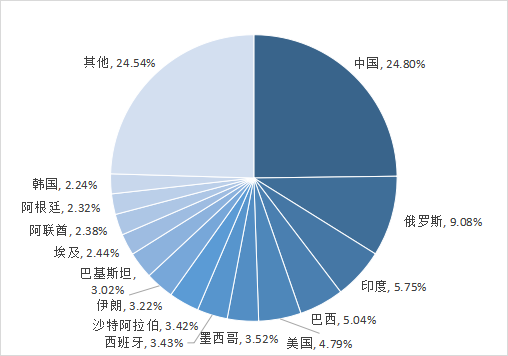

From the main market point of view, Yiwu market toys are mainly exported, 58% of merchants said that foreign trade accounted for more than 80% of the store. Related products are exported to more than 200 countries and regions around the world, accounting for 25% of the world toy market.

In the past five years, the relevant operators mainly market

Data source: Yiwu Index

www.ywindex.com

2. Yiwu Market and industrial Belt

"We have been operating toys in Yiwu for many years, Yiwu Trade City toy industry has developed so well, can not be separated from our Chenghai toy industry, and now many of the merchants in the same trade are Yiwu window sales, Chenghai production." -- According to interviews with market operators, the toy industry in Yiwu market has formed a close cooperative, synergistic and complementary relationship with the upstream industry chain to jointly promote the development of the toy industry in the two places.

The picture shows the Chenghai Golders factory, which has changed the production mode of Chenghai building block toys and deeply involved in the supply chain

Photo Source: news.qq.com

Yiwu Market, with its advantages as a small commodity market, has become an important sales window for the toy industry, attracting many domestic and foreign buyers. In addition to Chenghai, Yiwu market also develops in coordination with many subdivided upstream industrial chains:

Cloud and wood play: gold medal manufacturing, industry and trade. Located in Yunhe County, Lishui, Zhejiang Province, is the capital of wooden toys in China. In recent years, it has actively introduced international well-known brands, such as HABA Group in Germany, to enhance the overall level of the local wood play industry by introducing advanced production and management experience.

Yangzhou plush: wide variety, batch and zero both. With a complete industrial chain, it is the C position in the plush toy industry, and the export volume of Yangzhou plush toys accounts for up to 95% of the country's share, which is suitable for cost-effective and large-scale product demand.

Dongguan Toys: the city of fashion play, re-development and design. A quarter of the world's animation derivatives and nearly 80% of China's tide games are produced in Dongguan, and actively break through to the "new" through independent research and development of original IP.

China's toy industry is accelerating the development trend of competition and cooperation in different regions, and jointly promoting the progress of the industry through innovation and cooperation.

3. Pivot

In the Yiwu index classification system, the toy category is one of the 15 primary categories, including wool (cloth) toys, inflatable toys, model toys, control toys, electronic and electric toys, outdoor toys, play toys, educational toys, novel toys, baby toys, toy accessories, 11 secondary categories, complete categories, everything. Taking wool (cloth) cashmere toys as an example, there are 3 third class categories and 13 fourth class categories:

Plush toys: static plush toys, electric plush toys, intelligent plush toys, plush toys pendants, other plush toys

Fabric toys: static fabric toys, electric fabric toys, intelligent fabric toys, fabric toy pendants, other fabric toys

Fur toys: animal leather toys, animal simulation fur toys, other fur toys

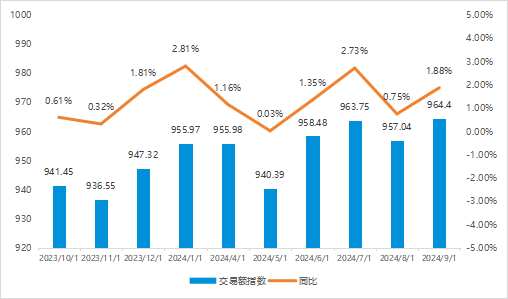

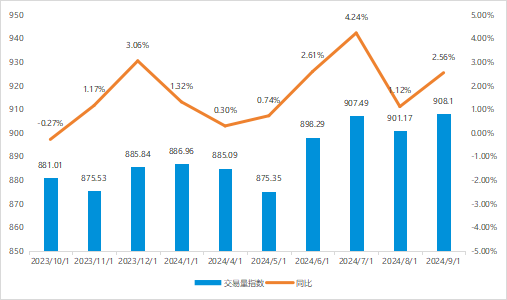

According to Yiwu Index monitoring, in the past year, the toy industry prosperity index has been generally stable and rising, and in September 2024, the toy industry prosperity index was 1270.57 points. Among them, the trading volume index rose by 1.88% year-on-year, the trading volume index rose by 2.56% year-on-year, and the market trading performance was good.

