【 Frontier information 】 Small commodity industry information station

发布时间:2024-12-10 18:02:23查看次数:111

摘要: Continue to pay attention to Yiwu Index, we will provide you with exchange rate analysis, shipping prices, raw material market interpretation, enterprise policy, industry news and hot information and other latest developments to help you make decisions and development!

First, exchange rate dynamics

Yiwu Market is the world's largest small commodity distribution center, with major exporting countries covering all continents, including Europe, North America, Africa, Southeast Asia, South America and the Middle East. The following is the currency exchange rate of major exporting countries in Yiwu market:

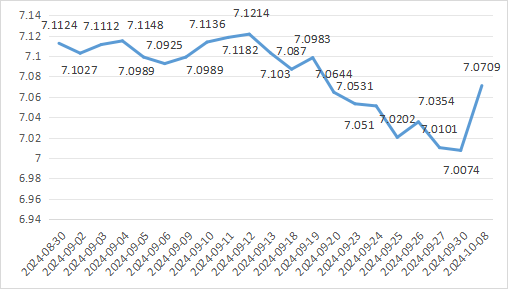

1. United States Dollar (USD)

On Oct. 8, the dollar was trading around 7.07 yuan. On September 18, local time, the Federal Reserve announced that it would cut the target range of the federal funds rate by 50 basis points, to the level of 4.75% to 5.00%, which is the first rate cut since March 2020. The exchange rates of China and the United States subsequently produced large fluctuations, and the Fed's rate cut had a ripple effect on the global currency market.

Chart of USD/RMB central parity rate

Data source: China Money Network

www.ywindex.com

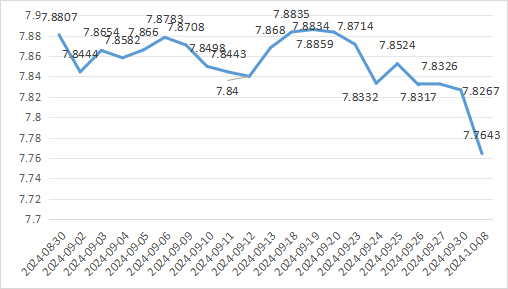

2. Euro (EUR)

On October 8, the exchange rate of the euro against the RMB was around 7.75 yuan, and the monthly average exchange rate of the euro/RMB in September 2024 was 7.8572, and the exchange rate of the RMB against the euro was raised, and the RMB was relatively strong. The ECB cut interest rates again in September, cutting its three main rates by 25 basis points to 60 basis points. The fluctuation of the RMB exchange rate against the euro is affected by multiple factors: the increased uncertainty of the eurozone economic data, such as rising inflation and interest rate adjustment, resulting in divergent market expectations for the euro.

Chart of the euro/RMB central parity rate

Data source: China Money Network

www.ywindex.com

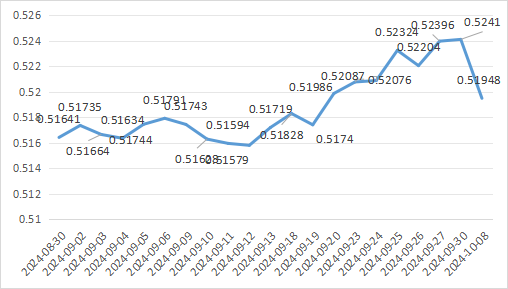

3. Uae Dirham (AED)

The exchange rate of RMB/UAE dirham was around 0.52 yuan on October 8, and the monthly average exchange rate of RMB/UAE Dirham in September 2024 was 0.51889. As an oil exporter, the UAE's economy is particularly dependent on the performance of the oil market. In addition, the acceleration of RMB internationalization and the deepening of China-Arab economic cooperation also have a certain impact.