Toy trading volume index in the past year

Data source: Yiwu Index

www.ywindex.com

Toy trading volume index in the past year

Data source: Yiwu Index

www.ywindex.com

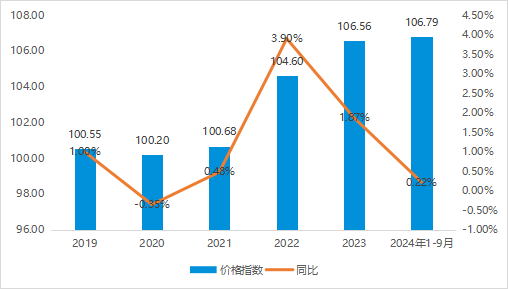

According to Yiwu Index monitoring, in the past five years, the toy price index has increased steadily. Affected by the obstruction of international logistics and the strengthening of cross-border remittance risk control, the price index has risen significantly in 2022, and then the growth rate has slowed down relatively, entering a period of steady growth. On the whole, there is a large demand for low-price toys in Yiwu market, and the sales increase is obvious. Market operators are gradually laying out high-price toys. Although the current market volume is not large, it has great development potential.

Toy price index in the past five years

Data source: Yiwu Index

www.ywindex.com

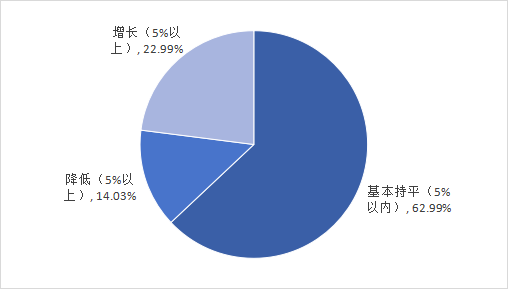

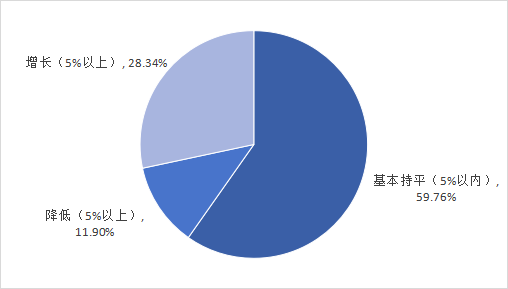

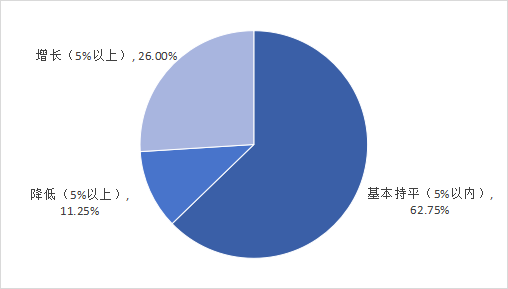

According to Yiwu Index monitoring, the operating cost of toys in 2024 has increased compared with the same period last year. Among them, 22.99% of merchants reported that logistics costs increased by more than 5%, 28.34% reported that labor costs increased by more than 5%, and 26% reported that raw material prices increased by more than 5%. Facing the challenge of rising cost, the industry should optimize the business strategy and improve the business efficiency.

Logistics cost

Data source: Yiwu Index

www.ywindex.com

Labor cost

Data source: Yiwu Index

www.ywindex.com

Raw material price

Data source: Yiwu Index

www.ywindex.com

4. Consumer insights

From the age point of view, the toy industry consumers show a younger trend, 18-23 years old consumers accounted for the most significant increase, but the overall is still dominated by 24-40 years old consumers; The proportion of male consumers has increased, but the overall consumer is still dominated by women.