Chart of Yuan/UAE Dirham central parity

Data source: China Money Network

www.ywindex.com

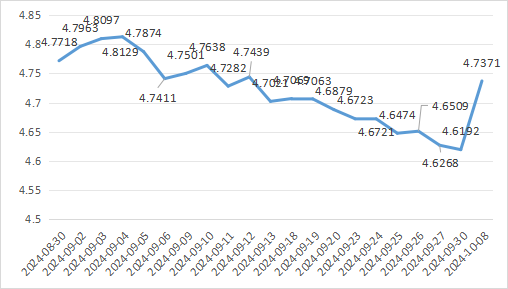

4. Thai Baht (THB)

The exchange rate of RMB/baht was around 4.75 yuan on October 8, and the monthly average exchange rate of RMB/baht in September 2024 was 4.7171. The baht has surged 10 per cent against the dollar since the end of June, its highest since the first quarter of 1998. In recent years, Thailand's tourism recovery, export growth and the Federal Reserve's interest rate cut helped the baht perform strongly in September.

Chart of RMB/Baht central parity rate

Data source: China Money Network

www.ywindex.com

5. Brazilian Real (BRL)

On October 8, the exchange rate of the yuan to the Brazilian real was around 1.28 yuan, and the monthly average exchange rate of the Brazilian real/yuan in September 2024 was 1.2769. On September 18, local time, the monetary policy committee of the Central Bank of Brazil voted unanimously to raise the benchmark interest rate by 25 basis points to 10.75%. Brazil's central bank raised interest rates for the first time in two years, in line with market forecasts and aimed at strengthening the economy and curbing inflation, which usually attracts foreign capital inflows and helps the currency appreciate.

Brazilian real (CNY/BRL) Reference exchange rate chart

Data source: China Money Network

www.ywindex.com

Second, international logistics overview

1. Ocean freight trend

Ningbo Zhoushan Port undertakes a large number of exports of Yiwu small commodities by sea, and Yiwu is being built into the "sixth port area" of Ningbo Zhoushan Port, jointly building an efficient logistics channel. Yiwu Index monitors it based on relevant data and interprets the trend of international shipping freight.

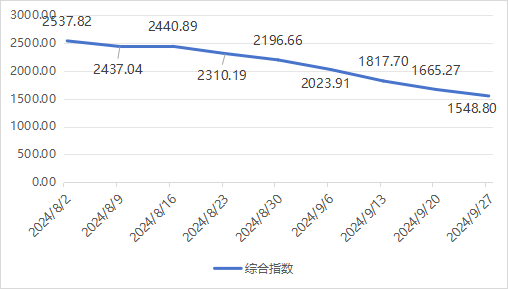

In September 2024, the average value of Ningbo export container Freight Index (NCFI) was 1763.9 points, down 26.0% month-on-month and up 172.5% year on year. Container shipping prices, which rose sharply in the first half of this year, are gradually coming back. Because the supply is greater than the demand in the short term, the market freight rate shows an adjustment market.

NCFI composite index change trend chart

Source: Ningbo Shipping Exchange

www.ywindex.com

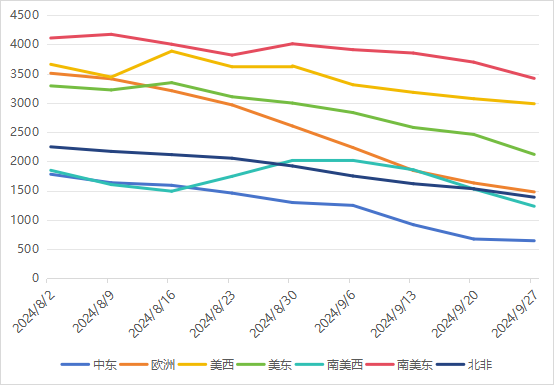

In September 2024, the price of the Ningbo-US-East route fell to 8693 US dollars/FEU in the month, and the average freight index was 2497.5 points, down 21.7% month-on-month and up 181.7% year on year;

Ningbo-us-west route price fell to 6816.2 US dollars/FEU in the month, the average freight index was 3136.0 points, down 14.0% month-on-month, up 177.4% year on year;

Ningbo-europe route fell to 5074.4 US dollars/FEU in the month, the average freight index was 1795.7 points, down 42.8% month on month, up 335.1% year on year;

The average freight index of Ningbo-Middle East route was 868.0 points, down 44.0% month-on-month and up 57.5% year-on-year.