From the perspective of urban distribution, the number of consumers in third - and fourth-tier cities increased, and the proportion increased. The number of consumers in first - and second-tier cities still accounts for the largest proportion, pay attention to experiential consumption, and have diversified experience scenes, and the offline market has recovered, replacing some online markets.

According to Yiwu Index monitoring, toy stores, fashion stores and department stores have become the three offline channels with the fastest sales growth in 2023. With the diversification of consumer demand and the continuous progress of retail technology, it is expected that the downstream toy market will continue to maintain the trend of online and offline integration in the future.

From the point of view of the distribution of price segments, the price of toys mainly sold in the market is concentrated in the price segment of 0-30 yuan, the price segment below 10 yuan is highly competitive, and many brands are concentrated in the price segment below 300 yuan. With the upgrading of consumption concepts, products above 1,000 yuan show higher growth potential, and consumers' demand for high-quality and high-priced products has increased, and the industry has shown a certain trend of consumption upgrading.

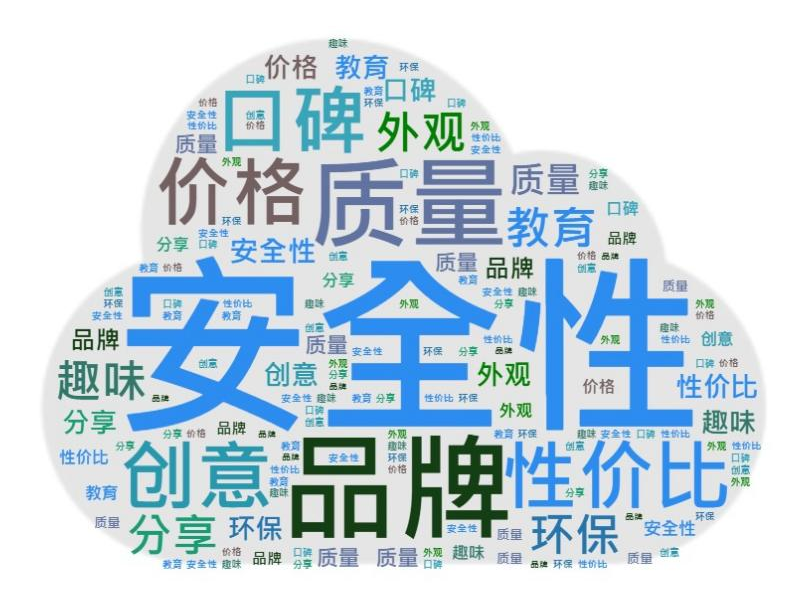

From the perspective of purchasing decision-making factors, according to the Yiwu Index survey, with the improvement of consumers' awareness of scientific parenting and the improvement of children's growth safety requirements, parents not only pay attention to the entertainment of toys, but also pay more attention to their safety, education and the promotion of children's comprehensive physical and mental development. Specifically, the purchase of toys is mainly determined by "safety, product quality, brand reputation, cost performance, educational value, fun" and other factors.

Figure source: Yiwu Index

Second, the domestic toy industry market analysis

1. Overview of domestic toy market

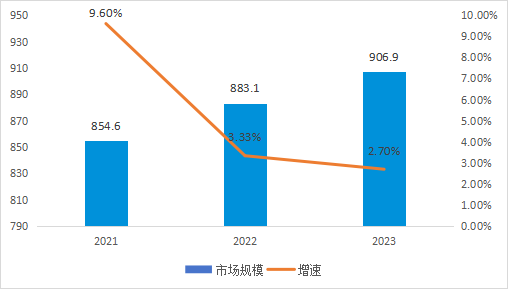

In the past three years, the size of the domestic toy market has continued to grow, the growth rate has slowed down accordingly, and the construction of relevant industrial belts has matured and turned to the stage of high-quality development.