NCFI main route index change trend chart

Source: Ningbo Shipping Exchange

www.ywindex.com

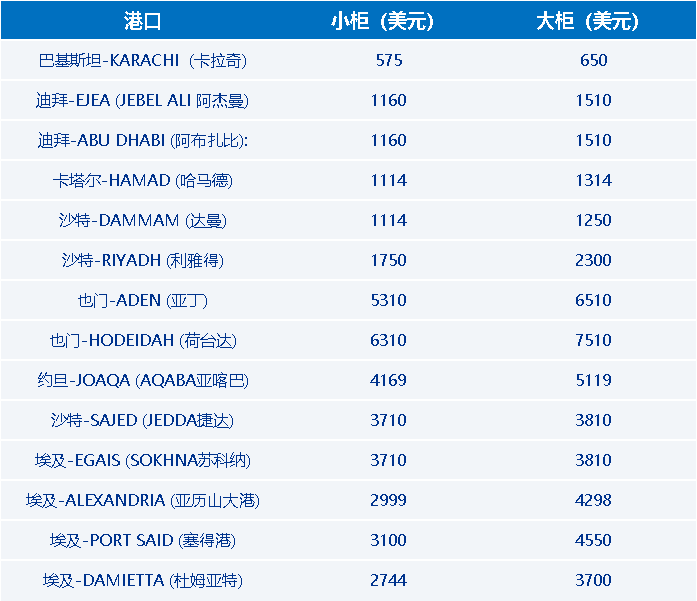

Although shipping prices have continued to decline, they are still relatively high. The following figure is the container price of the export route of Jianyi Transport platform (Ningbo to the following ports) in early October, for reference only.

Data source: Public data collation

www.ywindex.com

2. Dynamics of major international shipping hubs

More than 90% of the goods transported in global trade are carried out by sea. Among the global shipping routes, the Suez Canal and the Panama Canal are crucial. Today, both canals face some challenges:

The Suez Canal is affected by the spillover effect of the conflict in the Middle East, and the security problem is particularly prominent in the Red Sea region. Some ships sail around the Cape of Good Hope, and the transportation cost has increased significantly. If there is further unrest in the Middle East, shipping problems could intensify.

Regional droughts in the Panama Canal in recent years have limited the depth of draft and daily throughput of ships, driving up shipping costs. As the rainy season came and water shortages eased, the canal authority began to ease restrictions. The authority announced in September that it would gradually increase the daily toll to 36 vessels.

This geopolitical and environmental risk is exacerbating supply chain uncertainty.

LNG ships preparing to pass through the Panama Canal Source: CCTV News client

3. Current affairs of shipping

Domestic dynamics

- Ningbo Zhoushan Port added a new route, and Zhejiang's first direct route to Guyana and Suriname was opened.

- Ningbo Zhoushan Port will increase container throughput by 2 million TEUs and is expected to be operational in December 2027.

- Ocean Network Link Shipping (ONE), HMM and Yangming Shipping announced the deepening of their Alliance under the new name "Premier Alliance", which will take effect from February 2025 and cover major east-west routes for a period of five years.

International dynamics

- On October 3, the International Longshoremen's Association (ILA) and the United States Maritime Alliance Limited (USMX) reached a tentative agreement on wages; On October 4, most ports in the eastern United States and along the U.S. Gulf Coast resumed operations.

- Due to the potential strike risk in the Eastern United States, Haba has added a "Work interruption surcharge" (WDS) of $1,000 /TEU for shipments from multiple regions to the Eastern United States and the Gulf of Mexico since October 18.

- Amazon has updated its logistics policy to reduce the maximum shipping time from China to the continental United States (except Hawaii, Alaska, etc.) from 28 days to 20 days starting October 25, 2024.

Iii. Overview of raw material market

The production of small commodities in Yiwu market involves the procurement of a large number of raw materials such as textiles, plastic products, hardware accessories and electronic components, and is particularly sensitive to fluctuations in the cost of upstream raw materials, which will directly transmit and affect the final pricing of commodities. The following is a simple analysis of steel, cotton, polyethylene (PE) and other important basic raw materials:

1. Steel

Rebound after price shock: affected by high temperature and rain and extreme weather in the early stage, downstream demand is obviously insufficient, and steel market prices show a downward trend of shock. However, entering September, with the improvement of weather conditions and the strengthening of policy support, the market supply and demand relationship has improved, and steel prices are expected to bounce back.