The size and growth rate of domestic toy market in recent three years

Data source: Public data collation

www.ywindex.com

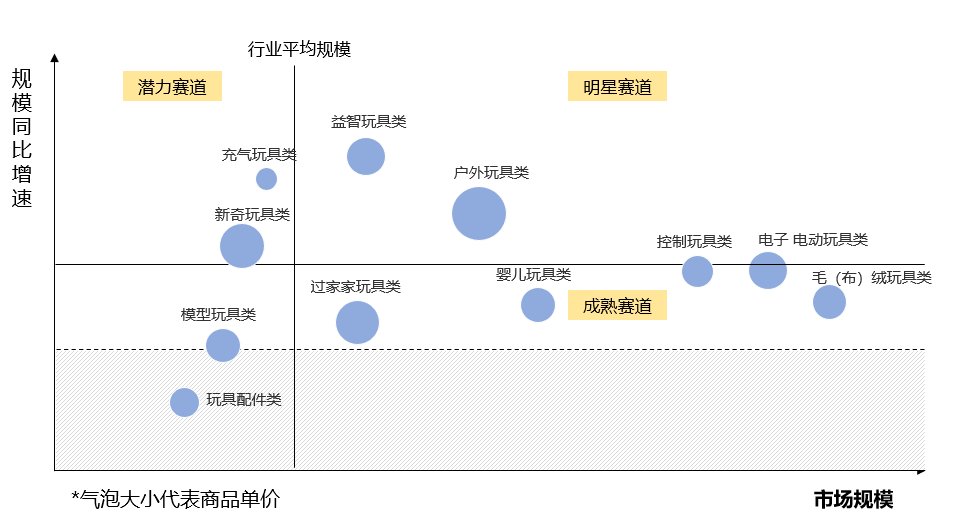

In terms of categories, the sales and prices of plush fabric toys on the online platform increased significantly, with the highest growth rate among toy categories, reaching 15.6%; Educational toys and building blocks are favored by parents because of their positive impact on children's thinking and hands-on skills, becoming a popular choice for children's Day gifts.

Domestic toy market segmentation category situation

Data source: public data collation; Yiwu index

www.ywindex.com

At the same time, parents' preference for toy materials is relatively balanced, and toys of various materials such as plush, plastic, wood, and metal have their fixed consumer groups.

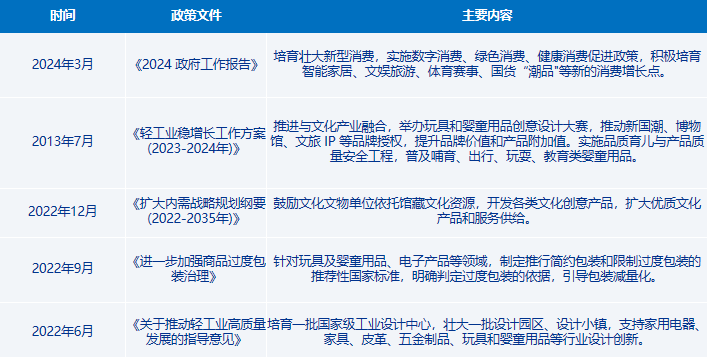

In terms of policy, the introduction of a large number of domestic policies shows that China supports the high-quality development of the toy industry.

Overview of important policy documents in the toy industry in the past three years

2. Competitive landscape

Overall, China's toy industry shows a competitive pattern of common development of domestic brands and overseas brands. Domestic toy brands are gradually dominating the domestic market, while overseas brands are performing well in terms of growth rate. In terms of industrial belt, the development of industrial clusters is obvious, but the overall industry concentration is low.

From the perspective of enterprise competition pattern, the number of Chinese toy manufacturers is large, but the level of research and development design and brand awareness of Chinese toy manufacturers is not high, the enterprise scale is small, the distribution is scattered, and the degree of industry concentration is low. According to the proportion of toy/toy derivatives sales revenue of major listed enterprises in China's toy industry in the industry, the market share of listed toy companies such as Aofei Entertainment, Starlight Entertainment, Gaulle Stock, and Shifeng Culture is relatively low. The growth of overseas toy brands in the Chinese market cannot be ignored, and internationally renowned toy brands such as Lego and Mattel have occupied a place in the Chinese market with their high quality, innovative design and strong brand influence.

From the perspective of regional competition pattern, China's toy production and export bases are concentrated in Guangdong, Jiangsu, Zhejiang, Shandong, Shanghai and Fujian and other reform and opening up earlier and economically developed coastal areas. With its mature toy manufacturing base and industrial cluster advantages, Guangdong Province has become an important area for Chinese toy brand competition, and the number of listed companies has reached 8.

Overall, the brand competition pattern of China's toy industry is developing in the direction of diversification and internationalization, and it is expected that the brand competition of China's toy industry will be more intense in the future, and it will also give birth to more market opportunities and innovation space.

Third, overseas toy industry market analysis

1. Overseas market overview

Looking at the overseas toy market, with the increasing economic strength of emerging market countries, the concept of toy consumption has gradually extended from mature Europe and the United States to emerging markets. Good economic development trend, large children's consumer groups and low per capita consumption make the emerging toy market represented by Asia, Eastern Europe, Latin America, the Middle East and Africa become an important growth point of the global toy industry. According to Statista data, the revenue of the global toy market will reach $129.5 billion in 2024, with a compound annual growth rate of 2.49% between 2024 and 2028.

Toy revenue in the North American market declined in 2023, but it still dominates the world, with the United States being the world's largest toy consumer market. U.S. toy sales in 2023 were $28 billion, down 8% year-over-year, the first decline since 2020, but up $5.7 billion, or 26%, from 2019, driven by rising demand for educational and interactive toys.

Countries such as China and India in the Asia-Pacific market, with their large population and rapid economic growth, bring great growth potential to the toy market, among which, the Indian market is expected to grow at a CAGR of nearly 5.0% between 2024 and 2030.

The European market saw a decline in revenue in 2023 compared to 2019, but with a gradual economic recovery, the market is expected to pick up in 2024.

Latin American market toy market scale growth trend is obvious. According to analytics firm StrategyHelix, the market is expected to grow by $11 billion between 2021 and 2027, a compound annual growth rate of 12.9 percent. Mexico is one of the world's major toy producers and the second largest toy consumer market in Latin America after Brazil.

In terms of product types, building block sets and plush toys increased sales by 4% and 3% respectively in 2023, while strategic trading card games and vehicle toys also performed well, achieving growth for the fourth consecutive year.

In terms of material use, plastic toys occupy a major share of the market due to their diversity and cost advantages, but the trend of environmentally friendly toys is also rising, reflecting the global concern for sustainable development.

The growth of the global toy market is influenced by a variety of factors, including the increase in personal disposable income, the expansion of the middle class population, the growth of online sales, the rising demand of consumers for educational and interactive toys, and the continued focus on environmentally friendly and sustainable toys.

2. Export situation

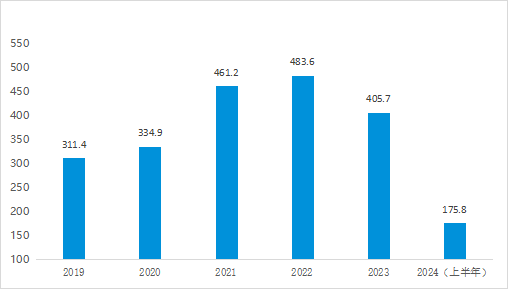

China's toy exports in 2023 amounted to $40.57 billion, down 12.2% year on year. In renminbi terms, product exports totaled 285.83 billion yuan, down 7.4 percent year on year. This decline is mainly due to weak consumption in traditional markets such as Europe and the United States, but growth in emerging markets presents new opportunities for toy manufacturers.

Total toy exports 2019-2024 (unit: USD 100 million)

Source: General Administration of Customs of China

www.ywindex.com

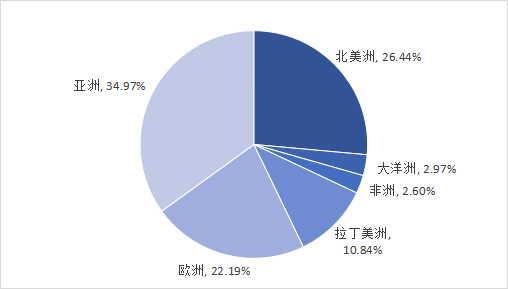

In 2023, China's toy exports to North America and Europe fell the most, down 15.43% and 8.69% respectively. In contrast, the African region showed strong demand and was the only one of the six regions to achieve export growth. Singapore, Kazakhstan, Kyrgyzstan and other countries have higher growth rates.