Weakened cost support: raw material prices such as iron ore, coke, etc. have rebounded after a deep fall in the early stage, but the overall is still weak, and the negative cost feedback effect is enhanced, which has formed a certain pressure on steel prices. However, at the same time, the Fed's interest rate cut expectations and other factors may also ease the pressure on commodities, forming a certain support for steel prices.

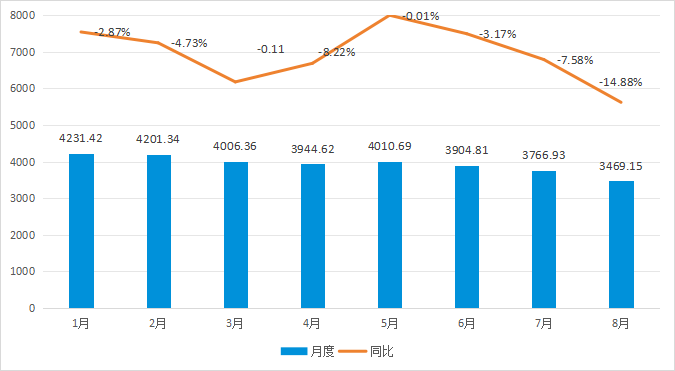

Domestic steel composite average price index monthly index

Source: My Steel

www.ywindex.com

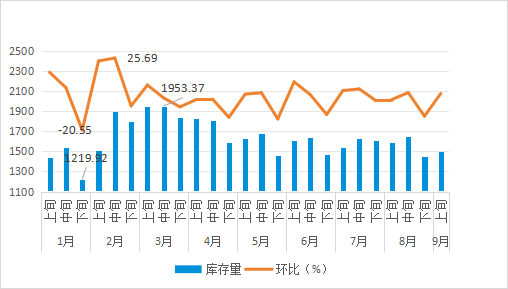

Inventory growth: According to China Steel Association data show that in early September 2024, the key statistics of steel enterprises steel inventory reached 14.97 million tons, an increase of 2.9%. Inventories are up 21.1% from the beginning of the year; But compared with the same period last month, inventories were down 5.8%. The increase in steel inventories and the slowdown in destocking constitute a negative trend for steel prices.

Inventory of steel enterprises in 2024 (10,000 tons)

Data source: China Iron and Steel Association

www.ywindex.com

2. Cotton

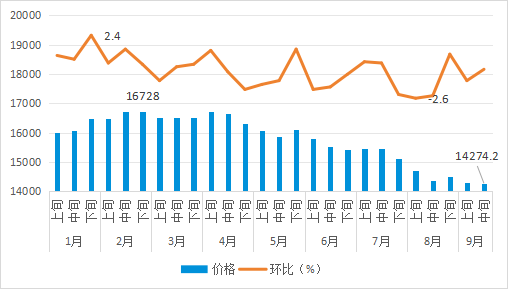

Price pressure, narrow decline: In 2024, the international cotton market price volatility downward, especially since March, international cotton prices continue to fall. In September, cotton prices at home and abroad have rebounded: in mid-September, the price of cotton (leather cotton, white cotton three levels) in the national circulation field was 14,274.2 yuan/ton, down 42.5 yuan/ton from the previous period, a decline of 0.3%. In the second half of the year, under the influence of factors such as the landing of the main cotton producing area and the landing of the Federal Reserve's interest rate reduction policy, the domestic and foreign cotton prices showed signs of rebound, and the overall gap between domestic and foreign cotton prices narrowed.

Changes in domestic cotton Market Price in 2024 (Yuan/ton)

Source: National Bureau of Statistics

www.ywindex.com

Production is expected to increase: According to the data of the Ministry of Agriculture and Rural Affairs and the China Cotton Association, the national cotton production is expected to increase to 5.72 million tons in 2024/25 (September 2024 - August 2025), an increase of 1.8% over the previous year. At present, new cotton in some areas has been sporadically listed, and it is expected that the centralized listing time in Xinjiang will be advanced to the end of September.

3. Polyethylene (PE)

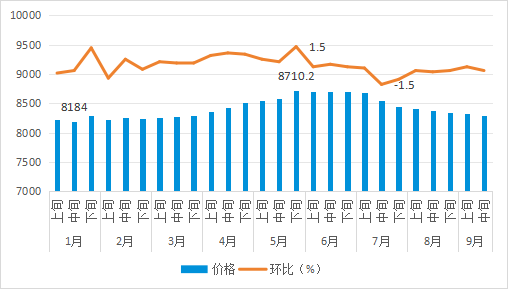

The price center of gravity is relatively stable: in September 2024, the average price of the national mainstream market fluctuated between 8152.44 and 8168.33 yuan/ton, and the rise and fall were small, and the overall price center of gravity was relatively stable. The price of crude oil is an important factor affecting the cost of polyethylene. Although the oil price has rebounded recently, the overall trend is still weak, which has formed a certain downward pressure on the price of polyethylene.

Price changes of domestic polyethylene market in 2024 (Yuan/ton)

Source: National Bureau of Statistics

www.ywindex.com

Social stocks are on a destocking trend: In September 2024, the market demand for polyethylene showed a clear seasonal increase. The agricultural film industry and packaging industry, as an important downstream application area of polyethylene, its market demand has increased during this period, which has increased the demand for polyethylene raw materials. In addition, downstream enterprises seize the opportunity of market price fluctuations, buy raw materials at low prices, and continue to consume inventory as production activities continue. These factors work together to make the social inventory of polyethylene show a trend of reduction.

Fourth, Hui enterprise policy overview

"Brand going to sea" is an important carrier for Zhejiang Province to promote the "sweet potato economy" and upgrade the "No. 1 open project", and it is a key starting point for actively responding to the new situation of globalization. The following excerpts are some of the Zhejiang Province and Yiwu brand out of the relevant preferential policies.

- Approved to set up overseas general projects (including processing and manufacturing enterprises, trade marketing and service institutions, resource development and research and development center projects) in the same year, the Chinese investment is more than 500,000 yuan (including) to 1 million US dollars, 1 million yuan (including) to 3 million US dollars, 3 million US dollars (including), One-time rewards of 100,000 yuan, 150,000 yuan and 200,000 yuan were given respectively. The capital increase project approved in the current year shall be rewarded in accordance with the above provisions. (Source: Yiwu Commerce Bureau)

- We will support enterprises in actively participating in overseas mergers and acquisitions. For enterprises with independent brands, independent intellectual property rights and independent marketing networks, after the successful merger, a one-time reward of up to RMB 1 million will be given according to 3% of the contract amount of the merger and acquisition. (Source: Yiwu Commerce Bureau)

- Encourage enterprises to take out overseas investment insurance. For enterprises to carry out overseas investment, carry out overseas mergers and acquisitions, carry out foreign contracted project business, etc., insurance premiums paid by overseas investment insurance, according to the actual premium paid by 50% of the reward. (Source: Yiwu Commerce Bureau)

- It is recommended to select provincial-level overseas economic and trade cooperation demonstration zones. Newly assessed overseas economic and trade cooperation zones can receive a maximum subsidy of 1 million yuan. (Source: Zhejiang Provincial Department of Commerce)

- Recommend the selection of provincial overseas warehouse. Awarded companies can receive up to $1.5 million in support. (Source: Zhejiang Provincial Department of Commerce)

- Support enterprises in building independent stations. For enterprises that build their own independent stations to sell products and utilize digital platforms such as overseas social media and search engines, online sales and export performance (" 9610/9710/9810 "declaration export exceeds $100,000), each enterprise will be given a one-time website award of 20,000 yuan. If the annual sales of the independent station reach 2 million US dollars, 50% of the promotion costs (including the construction of the station, drainage and other costs) will be granted, and the individual enterprise will not exceed 200,000 yuan per year. (Source: Yiwu Market Development Committee)

Continue to pay attention to Yiwu Index, we will provide you with exchange rate analysis, shipping prices, raw material market interpretation, enterprise policy, industry news and hot information and other latest developments to help you make decisions and development!

—— The content of this article is translated by Al ——

我的收藏

我的收藏