Proportion of toy exports in 2023

Source: General Administration of Customs of China

www.ywindex.com

The number of customers in emerging markets has increased, but the order scale is not as large as that in Europe and the United States, showing fragmented characteristics. As emerging markets mature, they will face localization challenges, and merchants will need to adapt more quickly to different consumer preferences in different places to adapt products.

From the category point of view, the popular categories in overseas markets are consistent with the domestic market analyzed above.

TOP5 traditional toy export categories in 2023

Data source: Public data collation

www.ywindex.com

Overall, although China's total toy exports have declined, the growth potential of emerging markets still exists. Educational toys, model toys, plush toys and other categories still have a large space for development overseas.

4. Potential opportunities and trends

Science and technology interaction

Interactive toys are warmly sought after by the market because of their ability to provide a richer user experience, and early education products, intelligent science and education toys and other products have become the new favorite. As early as 2020, the market size of China's smart toy industry has reached 12.04 billion yuan, an increase of 82% year-on-year, showing great potential for development.

According to the editorial office of Yiwu Index, some parents said that when they choose toys, they pay special attention to the interaction and education of toys, hoping that toys can continue to provide children with freshness and continuous attraction, and have more parent-child interaction with children through toys, such as toys with AR technology, or robot toys that can be controlled through applications. Although the price of related products is high, a large number of audiences are still willing to pay for them.

Brand IP

The protection of intellectual property rights of toys has gradually been paid attention to, and the trend of IP and branding is obvious. A merchant operating a Sanrio series of products in the first district said, "Many buyers are in the online brush to our home to do legitimate authorization, to take goods in our store, many young people are directed to IP", IP authorization often means "more get out of hand", "good workmanship", sales can reach non-IP similar goods more than 10 times.

With the blessing of IP, the toy industry promotes the upgrading of consumption, and businesses can accelerate the layout of the high-end toy market. In addition, the state's strengthened protection of intellectual property rights has protected the innovation achievements and legitimate rights and interests of enterprises. The branding and IP of the toy industry will become a major strategy for merchants to increase the added value of products.

Regional subsidence

With the improvement of consumption power in third - and fourth-tier cities and rural areas, consumers in these areas have an increasing demand for toys, and women aged 24-40 in low-tier cities have become the main consumer groups, providing a new growth point for toy brands, and brands can focus on targeted marketing and layout.

According to the Yiwu index editorial department visited, an offline channel business mentioned, "a few years ago I was doing online stores, and now the electricity business is also rolled up, the past two years to take goods to the line down, our hometown store rent is not expensive, some small toys at the school gate or sell very well." Toy businesses should pay attention to the trend of regional subsidence and strengthen the development of low-line city channels.

The audience is all age

Toys are gradually becoming all-age, and the demand for toys for adults and even the elderly is increasing. The proportion of adults buying toys has risen significantly in recent years, with more than seven buyers of JellyCat plush toys and Lego bricks becoming adults to buy gifts for themselves. According to Yiwu Index monitoring, model mecha, card, hand and other adult categories have more than 100% growth.

Some toy companies have begun to focus on the elderly market. A merchant in the first district said that although China's elderly toy market is still in the early stages of development, from the overall scale, there is actually a very high market demand. "In my shop, Luban locks sell very well. Some old people used to work as woodworkers, and they especially like these little things, which can also exercise their fingers." Elderly people in nursing homes have a strong need for cultural entertainment, so the company has opened a special line of toys for the elderly to meet their spiritual and social needs.

Sum up

Industry: The overall prosperity is stable, the overall price has declined, the competition in the low-end market is fierce, and all kinds of costs have increased slightly

Market: The overall domestic market shows an upward trend, the growth rate is slowing down, the foreign European and American markets occupy a dominant position, and the emerging markets have increased

Channels: Online and offline simultaneous sales, third - and fourth-tier cities demand growth is obvious, consumer groups show all ages

Category: Educational, educational, interactive toys or become the most popular three categories, the brand value is increasingly prominent

—— The content of this article is translated by Al ——

My favorites

My favorites